black dog

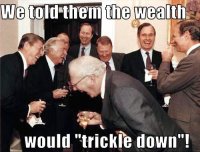

Free America

I don't have to "prove" it. I see it working every single day. When you own and operate businesses, the mechanisms and consequences are as plain as the nose on your face.

Not that you'd have any reason to understand any of that. You've never been there. Loser.

Consequences for bad management can huurt... About eight years ago I locally over spend on machinery and consumables at two local St Mary's business's..

Luckily both companies treated me very well during the dumping economy, I was honest with Doc and everytime he told me, You can pay me when you can... and I paid what I owed over a extended period.. It was a big business lesson to me..

Thanks Doc & Brian... I hope scoot is doing well...