You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

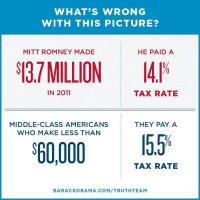

Romney shouldn’t pay a lower tax rate

- Thread starter nhboy

- Start date

GoodnessME

Active Member

than middle-class families

Then blame the TAX CODE not him. He paid what the CODE calculated!! Change the CODE!!! He tried to pay more by not claiming ALL his charity deductions...

Last edited:

JoeRider

Federalist Live Forever

Then blame the TAX CODE not him. He paid what the CODE calculated!! Change the CODE!!! He tried to pay more by not claiming ALL his charity deductions...

When boy wonder look at what went to charity his combine contribution to society is about 44%. Keep up the good work boy wonder, you are going to lose this one since Obama is not even close to pay 44% back to society. (Obama was like 20%)

MarieB

New Member

Fact Check: Is Romney's tax rate really lower than yours?

President Obama's campaign, with a good dose of help from the media, is pushing a claim that millionaire Mitt Romney is taxed at a "lower rate" than someone making $50,000 a year.

The claim, though, is open to debate. It only holds up in a particular scenario in which both income and all payroll taxes are counted.

The president's campaign presumably is referring to Romney's release last week of his 2011 tax returns, which showed he paid an effective tax rate of 14.1 percent.

This revelation, as might be expected, fueled a wave of campaign stump speeches and videos. The latest was an Obama Web video blasting Romney's "strange take on tax fairness." It included clips of people accusing Romney of paying a lower rate than "average" Americans. An accompanying campaign email said: "Mitt Romney admitted he thinks it's fair that his $20 million income was taxed at a lower rate than someone making $50,000."

IRS data, though, shows that Romney's effective income tax rate -- that's what he pays as a percentage of his income once deductions and other benefits are factored in -- is actually far higher than what most Americans pay.

And it's certainly higher than what someone making $50,000 pays.

IRS data from 2010 shows someone making between $50,000 and $75,000 on average pays an effective rate of 7.8 percent. Even someone making between $100,000 and $200,000 pays a 12.1 percent rate -- also lower than Romney's.

Read more: Fact Check: Is Romney's tax rate really lower than yours? | Fox News

President Obama's campaign, with a good dose of help from the media, is pushing a claim that millionaire Mitt Romney is taxed at a "lower rate" than someone making $50,000 a year.

The claim, though, is open to debate. It only holds up in a particular scenario in which both income and all payroll taxes are counted.

The president's campaign presumably is referring to Romney's release last week of his 2011 tax returns, which showed he paid an effective tax rate of 14.1 percent.

This revelation, as might be expected, fueled a wave of campaign stump speeches and videos. The latest was an Obama Web video blasting Romney's "strange take on tax fairness." It included clips of people accusing Romney of paying a lower rate than "average" Americans. An accompanying campaign email said: "Mitt Romney admitted he thinks it's fair that his $20 million income was taxed at a lower rate than someone making $50,000."

IRS data, though, shows that Romney's effective income tax rate -- that's what he pays as a percentage of his income once deductions and other benefits are factored in -- is actually far higher than what most Americans pay.

And it's certainly higher than what someone making $50,000 pays.

IRS data from 2010 shows someone making between $50,000 and $75,000 on average pays an effective rate of 7.8 percent. Even someone making between $100,000 and $200,000 pays a 12.1 percent rate -- also lower than Romney's.

Read more: Fact Check: Is Romney's tax rate really lower than yours? | Fox News

NorthBeachPerso

Honorary SMIB

Yet another thread posted on multiple forums across the internet using the exact same wording and the exact same graphic.

Vince

......

The have to make it look like it's Romney's fault so he looks bad in the eyes of the voting public.Then blame the TAX CODE not him. He paid what the CODE calculated!! Change the CODE!!! He tried to pay more by not claiming ALL his charity deductions...

struggler44

A Salute to all on Watch

......Everything I've been able to find shows a middle-class American making 60k a year would pay approx a 7.2 -8.1% tax rate; where did you get the 14% number from?

FreedomFan

Snarky 'ol Cuss

I can't believe this distraction of a story still has legs. The supplicant media just eats up the propaganda.

Mitt Romney will be a horrible president, but not because of how much tax he does or doesn't pay. Mitt Romney will be a terrible president because he will continue to erode, not restore our freedoms.

Mitt Romney will be a horrible president, but not because of how much tax he does or doesn't pay. Mitt Romney will be a terrible president because he will continue to erode, not restore our freedoms.

Vince

......

And Obama's socialist agenda will not erode our freedoms.I can't believe this distraction of a story still has legs. The supplicant media just eats up the propaganda.

Mitt Romney will be a horrible president, but not because of how much tax he does or doesn't pay. Mitt Romney will be a terrible president because he will continue to erode, not restore our freedoms.

FreedomFan

Snarky 'ol Cuss

And Obama's socialist agenda will not erode our freedoms.

Of course.

The lesser of two evils is still a vote for evil.

Vince

......

I can't argue with that.Of course.

The lesser of two evils is still a vote for evil.

-SS-

DHS Extremist

than middle-class families

Tax Rates only matter when it isnt a democrat / progressive / socialist.

Yahoo! -Mitt RomneyIn 2004, John Kerry and his wife released portions of their separate tax returns that showed the couple paid an effective federal tax rate of about 13 percent on $5.5 million in income from the year before.

Whooops, looks like your troll has easily been dismantled. A little basic research would spare you alot of humiliation. Ironic considering you mention repeating lies often enough.

=================

Now we'll look at the some facts that our media refuses to publish (and it's been around since 2010):

http://www.zerohedge.com/article/en...um-wage-has-more-disposable-income-family-makTonight's stunning financial piece de resistance comes from Wyatt Emerich of The Cleveland Current. In what is sure to inspire some serious ire among all those who once believed Ronald Reagan that it was the USSR that was the "Evil Empire", Emmerich analyzes disposable income and economic benefits among several key income classes and comes to the stunning (and verifiable) conclusion that "a one-parent family of three making $14,500 a year (minimum wage) has more disposable income than a family making $60,000 a year." And that excludes benefits from Supplemental Security Income disability checks. America is now a country which punishes those middle-class people who not only try to work hard, but avoid scamming the system. Not surprisingly, it is not only the richest and most audacious thieves that prosper - it is also the penny scammers at the very bottom of the economic ladder that rip off the middle class each and every day, courtesy of the world's most generous entitlement system.

Look at the nice pretty picture at the link.

......Everything I've been able to find shows a middle-class American making 60k a year would pay approx a 7.2 -8.1% tax rate; where did you get the 14% number from?

Who knows? This one massively set off my BS meter - I don't know anyone in that tax bracket who paid that much in federal income taxes.

The only conclusion I can come to is they base it on the federal income tax bracket, presuming no exemptions, no deductions, no credits, for a single person and excluding the amount of income taxed at a lower rate BUT including taxes from all other sources, such as FICA and state & local.

He also voluntarily took less in deductions and ended up paying a quarter million more than he had to. I'd really like to see how much "extra" tax that Obama or the Bidens paid.

-

-

-

Remember this - if the rich pay more in taxes, YOUR tax won't go down. If you took ALL THEIR INCOME, your taxes will not go down. If you took all their wealth, including their property and everything they own - it still won't lower your tax. The tax rates are fixed - if absolutely every single person in the country gave all their income to the government, your bill remains the same, and they don't lower the tax because they had a banner year.

E

EmptyTimCup

Guest

than middle-class families

Wow that is dishonest ........

Romney is not working 9 to 5

he is living off of money he already earned ......... and then reinvested

if you do not like that investments have a lower tax threshold petition yur congress critter to raise the taxes on investments

Attachments

E

EmptyTimCup

Guest

Whooops, looks like your troll has easily been dismantled. A little basic research would spare you alot of humiliation. Ironic considering you mention repeating lies often enough.

it is about sound bites for AI / Dancing / Batchler crowd ... not people who research the facts

E

EmptyTimCup

Guest

Remember this - if the rich pay more in taxes, YOUR tax won't go down. If you took ALL THEIR INCOME, your taxes will not go down. If you took all their wealth, including their property and everything they own - it still won't lower your tax. The tax rates are fixed - if absolutely every single person in the country gave all their income to the government, your bill remains the same, and they don't lower the tax because they had a banner year.

Wow that is dishonest ........

Exactly. Romney's rate is quite identical to mine...and everyone else's.

But cellarboy wouldn't know nor would he care about that.

MMDad

Lem Putt

Of course.

The lesser of two evils is still a vote for evil.

And the lesser of four, six, or eight evils is still a vote for evil.

Don't pretend you are somehow superior because your less evil is different than my less evil.

Wirelessly posted

http://m.whitehouse.gov/blog/2011/04/18/president-obama-and-vice-president-biden-s-tax-returns-and-tax-receipts

I am sure that site will have the other years as well if you poke around.

MMDad said:Does anyone know what Obama's effective tax rate is? Or what it would be if he actually gave to charity?

http://m.whitehouse.gov/blog/2011/04/18/president-obama-and-vice-president-biden-s-tax-returns-and-tax-receipts

I am sure that site will have the other years as well if you poke around.