For your consideration ...

Ok - having briefly read both links - I know a lot more about its history and what lead to its dissolution.

What I don't know is the answer to the two questions I mentioned - what would happen to GOLD if it were re-adopted?

And on a related note - is there ANY commodity in the world whose mining could keep up with the value of money needed?

As near as I can tell - if the U.S. had ALL THE GOLD left in the world - it wouldn't be anywhere near useful at today's prices.

So - going back to the gold standard wouldn't work, even if we were able to get all the gold on the planet.

Worse - because of the essentially arbitrary value of the dollar - there exists a possibility it could be rendered valueless.

Unlikely - but possible.

First ... What we use today as money, is not money.

Second ... it really was not a "gold standard" per se, but a bi-metal standard, using sliver and gold at a ratio of 15 ounces of silver to one ounce of gold.

Third ... The definition of a "dollar" was defined by congress via the Coinage Act of 1792 as 371.25 grains of fine silver. And the Gold standard Act of 1900 defined a dollar at 25.8 grains of 90% pure gold.

Forth ... You do not understand what is money.

Money, "specie", comes from, and represents, the

labor necessary to produce an ounce of silver, or an ounce of gold. It is labor, a person's labor, a person's sweat and toil, that gives every Thing its value. Think of it this way, a miner of silver, after long hours manages to find some silver and has it smelted and converted into 20 one ounce coins by the government. The silver coins are his property, produced from his labor. They are his personally owned non-taxable property, because it would be considered theft to take from a person's own productivity. A wood-maker makes chairs from trees he felled himself. He's made, and now owns, 15 rocking chairs. The miner wants a rocking chair. The wood-maker sells, trades, one of his chairs for an ounce of silver. All things being equal, it took each man about 10 hours to mine an ounce of silver, and make a chair. It is the labor involved that makes the coin and chair have value.

The currency we use today has a counter-party. The currency we use today is issued by a private business, not answerable to Congress, at interest. You do not own the "money" you have. The banks own the money, currency. Every dollar in circulation represents debt. Who's debt? Everyone's debt. Mortgage debt, commercial debt, credit card debt, you name the debt, it is all debt. Every single paper dollar is debt, represents debt.

Gold and silver coins, along with nickles and copper pennies do not represent debt. Because they have no counter-party.

If we are in over $34 Trillion in debt as a Nation, from where did the money come from? Did these private banks, all these years, decades, have these trillions of dollars in a vault just waiting to be lent? No no no. They create it all out of thin air as a simple accounting ledger entry.

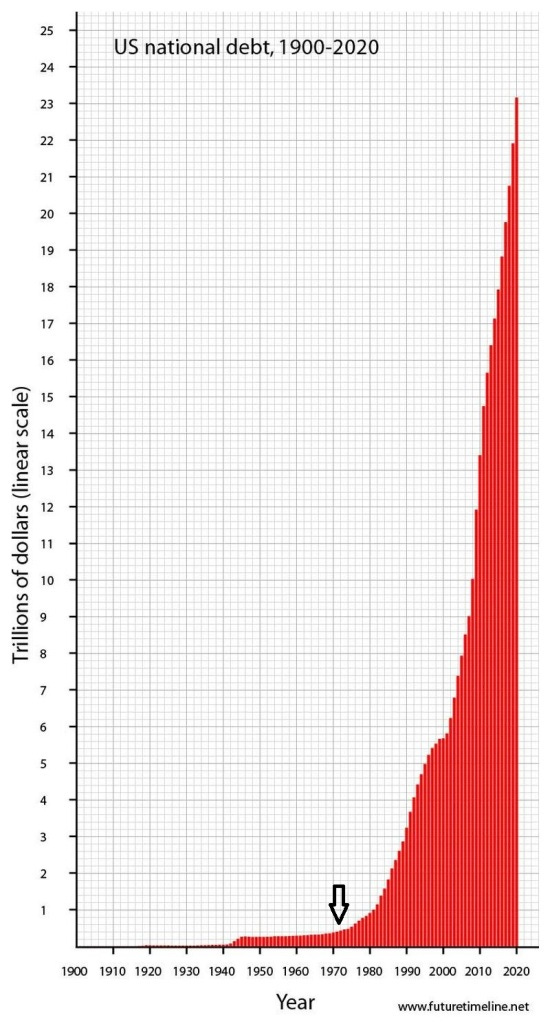

The arrow in the chart below shows when Nixon, in 1971, took us off the Bretton Woods International Monetary System agreement ending the convertibility of the dollar into gold for other nations trading with the US. After which we have a complete fiat, by dictate, currency.

How our Nation's money, specie, has been taken away and debased; It began in 1913 when Woodrow Wilson signed the Federal Reserve Act. In 1933 FDR confiscated our gold, and gave it to the banksters. In 1964 all silver was removed from our coinage. And last, in 1982, the penny had its copper removed and now is copper coated zinc. All our coinage is nothing but cheap worthless tokens. Well, except for the nickle which does have a metal value of about 7 cents.

You, me, we, are all slaves to the monetary system today, and at its complete mercy. There is absolutely no value in the currency we use today. Zero. Zilch. Nada. Nothing. Other than force and intimidation to make us use it.

We have all been forced into playing the game of three card monty, and we are the marks. We will always lose. We have been, generation after generation after generation, been lead to believe what we are using is real money. When in reality we are nothing but slaves to the banking interests and their fake money.

Understand this. The banks have no money, none. But they do buy lots and lots of gold bullion with their fake made out of thin air so-called "money". Now why is that? If gold, or silver, has no value, monetarily, why do banks, and countries, continue to buy and store it in underground vaults?

The private, in-it-for-their-own-enrichment, banks control everything. E-V-E-R-Y-T-H-I-N-G. The banks create currency that has no value. For the banksters, it is all about control. Control of the people. And getting rich by stealing the production of people's labor.

This is a detailed and nuanced subject. If you have questions, I am back in the house.

The chart below shows the definition of "exponential". Now, after four years since the chart was made, and having today a total of $34 Trillion in National debt. It takes it well off the top of the chart, but only just four steps to the right. Can you see where all this is heading? This Nation is being lead to slaughter.

By the way, it is not that prices are going up, or gold prices are going up, it is the "value" of the dollar that is going down. Aka, Inflation.

:max_bytes(150000):strip_icc()/GettyImages-1227917506-b8093677aac4470f9dd57bde83098b22.jpg)