Joe Biden’s Economic Dunkirk

Fast forward 44 years and Stockman’s dire warning about regulatory time bombs and an economic Dunkirk is about to come horrifyingly true.

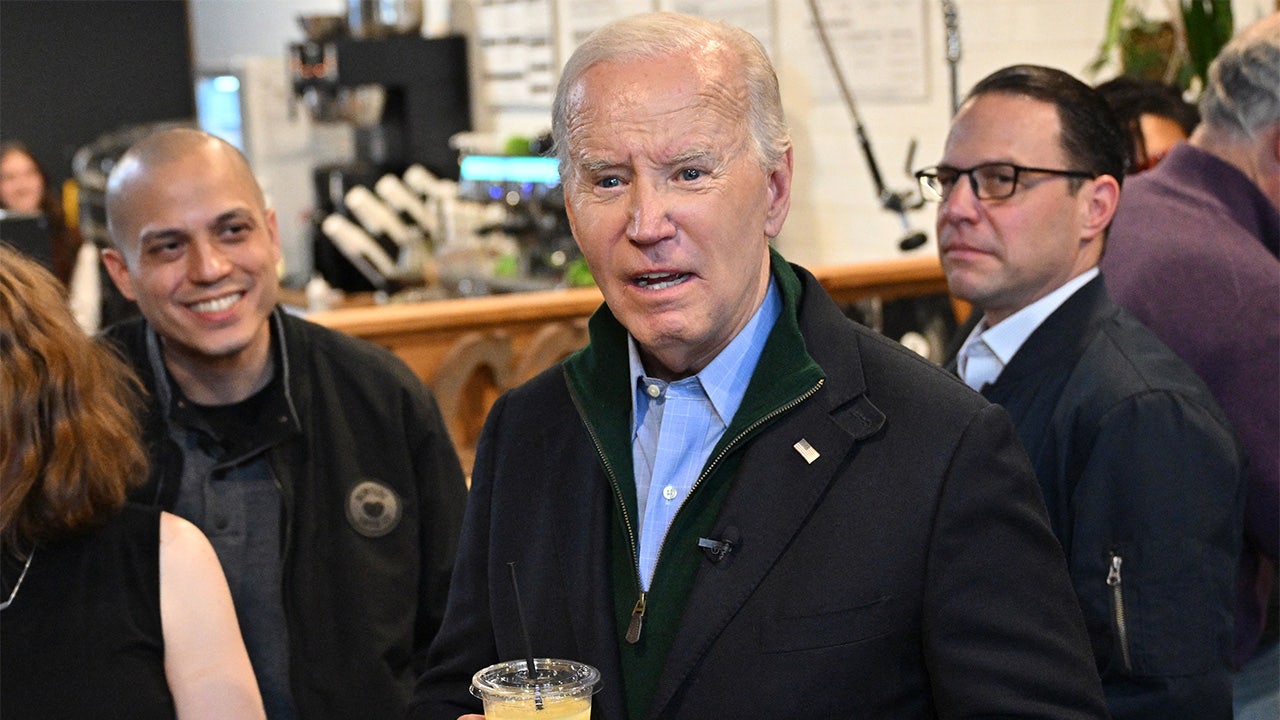

That’s because, unlike Carter, President Joe Biden is unable or unwilling to learn in office. And so, instead of deregulating the economy to fuel growth and lower prices, he is smothering it with an unprecedented number of new and massively expensive rules and regulations.

Rules that will:

- Force car owners into inconvenient, expensive, range-deficient EVs.

- Impose emission standards on large trucks that, the industry says, will be “the most challenging, costly and potentially disruptive heavy-duty emissions rule in history.”

- Sharply raise the cost of drilling for oil and gas on public lands and raise the cost of water.

- Make it nearly impossible to get permits to expand or build new facilities in most areas of the country without violating impossibly strict clean-air standards.

- On and on the list goes.

To quote Stockman, if these time bombs aren’t immediately diffused by the next administration, they will “sweep through the industrial economy with near gale force, pre-empting multi-billions in investment capital, driving up operating costs, and siphoning off management and technical personnel in an incredible morass of new controls and compliance.”