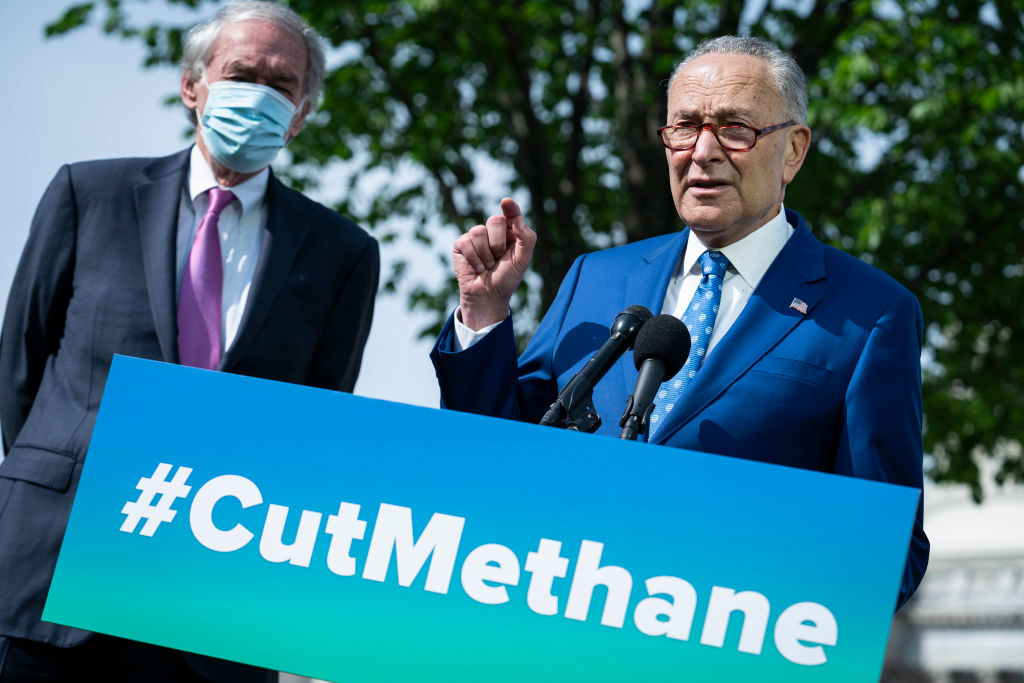

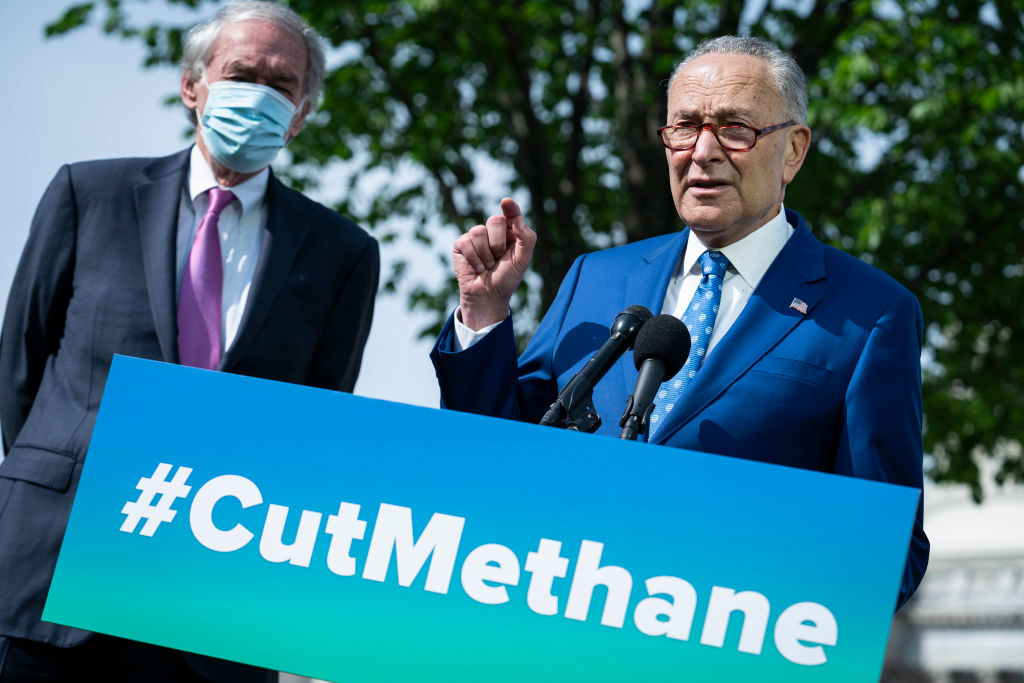

The IRA, you see, contains a “Methane Emissions Charge” that will impose a $900-a-ton tax on oil and gas producers that will increase to $1,500 after two years. The left is patting itself on the back for their valiant work to cut greenhouse gas emissions drastically by 2030. But here’s the thing: the energy industry is already working hard to cut emissions; it’s in their interest to do so. And when the government fines them for not capturing enough methane, guess who gets to foot the bill? Households already burdened by inflation.

“Methane that escapes during production or transportation is called fugitive or vented emissions,” Bernard L. Weinstein wrote at the Hill when the methane fee was introduced in the original Build Back Better bill last year. “These emissions have dropped remarkably sharply over the past decade. Why? Because energy companies have every incentive to capture methane, which is the principal component of natural gas. Those who put hard work and money into producing and transporting natural gas don’t want to lose any of it on the way to market.”

Long before BBB came along, market forces were at work, and methane emissions from natural gas extraction declined by 16 percent from 1990 to 2019. So in other words: the oil and gas industry is reducing methane emissions, and the Biden administration wants to take credit for it. And in the midst of an energy crisis, as suppliers scramble to meet demand, the government is adding mandates and punishments to the fraught industry, making the process of supplying energy to Americans all the more onerous.

“Why isn’t Big Oil up in arms about the climate-friendly Inflation Reduction Act?” wonders a headline at marketplace.org. The bill’s minimum tax rate isn’t a big deal to oil companies, the article says, because “a lot of the larger oil companies already pay taxes above that minimum,” and, as Weinstein noted, “they’ve been trying to limit methane leakage anyway.”

spectatorworld.com

spectatorworld.com

“Methane that escapes during production or transportation is called fugitive or vented emissions,” Bernard L. Weinstein wrote at the Hill when the methane fee was introduced in the original Build Back Better bill last year. “These emissions have dropped remarkably sharply over the past decade. Why? Because energy companies have every incentive to capture methane, which is the principal component of natural gas. Those who put hard work and money into producing and transporting natural gas don’t want to lose any of it on the way to market.”

Long before BBB came along, market forces were at work, and methane emissions from natural gas extraction declined by 16 percent from 1990 to 2019. So in other words: the oil and gas industry is reducing methane emissions, and the Biden administration wants to take credit for it. And in the midst of an energy crisis, as suppliers scramble to meet demand, the government is adding mandates and punishments to the fraught industry, making the process of supplying energy to Americans all the more onerous.

“Why isn’t Big Oil up in arms about the climate-friendly Inflation Reduction Act?” wonders a headline at marketplace.org. The bill’s minimum tax rate isn’t a big deal to oil companies, the article says, because “a lot of the larger oil companies already pay taxes above that minimum,” and, as Weinstein noted, “they’ve been trying to limit methane leakage anyway.”

Democrats pick a bad time to punish the energy industry

Big Oil isn’t “up in arms” about the methane emissions fee because they know everyone in America needs energy and has no other choice

spectatorworld.com

spectatorworld.com