I was RV shopping a few months ago. I thought I might upgrade my rig. I would need a loan to make the purchase. Since I don't have a fixed address, I went online and found a lender that caters to people in my situation. I filled out a form online. Later I decided not to get a new RV. Someone called from the loan company. I told them that I didn't need the loan any longer.

Then I get a disapproved letter in the mail. I guess that would have been very embarrassing if I tried to go forward with the purchase. But here's what I don't understand about the entire process. The letter states that they got my information from Experian Consumer US. At the time of the loan my credit score was 827. Experian considers a range of lows at 250 and the high at 900. I remember being somewhat excited when my credit score broke 800. They said I had things that affected my score negatively. They listed:

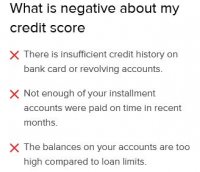

Lack of recent bank-national revolving information

No recent revolving balances

Length of time accounts have been established

Too few accounts currently paid as agreed

Too many inquires the last 12 months

I currently have 2 credit cards. At the time of the loan I only had one. I pay my balance in full every month. I have 2 lines of credit that I hardly ever use. In the rare occurrence I use them, they get paid in full as soon as possible. I did miss a credit card transfer that was paid in full 5 days late. I have 2 mortgages on 2 different properties that have never missed a payment in over 10 years. I have no car payment nor any other debt obligation. I like to say I'm debt averse. I have been with both of my credit unions for over 30 years. I have never filed for bankruptcy nor ever defaulted on any loans. I have several income streams and savings in 2 credit unions. Just not enough cash on hand to buy an RV outright.

So to the lending professionals out there, is this a normal situation given the credit score? If I had so many negatives, why a score above 800? While we never got to the point of final numbers, I was looking at borrowing between $50 to $70K with a trade in and a decent down payment. In my ignorance I figured a bank would be happy to lend money to me. Interest rates are low but not if you can't get approved.

Then I get a disapproved letter in the mail. I guess that would have been very embarrassing if I tried to go forward with the purchase. But here's what I don't understand about the entire process. The letter states that they got my information from Experian Consumer US. At the time of the loan my credit score was 827. Experian considers a range of lows at 250 and the high at 900. I remember being somewhat excited when my credit score broke 800. They said I had things that affected my score negatively. They listed:

Lack of recent bank-national revolving information

No recent revolving balances

Length of time accounts have been established

Too few accounts currently paid as agreed

Too many inquires the last 12 months

I currently have 2 credit cards. At the time of the loan I only had one. I pay my balance in full every month. I have 2 lines of credit that I hardly ever use. In the rare occurrence I use them, they get paid in full as soon as possible. I did miss a credit card transfer that was paid in full 5 days late. I have 2 mortgages on 2 different properties that have never missed a payment in over 10 years. I have no car payment nor any other debt obligation. I like to say I'm debt averse. I have been with both of my credit unions for over 30 years. I have never filed for bankruptcy nor ever defaulted on any loans. I have several income streams and savings in 2 credit unions. Just not enough cash on hand to buy an RV outright.

So to the lending professionals out there, is this a normal situation given the credit score? If I had so many negatives, why a score above 800? While we never got to the point of final numbers, I was looking at borrowing between $50 to $70K with a trade in and a decent down payment. In my ignorance I figured a bank would be happy to lend money to me. Interest rates are low but not if you can't get approved.