You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another School Security feature to waste more taxpayer dollars.

- Thread starter 3CATSAILOR

- Start date

Bring back religion, morals, and rulers across the knuckles and we don’t need to spend any money on security.

that is not going to help the culture in the Black Community ....

Damn LBJ's "Great Society" manure.that is not going to help the culture in the Black Community ....

"We'll have em voting Democrat for 200 years."

LightRoasted

If I may ...

For your consideration ...

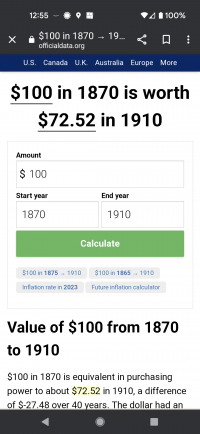

Fun fact. Social Security was instituted due to the devaluing of the dollar. Whereas before, a dollar would pretty much hold its value over time so that a dollar saved in 1870, had the same purchasing power in 1910 as it did when it was saved. Which of course allowed those that were thrifty, and saved the fruits of their labor, over the course of their lives, to provide for themselves in their later years. Ergo, individual responsibility ruled that day in that era.

Fun fact. Social Security was instituted due to the devaluing of the dollar. Whereas before, a dollar would pretty much hold its value over time so that a dollar saved in 1870, had the same purchasing power in 1910 as it did when it was saved. Which of course allowed those that were thrifty, and saved the fruits of their labor, over the course of their lives, to provide for themselves in their later years. Ergo, individual responsibility ruled that day in that era.

PeoplesElbow

Well-Known Member

For your consideration ...

Fun fact. Social Security was instituted due to the devaluing of the dollar. Whereas before, a dollar would pretty much hold its value over time so that a dollar saved in 1870, had the same purchasing power in 1910 as it did when it was saved. Which of course allowed those that were thrifty, and saved the fruits of their labor, over the course of their lives, to provide for themselves in their later years. Ergo, individual responsibility ruled that day in that era.

$100 in 1870 → 1910 | Inflation Calculator

The -0.80% inflation rate means $100 in 1870 is equivalent to $72.52 in 1910. This inflation calculator uses the official US consumer price index.

Attachments

LightRoasted

If I may ...

For your consideration ...

And you are going to believe that? Yet the chart they provide shows no inflation during the time frame. Gold does not lose value. Silver does not lose value. Both of which were being use at the time as money. There might have been some price increases due to demand or shortages of certain items. But there was no real monetary inflation such as we have today, which is referenced in the chart after 1913 and specifically after 1971.

Ponder this time frame ..... If your after-tax wealth has not increased by 39% since March 2020, then you are not keeping up with the Fed’s monetary debasement. You are losing ground and on the road to serfdom. It’s just an anecdote, but I don’t know anyone whose after-tax wealth has grown by 39% since March 2020. I imagine that most people don’t know anyone, either.

Here’s the bottom line … There’s an excellent chance more inflation and financial chaos is coming soon.

Are you ready for it?

$100 in 1870 → 1910 | Inflation Calculator

The -0.80% inflation rate means $100 in 1870 is equivalent to $72.52 in 1910. This inflation calculator uses the official US consumer price index.www.officialdata.org

And you are going to believe that? Yet the chart they provide shows no inflation during the time frame. Gold does not lose value. Silver does not lose value. Both of which were being use at the time as money. There might have been some price increases due to demand or shortages of certain items. But there was no real monetary inflation such as we have today, which is referenced in the chart after 1913 and specifically after 1971.

Ponder this time frame ..... If your after-tax wealth has not increased by 39% since March 2020, then you are not keeping up with the Fed’s monetary debasement. You are losing ground and on the road to serfdom. It’s just an anecdote, but I don’t know anyone whose after-tax wealth has grown by 39% since March 2020. I imagine that most people don’t know anyone, either.

Here’s the bottom line … There’s an excellent chance more inflation and financial chaos is coming soon.

Are you ready for it?

PeoplesElbow

Well-Known Member

So during that time frame gold went from about $27/oz to $20/oz. Looks like gold lost value to me.For your consideration ...

And you are going to believe that? Yet the chart they provide shows no inflation during the time frame. Gold does not lose value. Silver does not lose value. Both of which were being use at the time as money. There might have been some price increases due to demand or shortages of certain items. But there was no real monetary inflation such as we have today, which is referenced in the chart after 1913 and specifically after 1971.

Ponder this time frame ..... If your after-tax wealth has not increased by 39% since March 2020, then you are not keeping up with the Fed’s monetary debasement. You are losing ground and on the road to serfdom. It’s just an anecdote, but I don’t know anyone whose after-tax wealth has grown by 39% since March 2020. I imagine that most people don’t know anyone, either.

Here’s the bottom line … There’s an excellent chance more inflation and financial chaos is coming soon.

Are you ready for it?

View attachment 169477

200 years of prices - Only Gold

Historical Gold Prices Over 200 years of historical annual Gold Prices Historical Annual Closing Gold Prices Since 1792 Year Close % change Year Close % change Year Close % change 1995 $387.00 0.98% 1974 $183.77 72.59% 2015 $1,060.00 -11.6 % 1994 $383.25 -2.17% 1973 $106.48 66.79% 2014...

onlygold.com

onlygold.com

HemiHauler

Well-Known Member

The argument is that gold never loses inherent value. When you measure it by fiat currency, of course the value will vary.So during that time frame gold went from about $27/oz to $20/oz. Looks like gold lost value to me.

200 years of prices - Only Gold

Historical Gold Prices Over 200 years of historical annual Gold Prices Historical Annual Closing Gold Prices Since 1792 Year Close % change Year Close % change Year Close % change 1995 $387.00 0.98% 1974 $183.77 72.59% 2015 $1,060.00 -11.6 % 1994 $383.25 -2.17% 1973 $106.48 66.79% 2014...onlygold.com

PeoplesElbow

Well-Known Member

At the time our currency wasnt fiat currency. I assume this is what you could have actually bought an ounce for back then with the currency of the time.The argument is that gold never loses inherent value. When you measure it by fiat currency, of course the value will vary.

LightRoasted

If I may ...

For your consideration ...

Again. Gold and silver do not lose value. The quantity may change as such when new stock is added to the economy, (say after a large mine load discovery), there may be a small increase in prices of goods and services for a short period of time but then prices will stabilize. What those links you provided are doing, is assuming and applying, is the fiat $dollar relative to gold.

Gold did fluctuate though. The reason, gold's market value relative to silver.

BTW. Did you know the definition of a US dollar is 371.25 grains (0.7734375 troy ounces) pure silver, following the Spanish milled dollar?

So during that time frame gold went from about $27/oz to $20/oz. Looks like gold lost value to me.

200 years of prices - Only Gold

Historical Gold Prices Over 200 years of historical annual Gold Prices Historical Annual Closing Gold Prices Since 1792 Year Close % change Year Close % change Year Close % change 1995 $387.00 0.98% 1974 $183.77 72.59% 2015 $1,060.00 -11.6 % 1994 $383.25 -2.17% 1973 $106.48 66.79% 2014...onlygold.com

Again. Gold and silver do not lose value. The quantity may change as such when new stock is added to the economy, (say after a large mine load discovery), there may be a small increase in prices of goods and services for a short period of time but then prices will stabilize. What those links you provided are doing, is assuming and applying, is the fiat $dollar relative to gold.

Gold did fluctuate though. The reason, gold's market value relative to silver.

BTW. Did you know the definition of a US dollar is 371.25 grains (0.7734375 troy ounces) pure silver, following the Spanish milled dollar?

Pffft, yea that's just what we need is people fighting over who's imaginary friend is better.Bring back religion

Good luck on that eternity thing. You're going to need it.Pffft, yea that's just what we need is people fighting over who's imaginary friend is better.

PeoplesElbow

Well-Known Member

The quantity may change as such when new stock is added to the economy, (say after a large mine load discovery), there may be a small increase in prices of goods and services for a short period of time but then prices will stabilize.For your consideration ...

Again. Gold and silver do not lose value. The quantity may change as such when new stock is added to the economy, (say after a large mine load discovery), there may be a small increase in prices of goods and services for a short period of time but then prices will stabilize. What those links you provided are doing, is assuming and applying, is the fiat $dollar relative to gold.

Gold did fluctuate though. The reason, gold's market value relative to silver.

BTW. Did you know the definition of a US dollar is 371.25 grains (0.7734375 troy ounces) pure silver, following the Spanish milled dollar?

That is the definition of losing (or gaining) value, if something can gain value it can certainly lose it.

I think you look at precious metal based currency through rose colored glasses. I'm neither for or against it, but I think you are basing your beliefs on one side of the argument entirely.

One benefit of inflation is for anyone or any entity with a mortgage, or any other long term debt. A fixed payment today may be significant, but down the road the payments are far less.

Another example would be a royalty, so I have to pay ACME corp $1 for every widget I sell, 20 years from now that $1 is a much smaller chunk of the pie.

LightRoasted

If I may ...

For your consideration ...

You are confusing temporary price inflation with fiat monetary inflation which is permanent and ever increasing tied to the expansion of the fiat money supply.

Pre-1913. Gold's value did change, slightly, relative to the quantities of silver. If more silver was discovered, it increased the value of gold relative to the amount of silver. If silver supplies declined, the opposite. The ratio was first set at 15 ounces of silver to 1 ounce of gold, 15:1. However normalcy in prices returned after a new supplies were introduced into the economy. Today, that ratio, based on fiat currency spot prices, is about 90 ounces of silver to 1 ounce of gold, 90:1.

Your supposition that there is a benefit to inflation is the lie you've been told. Because, though yes, over the years, through the inflation mechanism, a mortgage will be paid with inflated, devalued, dollars, making it easier to pay that fixed mortgage. However, if the house went from $100,000 from 20 years ago, to now $400,000, it only represents what inflation has done. It is not because the house when up in value, it is because the dollar's value went down due to the increasing of the money supply. On top of that, over those years wages increased, but also the taxation that followed that taxed that increase which reduced what was made. As well as increase of property taxes based on the falsely inflated value of the property. *Monetary* Inflation is a losing proposition for everything and everyone. *Monetary* Inflation is theft. *Monetary* Inflation is a hidden tax because it devalues the dollars currently in one's possession. Forcing people to work longer to just keep up. and maintain their standard of living.

"I think you look at precious metal based currency through rose colored glasses." Nope. I just believe that The People should have control over their money system, as the US Constitution intended, rather than greedy private bankers which have no allegiance to this Nation. When the people have gold and silver coin in their possession, used as money, they control things. The govement just can't create money to use for stupid projects, because government cannot create gold or silver. And if the government went to the people for money for stupid projects, the people would say no, stopping the stupidity. While at present, under the current fiat money system, We The People have absolutely no say in the matter.

The quantity may change as such when new stock is added to the economy, (say after a large mine load discovery), there may be a small increase in prices of goods and services for a short period of time but then prices will stabilize.

That is the definition of losing (or gaining) value, if something can gain value it can certainly lose it.

I think you look at precious metal based currency through rose colored glasses. I'm neither for or against it, but I think you are basing your beliefs on one side of the argument entirely.

One benefit of inflation is for anyone or any entity with a mortgage, or any other long term debt. A fixed payment today may be significant, but down the road the payments are far less.

Another example would be a royalty, so I have to pay ACME corp $1 for every widget I sell, 20 years from now that $1 is a much smaller chunk of the pie.

You are confusing temporary price inflation with fiat monetary inflation which is permanent and ever increasing tied to the expansion of the fiat money supply.

Pre-1913. Gold's value did change, slightly, relative to the quantities of silver. If more silver was discovered, it increased the value of gold relative to the amount of silver. If silver supplies declined, the opposite. The ratio was first set at 15 ounces of silver to 1 ounce of gold, 15:1. However normalcy in prices returned after a new supplies were introduced into the economy. Today, that ratio, based on fiat currency spot prices, is about 90 ounces of silver to 1 ounce of gold, 90:1.

Your supposition that there is a benefit to inflation is the lie you've been told. Because, though yes, over the years, through the inflation mechanism, a mortgage will be paid with inflated, devalued, dollars, making it easier to pay that fixed mortgage. However, if the house went from $100,000 from 20 years ago, to now $400,000, it only represents what inflation has done. It is not because the house when up in value, it is because the dollar's value went down due to the increasing of the money supply. On top of that, over those years wages increased, but also the taxation that followed that taxed that increase which reduced what was made. As well as increase of property taxes based on the falsely inflated value of the property. *Monetary* Inflation is a losing proposition for everything and everyone. *Monetary* Inflation is theft. *Monetary* Inflation is a hidden tax because it devalues the dollars currently in one's possession. Forcing people to work longer to just keep up. and maintain their standard of living.

"I think you look at precious metal based currency through rose colored glasses." Nope. I just believe that The People should have control over their money system, as the US Constitution intended, rather than greedy private bankers which have no allegiance to this Nation. When the people have gold and silver coin in their possession, used as money, they control things. The govement just can't create money to use for stupid projects, because government cannot create gold or silver. And if the government went to the people for money for stupid projects, the people would say no, stopping the stupidity. While at present, under the current fiat money system, We The People have absolutely no say in the matter.

I am good without religion. Thanks for your concern.Good luck on that eternity thing. You're going to need it.