Two weeks ago, the New York Times ran an eyebrow-raising article under the heavily ironic headline, “

With Inflation This High, Nobody Knows What a Dollar Is Worth.” Certainly

the New York Times doesn’t know what a dollar is worth, and hasn’t for a long time. Joe Biden might not know, either. “

Wages keep going up, and inflation keeps coming down,” Biden boasted in January, during his State of the Union address.

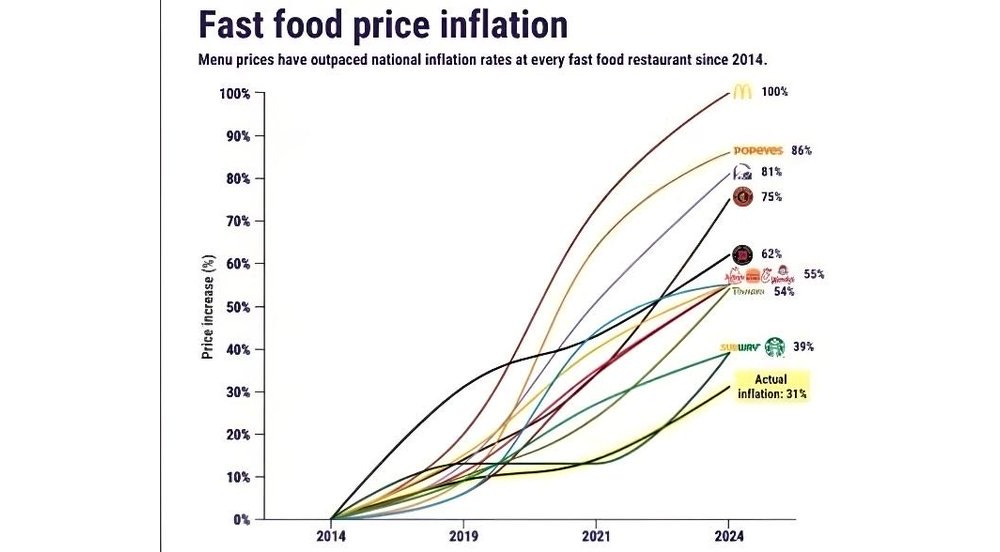

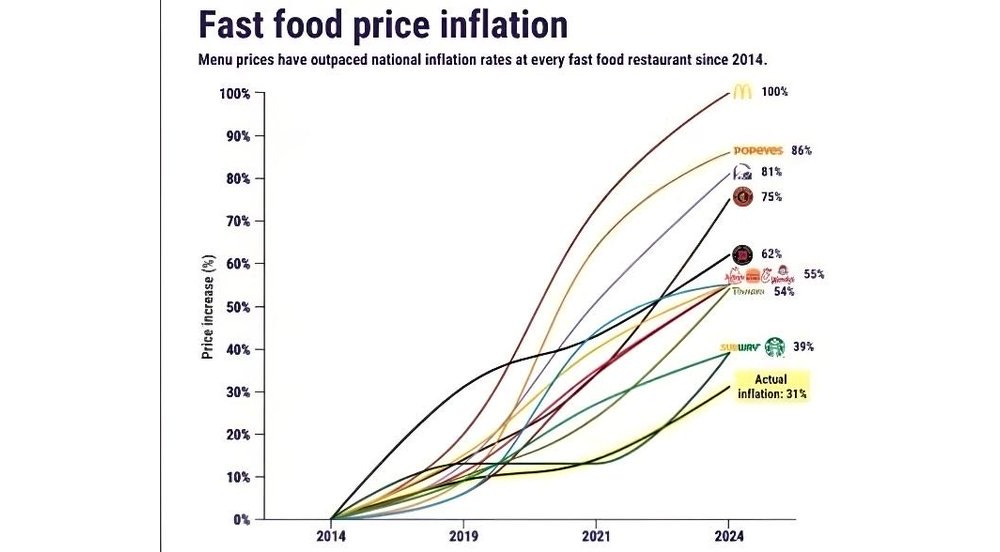

But independent researchers, using what they call the “Fast Food Index,” claim otherwise. Since last week, a viral image has been widely making the rounds. It caught my attention this morning, because I noticed that it stung corporate media, which immediately rushed to put out the political fires.

Here’s the viral graphic, which conclusively proves the real scale of inflation at a glance:

But wait! Don’t believe your lying eyes! Among several other platforms, all simultaneously late last week,

CNBC’s political fire brigades rushed out the Biden Administration’s talking-points fire truck:

CNBC was clearly uncomfortable putting much in writing. Instead its article referred readers to a “video explainer.” CNBC’s cheerful, MTV-style video explainer argued that you just shouldn’t use fast food as any kind of barometer for inflation. But the video couldn’t carry it off. First off, CNBC schizophrenically used the government’s figures as a starting point; the Consumer Price Index (CPI) grudgingly admits only that fast food is up +23% since Biden took office.

But then, blowing up its own argument in mid-sentence, in the video CNBC used a Subway turkey sub as an example. The sub cost $5 two years ago. It costs $11 now. Even Portlanders can tell that’s a lot more than +23%.

Laughably, trying to find the bright side, CNBC claimed the higher prices were leading to higher profits and benefiting investors. But

this week’s headlines tell a completely different story:

Two days ago, the Wall Street Journal ran a related story headlined, “

Consumers Fed Up With Food Costs Are Ditching Big Brands.” The article described alert Laguna Niguel consumer Denis Montenaro, 75, who recently ran by McDonald’s to grab his favorite order: a bacon and egg bagel and a black coffee. The retired manager “was stunned to see the $9.67 bill.”

That’s it! “I’m done with fast food,” Montenaro told the Journal.

Basically, and tying right to Biden’s ridiculous SOTU claim, CNBC dutifully explained how

fast food price inflation is really good news. “After the pandemic,” CNBC patiently lectured, “employers competed with each other to hire employees, by offering higher wages.” So

increased labor cost is the main reason, according to CNBC, that food prices are skyrocketing.

See? It’s

good news — for employees, that is, whose paychecks are getting bigger. Or is it? CNBC stopped short of imaging how those employees receiving higher wages then have to turn right around and buy higher-priced food items. So they aren’t really getting a raise. They might even be going backwards. But I digress.

The desperate, sold-out, government-captured, corporate media propaganda platform then hawked even more “good news”: CNBC assured viewers that inflation

is stabilizing now, so you don’t need to worry about that $11 sub costing $22 dollars by the end of the year. Of course, they’ve been claiming that inflation was stabilizing ever since Biden first infested the White House, but don’t hold that against them.

They’re right,

this time. If not, they’ll have another complicated explanation for why not.

This almost seems like a cliche, but if a Republican were occupying the White House, inflation would be

all that CNBC would be talking about, twenty-four-by-seven, and not in this good, optimistic, seeing-the-bright-side way. It would be the End of the Financial World. Trust me.

This video article, and the other similar ones, is a terrific example of one of the media’s favorite psyops, which they usually deploy in a series of articles. This time, that one viral graphic panicked them and they combined all the stages into one article. Here’s the formula: (1) It isn’t actually happening. (2) It might be happening sometimes but it’s very rare. (3) You should be happy that it’s happening.

Media ignores Portland attacks; Chinese scientists editing Ebola DNA to make it easier to transmit; corporate media freakout over fast food inflation; and Iowa joins Texas against Biden; and more.

www.coffeeandcovid.com