Funds Marylanders’ Top Priorities While Renewing Commitment to Fiscal Responsibility

ANNAPOLIS, MD—Governor Hogan today released his Fiscal Year 2021 (FY21) budget, which funds Marylanders’ top priorities, including crime, education, transportation, and the environment, while delivering on Governor Hogan’s promise to restore fiscal responsibility to Annapolis. This budget is 100% structurally balanced, limits budget growth to 1 percent without raising taxes or cutting services, and maintains more than $1.3 billion in reserves.

“We are very proud of this FY 2021 budget which funds all the state’s top priorities while maintaining $1.3 billion in reserves and limiting budget growth to 1% without raising taxes, without cutting services, and without raiding dedicated special funds, which had become a common practice in years past,” said Governor Hogan. “I look forward to working together with the House and the Senate in a bipartisan and collaborative fashion, and I’m eager for them to begin their role in the budget process.”

The full budget is available online.

This morning, Governor Hogan hosted lawmakers from both sides of the aisle for a fiscal summit breakfast at Government House to present the details of his budget, which has been formally submitted to the General Assembly.

Addressing Violent Crime

Record Education Funding

Assisting Vulnerable Marylanders

Record Spending on Mental Health and Substance Use Disorder Programs

Preserving Maryland’s Natural Resources and Environment

Improving and Enhancing Maryland’s Transportation Infrastructure

Strong Financial Stewardship

Protecting Maryland’s Taxpayers

Making Government Work

-###-

ANNAPOLIS, MD—Governor Hogan today released his Fiscal Year 2021 (FY21) budget, which funds Marylanders’ top priorities, including crime, education, transportation, and the environment, while delivering on Governor Hogan’s promise to restore fiscal responsibility to Annapolis. This budget is 100% structurally balanced, limits budget growth to 1 percent without raising taxes or cutting services, and maintains more than $1.3 billion in reserves.

“We are very proud of this FY 2021 budget which funds all the state’s top priorities while maintaining $1.3 billion in reserves and limiting budget growth to 1% without raising taxes, without cutting services, and without raiding dedicated special funds, which had become a common practice in years past,” said Governor Hogan. “I look forward to working together with the House and the Senate in a bipartisan and collaborative fashion, and I’m eager for them to begin their role in the budget process.”

The full budget is available online.

This morning, Governor Hogan hosted lawmakers from both sides of the aisle for a fiscal summit breakfast at Government House to present the details of his budget, which has been formally submitted to the General Assembly.

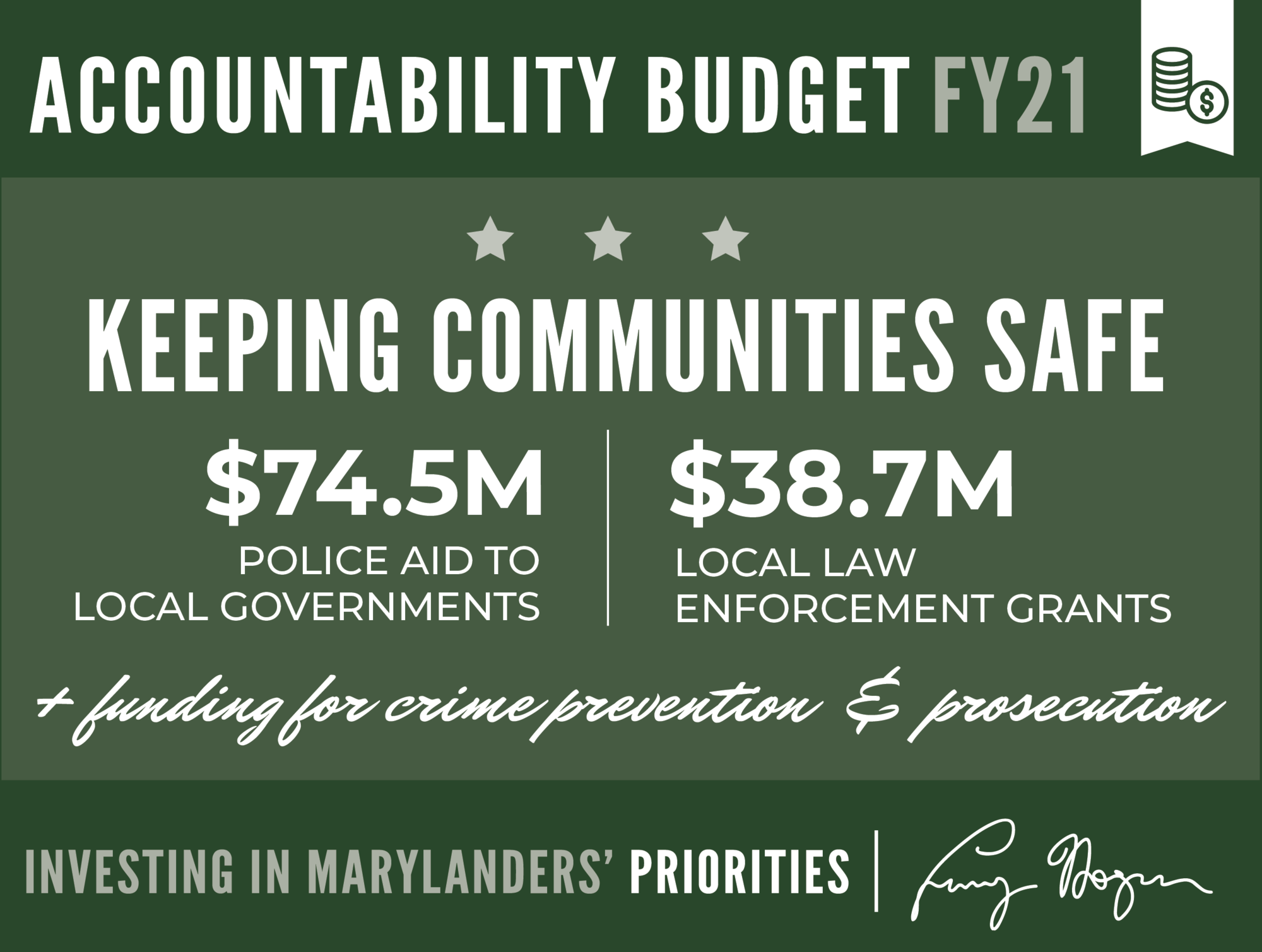

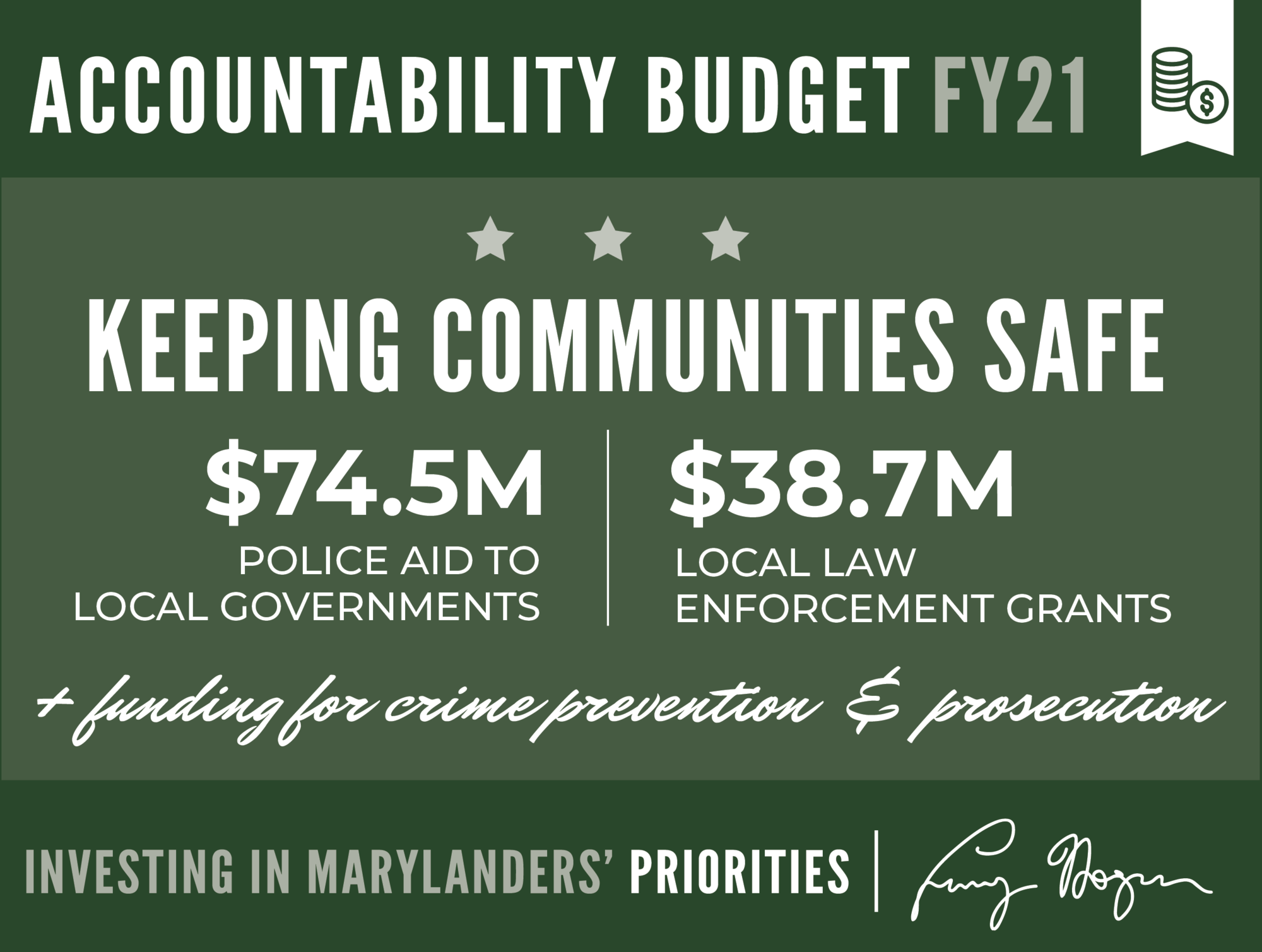

Addressing Violent Crime

- In FY21, police aid to local governments is funded at $74.5 million and local law enforcement grants are funded at $38.7 million. Another $1.9 million is provided for the Violence Intervention and Prevention Program.

- In the second year of the Governor’s Baltimore City Crime Prevention Initiative, the FY21 budget includes $6.9 million for grants that support crime prevention, prosecution, and witness protection and $2.7 million for the Baltimore Regional Intelligence Center.

- In keeping with Governor Hogan’s commitment to address the violent crime crisis in Baltimore City, the FY21 budget includes nearly $2.6 million for 25 new prosecutors and support staff for the Attorney General to prosecute violent crime.

- The budget maintains $3 million to fund initiatives to recruit and retain police officers at the local level.

- The FY21 budget includes nearly $272 million for community and residential operations to provide direct care services to youth under the Department of Juvenile Services’ supervision.

- Since taking office, Governor Hogan has invested nearly $44 million in the State Police fleet, including $9.1 million for the replacement of new police vehicles and equipment in FY21.

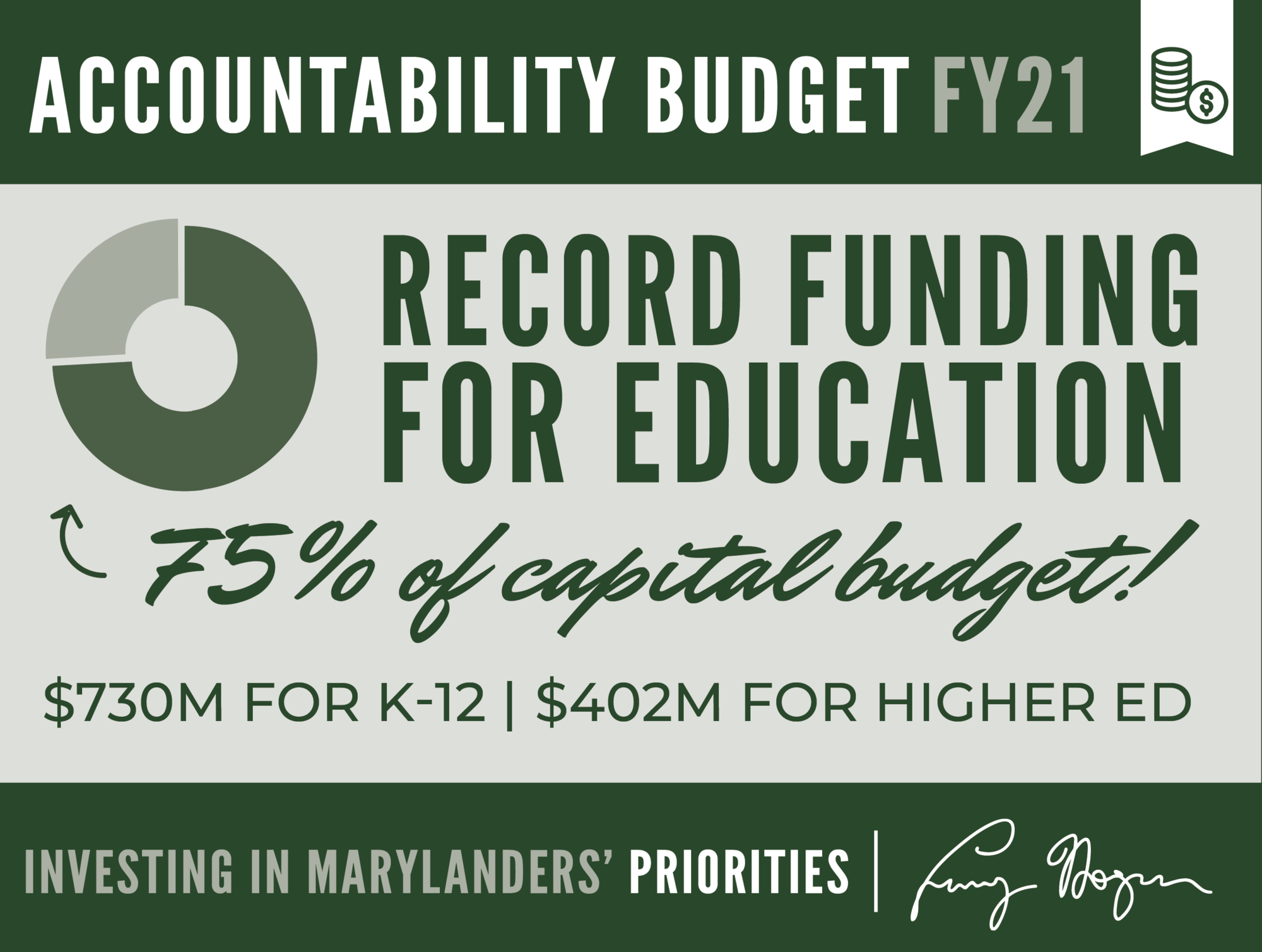

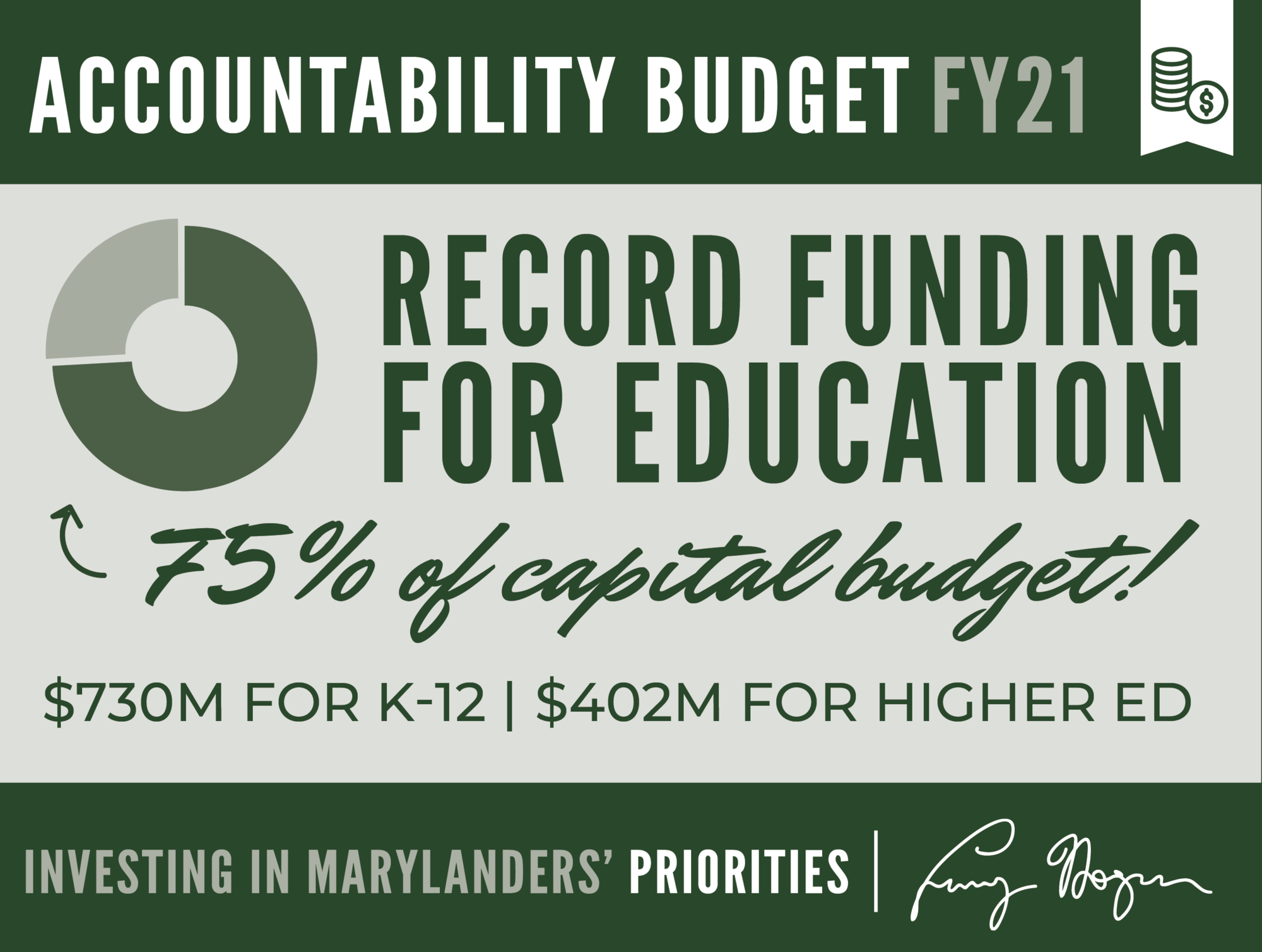

Record Education Funding

- The FY21 budget includes $250 million in funding to support the second year of the “Hogan Lockbox” to ensure that Video Lottery Terminal revenue supplements education funding.

- Since FY 2015, per pupil funding for K-12 education has grown from $7,273 to $8,157 (an increase of 12%).

- For the fifth consecutive year, Governor Hogan’s education budget goes above and beyond statutory funding formulas to ensure that every jurisdiction receives more direct education aid than in the prior year.

- Governor Hogan’s budget includes nearly $94 million to support the expansion of pre-kindergarten. Under the Hogan administration, state funding to expand pre-kindergarten access has grown by more than 2,000%.

- More than $100 million in additional funding above current law will be dedicated over the next two years to expand access to early support and interventions for children and their families, including high-quality, full-day pre-kindergarten for three- and four-year-olds.

- The governor has also committed more than $30 million above current law over two years to fund Concentration of Poverty Grants to provide full-time coverage of health care practitioners and community school coordinators.

- Governor Hogan’s new budget continues the important investments in Maryland’s higher education system to make sure that Marylanders have every opportunity to succeed.

- The FY21 budget again caps in-state resident tuition growth at 2% at the University System of Maryland, Morgan State University, and St. Mary’s College. This is the sixth year in a row that the governor has continued to make college more affordable for Maryland residents.

- The FY21 budget also makes important investments in Maryland’s community college network. Cade funding in FY21 for community colleges increases by $18.2 million (or 7.3%). Since Governor Hogan came into office, funding per student at the community colleges has grown from $2,070 to $3,115 (an increase of 50%).

Assisting Vulnerable Marylanders

- Governor Hogan’s FY21 budget provides funding to assist the state’s most vulnerable residents, from the nearly 1.4 million Marylanders on Medicaid, to low-income seniors, to individuals receiving temporary cash assistance.

- The State Reinsurance Program has helped lower premiums in the individual market by 23.5% over the last two years.

- More than $29 million is provided to expand treatment access for all individuals with the Hepatitis C virus.

- Recipients of temporary cash and disability assistance programs will see monthly benefit increases of 2.5% and 17%, respectively.

- $4.6 million goes toward food supplement benefits for more than 28,000 senior households.

Record Spending on Mental Health and Substance Use Disorder Programs

- Under Governor Hogan, statewide substance use disorder spending has more than doubled.

- Funding for Medicaid mental health treatment services has increased by $283 million (or 35%) under the Hogan administration.

- Residential treatment services for substance abuse has increased $57.5 million (or 500%) since FY 2016.

- Fourth installment of $10 million for the Opioid Operational Command Center.

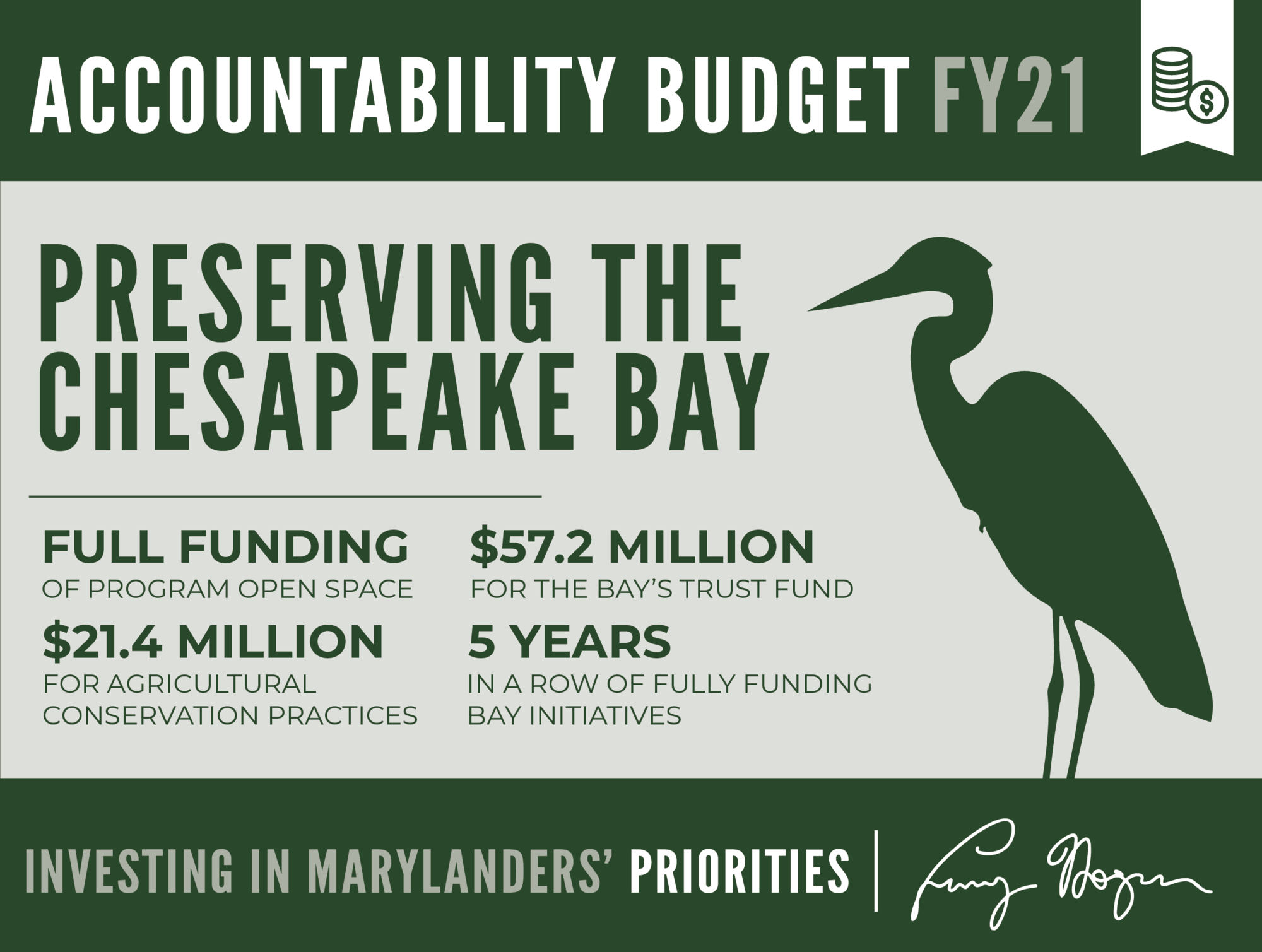

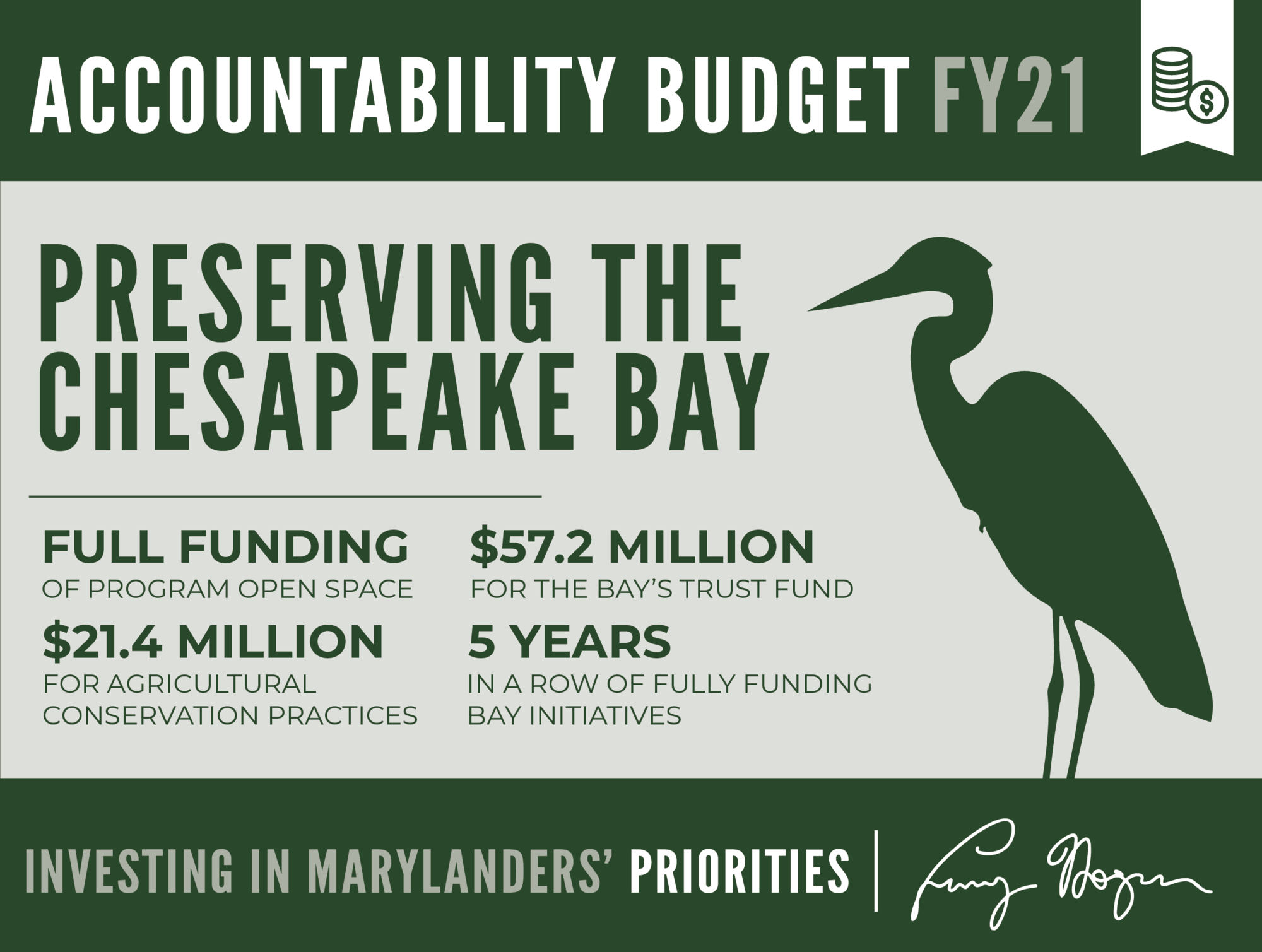

Preserving Maryland’s Natural Resources and Environment

- The FY21 budget fully funds all transfer tax programs, including Program Open Space, and it also includes $43.9 million to continue the repayments of past transfers.

- Programs supported by the Chesapeake and Atlantic Coastal Bays 2010 Trust Fund are fully funded for the fifth consecutive year—increasing nearly 7% over FY 2020 funding.

- Additional funding and positions are provided to support agricultural conservation practices to help Maryland farmers implement the Phosphorous Management Tool and meet Phase III Watershed Implementation Plan goals.

- Funding is included to extend and expand the state’s tax credit for zero-emissions vehicles.

- Funding for the Comprehensive Flood Management Program is reestablished at $6 million in FY21.

Improving and Enhancing Maryland’s Transportation Infrastructure

- Governor Hogan’s commitment to improving congestion in Maryland is unrivaled in terms of funding for highways and transit projects.

- In FY21, the State Highway Administration budget includes more than $340 million in key safety and traffic congestion relief projects.

- The governor’s transit budget includes record funding of almost $1.4 billion in operating funding and more than $941 million in capital funding.

- Transit operating funds have increased by more than 32% since FY 2015, while capital transit funds have increased by almost 60%.

- Funded capital improvements to Howard Street Tunnel to increase business at the Port of Baltimore and create thousands of jobs

- Funded construction of the Purple Line, which has spurred development and jobs in the region.

- Committed $167 million in additional funding to WMATA’s capital program for the second consecutive year.

- Restored funding for local jurisdiction transportation needs.

Strong Financial Stewardship

- The FY21 general fund budget grows by only 1.0%, while total fund budget growth amounts to only 1.5%.

- The governor’s budget exceeds the legislature’s guidelines by leaving a Rainy Day Fund balance of 6.25% of revenues—$242 million more than the statutory requirement—and a cash surplus greater than $100 million.

- When combining the FY21 ending fund balance and the funds available in the Rainy Day Fund, the state has more than $1.3 billion in reserves.

- Building on the Hogan administration’s commitment to shoring up the pension system, for the fifth year in a row, the budget proposal includes a pension payment that is $75 million more than is actuarially required. In FY21, pension funding totals $1.69 billion. Currently, the pension system is funded at 72.9%, compared to 69.7% in FY 2015. This rate of growth puts the system well on the way to the 80% benchmark for a well-funded pension system.

- For the second year in a row, the revenue estimate is reduced to account for volatility in non-withholding personal income tax revenues. This approach is fiscally responsible and ensures the state budget relies on sustainable, ongoing revenue growth, rather than one-time spikes.

Protecting Maryland’s Taxpayers

- Reflecting the Hogan administration’s commitment to no new taxes, for the 6th year in a row the FY21 budget does not include any tax or fee increases.

- Governor Hogan, as part of the FY21 budget, will introduce legislation to reduce the tax burden on Marylanders by expanding the Hometown Heroes tax credit, increasing the military retirement income exemption, and creating a new income exclusion for all retirees.

- For the fifth year in a row, Maryland businesses will have the lowest possible unemployment taxes allowed under state law.

Making Government Work

- The FY21 budget continues the administration’s efforts to make state government more efficient. With this budget, there are almost 5% fewer positions in the executive branch than in FY 2015. The state government workforce is the smallest it has been since 1986 and at its lowest level per capita since 1972.

- While there are fewer positions in state government, Governor Hogan understands the importance of making sure the state workforce is fairly compensated. To this end, the FY21 budget provides employees with a 2% salary increase effective January 1, 2021 and the possibility of a $500 bonus if revenues over-attain.

- To assist in the compensation of hard-to-recruit positions, the FY21 budget includes over $15 million to adjust the salaries of more than 3,500 positions. An additional 6,500 positions will become eligible to participate in the student loan repayment assistance program.

- The budget also includes $8 million in funding over the next two years to compensate approximately 1,000 correctional officers who agree to defer retirement for 4 years.

- Between FY 2019 and FY21, most state employees will have received cost of living adjustments totaling 8.5%, as well as a $500 bonus. The cumulative cost of all these salary increases and the annual salary revisions is in excess of $1 billion.

- The FY21 budget includes $30 million in funding to protect state government’s information technology infrastructure.

- Over the next two years, nearly $1.8 million is provided and 12 new positions are authorized for the expansion of the newly formed Office of State Procurement to continue efforts to modernize state procurement practices, get the best value for taxpayers, and make it easier for vendors to work with the state.

-###-