Let's put this thread to bed... Please.

Not only because of the lack of interest, comments & views, but because I've just sold all the stocks I bought last Wednesday and this run is over. (A thanks to the sympathetic board mommy for her 1 response.) Yeah, I know when to quit.

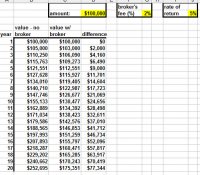

The final summary: I made $767 from the 17th until the 24th. That was an increase of 1.23% in my total yearly profit from the 17th. Not great, but not bad considering 5 trading days, 30 minutes total effort and only a 2.41% dip in the DJIA during that time. Not my best episode, but still better than a 'buy and hold'. He made $0. I'm now out of the market and waiting for the next shoe to drop before jumping back in at the next dip (sounds terribly ghoulish, doesn't it?) Including a few plots and graphs summarizing the whole episode.

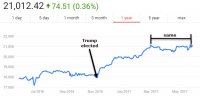

Being out of the market is dangerous because it might start shooting up and I won't make money. But I doubt it. DOW has been bumping around 21000 since the 25th of April and just now made it back (well, almost). Flat as Iowa. Trump, in the meantime, is taking his lumps with false news, incorrect polls, vocal chanting progs, Russian conspiratists, food stamp recipients and etc... so another emotional drop in DOW cannot be far away.

DIY, KISS stock investors. Be ready. Stay sharp. The next drop is soon! Be ready to buy.

Short term stuff to be sure.

Short term stuff to be sure. Short term stuff to be sure.

Short term stuff to be sure.