hitchicken

Active Member

Good poinr.

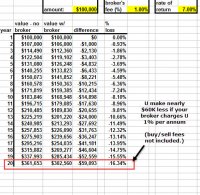

Some brokers charge a commission on each trade, some go with a annual percentage fee (usually between 1% and 2%), some do both. There are nearly as many ways brokers make money as there are brokers.

The plot below shows the effect of a 1% annual fee (that's considered low) on an client's holdings over 20 years. It ain't pretty.

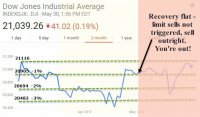

I use Merrill Edge. Free trades for maintaining a minimum amount. I also use ETrade. $6.95/trade. Any amount. On this last event, Only 1 stock was bought and sold through ETrade. $13.90 fee.

is your broker making money (commissions) everytime he sells/buys ?????????????????????

https://www.bogleheads.org/wiki/Main_Page start here

https://www.bogleheads.org/forum/index.php a good information page...

If so you are lossing money.

Go to fidelity, vanguard and do your own buying and selling...

Some brokers charge a commission on each trade, some go with a annual percentage fee (usually between 1% and 2%), some do both. There are nearly as many ways brokers make money as there are brokers.

The plot below shows the effect of a 1% annual fee (that's considered low) on an client's holdings over 20 years. It ain't pretty.

I use Merrill Edge. Free trades for maintaining a minimum amount. I also use ETrade. $6.95/trade. Any amount. On this last event, Only 1 stock was bought and sold through ETrade. $13.90 fee.