I listened to E.J. Antoni on WMAL last Friday. Very good explanation of these reports.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bidenomics

- Thread starter GURPS

- Start date

Look, we all had a delicious fried spam or bologna sandwich lunch growing up, but the fact the cheap meats are gaining popularity like no other food in this economy has to make the Left look up and admit the economy is not as peachy as they claim ... right? Nope. That would be wrong. They will claim the economy is fabulous just as they did with the jobs report where they pretend like they are not going to revise that number quietly in a few weeks.

Regardless of how sad the economy is, we can still laugh at the posts on X! And that is what we are here for right? To find the FUN in the world going to crap under Democrat rule?

Democrat Economist Who Warned Biden Of Inflation In 2021 Sounds Alarm Again: ‘Markets Could Crash’

According to the latest Consumer Price Index data — which was released by the Bureau of Labor Statistics — key drivers of the higher rates include car insurance, groceries, electricity, and gas. New parents and pet owners are feeling the pinch as well, with baby food now up over 30% since 2021 and pet food up 23.7%.

The higher-than-expected inflation numbers come just a day after Treasury Secretary Janet Yellen claimed that overall household finances were “quite strong” — and may put a sizable kink in any plans to begin bringing interest rates back down.

“I was not hugely surprised by the numbers,” Summers said when asked during a Bloomberg News interview on Wednesday what he thought about the latest inflation numbers. “In an economy that’s growing faster than potential, with an unemployment rate that has a three handle in the presence of massive and growing budget deficits and epically easy financial conditions, the idea that inflation would remain robust, or even accelerate, should not be a surprise to anyone.”

Summers said that inflation is actually running higher than the 3.5% number that the Biden administration released.

"..., with an unemployment rate that has a three handle in the presence of massive and growing budget deficits and epically easy financial conditions, the idea that inflation would remain robust, or even accelerate, should not be a surprise to anyone.”

Hijinx

Well-Known Member

Look, we all had a delicious fried spam or bologna sandwich lunch growing up, but the fact the cheap meats are gaining popularity like no other food in this economy has to make the Left look up and admit the economy is not as peachy as they claim ... right? Nope. That would be wrong. They will claim the economy is fabulous just as they did with the jobs report where they pretend like they are not going to revise that number quietly in a few weeks.

Regardless of how sad the economy is, we can still laugh at the posts on X! And that is what we are here for right? To find the FUN in the world going to crap under Democrat rule?

There is nothing cheap about cheap meats.

Spam is scrapings they couldn't sell otherwise and so are Vienna Sausage. Just scrap they process, and I can buy a canned ham as cheap as I can Spam now. I was getting 2 cans of Vienna sausage and the Dollar Tree $1.00, they don't have them any more $.93 cent at Food Lion now.

Potted meat at $1.10 and the can is so small it won't fill 3 crackers. I like Esskay Balogna $5.99 at BJ's $6.99 at Walmart I got the German Balogna $2.59 at BJ's I don't like it as much, but it's cheaper. Canned corned beef used to be a lb. can now 12 ounces, and over $5.00 so don't look for cheap meat, It aint cheap. They cut the scraps off pork, make a mush out of it press it and call it ham. If you really want a cheap meal go to BJ's buy one of their roasted chickens for $5.00.It is good for 2 meals for my wife and I and I get enough chicken salad for a couple of sandwiches..

What the hall was Shoppers food world thinking when they opened 3 stores in St. Mary's kept them open for a couple of months and then close them. An expensive mistake and people who got jobs just lost them.

I am going to miss their day old donuts, but everything else there was so high I had to leave it and the one in Mechanicsville stunk so bad I only went there once.

Hijinx

Well-Known Member

Janet Yellen is a Grandmother type who has no idea WTF she is doing, and should have retired 15 years ago.Democrat Economist Who Warned Biden Of Inflation In 2021 Sounds Alarm Again: ‘Markets Could Crash’

According to the latest Consumer Price Index data — which was released by the Bureau of Labor Statistics — key drivers of the higher rates include car insurance, groceries, electricity, and gas. New parents and pet owners are feeling the pinch as well, with baby food now up over 30% since 2021 and pet food up 23.7%.

The higher-than-expected inflation numbers come just a day after Treasury Secretary Janet Yellen claimed that overall household finances were “quite strong” — and may put a sizable kink in any plans to begin bringing interest rates back down.

“I was not hugely surprised by the numbers,” Summers said when asked during a Bloomberg News interview on Wednesday what he thought about the latest inflation numbers. “In an economy that’s growing faster than potential, with an unemployment rate that has a three handle in the presence of massive and growing budget deficits and epically easy financial conditions, the idea that inflation would remain robust, or even accelerate, should not be a surprise to anyone.”

Summers said that inflation is actually running higher than the 3.5% number that the Biden administration released.

Her incompetence is typical of the majority of the Biden Administration.

Yahoo’s article, consistent with most corpriate media reports, downplayed the ‘surprising’ increase, reporting inflation as only increasing a modest +3.5%. But other headlines from yesterday easily put the lie to that awkward untruth, such as:

Biden’s main argument for domestic success has always been bragging about his perversely-named “Inflation Redution Act.” Like everything else Biden has sniffed, that sick joke of a bill failed too.

Name one domestic area where normal citizens are better off than they were in January 2020. I dare you.

For your amusement, here’s a fun compendium of Biden officials denying that inflation exists or calling it temporary or “transitory”, meaning oh, it’s just a transition. True. It’s a transition from bad to worse:

CLIP: Two minutes of Biden and his incompetent officials lying about inflation (1:50).

☕️ GOING ON OFFENSE ☙ Thursday, April 11, 2024 ☙ C&C NEWS 🦠

FISA renewal fails after Trump tweet; Brand interviews Ladapo about vaxx; Biden's inflation policy fails; Russia global pushback strategy comes clear; Florida fights grooming and porch pirates; more.

Yahoo’s article, consistent with most corpriate media reports, downplayed the ‘surprising’ increase, reporting inflation as only increasing a modest +3.5%. But other headlines from yesterday easily put the lie to that awkward untruth, such as:

Biden’s main argument for domestic success has always been bragging about his perversely-named “Inflation Redution Act.” Like everything else Biden has sniffed, that sick joke of a bill failed too.

Name one domestic area where normal citizens are better off than they were in January 2020. I dare you.

For your amusement, here’s a fun compendium of Biden officials denying that inflation exists or calling it temporary or “transitory”, meaning oh, it’s just a transition. True. It’s a transition from bad to worse:

CLIP: Two minutes of Biden and his incompetent officials lying about inflation (1:50).

☕️ GOING ON OFFENSE ☙ Thursday, April 11, 2024 ☙ C&C NEWS 🦠

FISA renewal fails after Trump tweet; Brand interviews Ladapo about vaxx; Biden's inflation policy fails; Russia global pushback strategy comes clear; Florida fights grooming and porch pirates; more.

Bidenomics Update: Staggering Under the Weight of It All

Three years of Joe Biden, and we're all safely back in the poorhouse, making room for more new arrivals every day. This is particularly true as interest rates on those cards are making it mighty hard to claw your way out.

...But the federal survey doesn’t fully capture the run-up in credit card rates, which began in mid-2022.

The average interest rate charged on credit cards rose to 21.5% in November 2023 from 15.1% in May 2022, according to WalletHub.

Card rates rose along with interest rates generally: Federal regulators launched a historic campaign of rate increases to tamp down inflation, which peaked at a 40-year high of over 9% in the summer of 2022.

Forbes said the average rate is an eyewatering 27%+ this week.

The average credit card interest rate is 27.89%, according to Forbes Advisor’s weekly credit card rates report.

The Federal Reserve keeps tabs on the average interest rate that U.S. consumers pay for a variety of different financial products—credit cards included. In February 2024, the average credit card interest rate in the U.S. on accounts with balances that assessed interest was 22.63%, according to The Federal Reserve.

Up five percentage points in a shade over two months. Feeling used and abused yet?

Margaret Sullivan Complains Voters Are Too Worried About The Economy Instead Of ‘Democracy’

While dismissing Americans’ concerns about the economy, Sullivan said she thinks the 2024 election is an “existential one” because if Trump is elected again, he will start “taking down some of the restraints and the guardrails that kept him and his administration from doing as much harm to democracy as they could have the first time around.”

Sullivan also suggested journalists should stop worrying about looking partisan and instead should focus on how a second Trump term would allegedly hurt “democracy.”

“I don’t think it’s so far afield to have our coverage reflect that democracy issues and truth are important,” she said, insisting “we don’t need to be so defensive all the time about orienting coverage that way.”

Sullivan claimed the media have historically taken “refuge” in trying to treat political candidates the same with their coverage, but doubled down on her belief that corporate media should no longer apply those traditional journalistic principles of objectivity to Trump. “These candidates are not the same at all and so to equalize them is actually very, very misleading,” she said.

You think we are worried about keeping "democracy"? We're worried about keeping our SHIRT.

1. I don't think you give a damn about "democracy" since you're willing to completely violate its every tenet to "preserve" it and

2. I don't think y'all give a damn about US so long as you get all your agenda accomplished. We can all go straight to hell, just s'long as you get your green agenda and the rest.

Because - then it will be great -

For you.

Hijinx

Well-Known Member

Whoopi Goldberg Claims Average Americans OUTRAGED Over Biden's Inflation Don't Know Civics!

A high school drop out doing drugs at 17. Yeah she knows Civics all right.

Her claim to a PHD is BS, If she has the sheepskin let's see it.

Some dumb assed school once gave her a honorary degree which isn't worth the paper it is written on.

She claims she had 7 abortions by the time she was 25, maybe her PHD is on abortions.

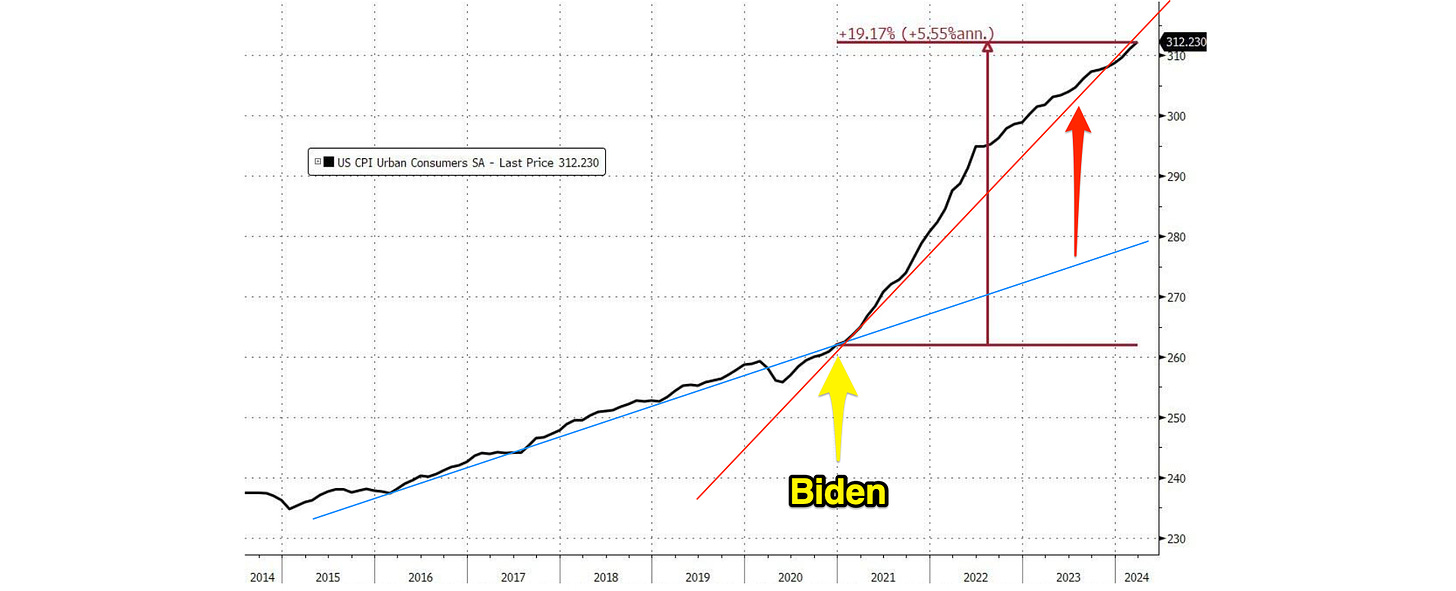

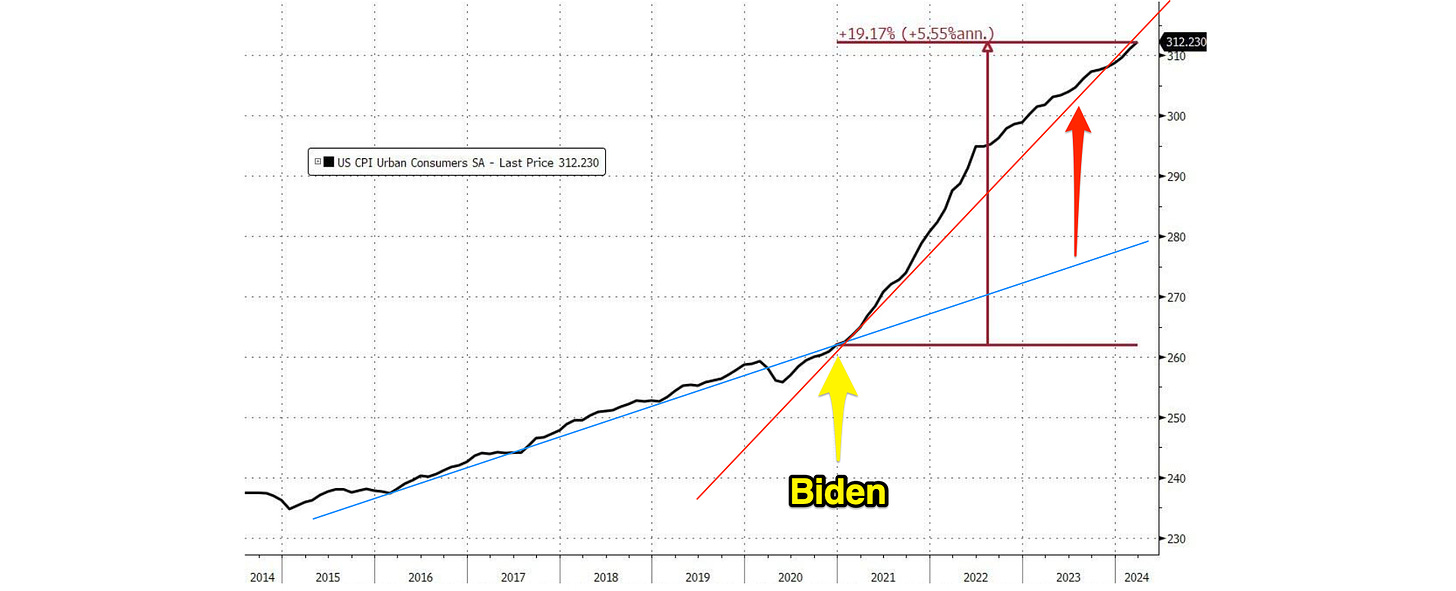

Top Economists Including Barack Obama’s Treasury Secretary Discover the Real Inflation Number Under Biden Reached 18% and Is Still Hovering at a 40-Year High

A recent research paper by four noted economists, including Larry Summers, the former Treasury Secretary under Barack Obama and former Harvard President, discovered that the real inflation rate during the Biden years, using pre-1983 calculations reached 18% in 2022.

The number is the highest inflation rate the country has seen in over 50 years.

This research project was published by these four authors at the nonpartisan National Bureau of Economic Research in late February and is just now making waves.

Marijn A. Bolhuis is an economist in the Macro Policy division of the International Monetary Fund’s Strategy, Policy, and Review (SPR) Department.

Judd Cramer is a Harvard Economist.

Karl Oskar Schulz a Harvard undergrad whose analysis found that the higher cost of borrowing is linked to persistent consumer gloom.

Larry Summers is a former Harvard President and Barack Obama’s Secretary of the Treasury. Larry worked as the chief economist of the World Bank from 1991 to 1993.

The researchers also found that if the pre-1983 calculations for the Consumer Price Index (CPI) or inflation rate has not come back down under 7 percent since its peak in 2022.

Joe Did That: Inflation Costs Americans an Extra $1K Monthly

Food, child care, and rent — the necessities — are devastatingly expensive under the Biden administration. Fox quoted Bright MLS chief economist Lisa Sturtevant, “Inflation has not just stalled, but it is moving in the wrong direction.” Unfortunately, low-income Americans — those who can least afford to spend more — are of course hardest hit by rising costs.

The Consumer Price Index (CPI), which measures the costs of what is supposed to be a representative “basket of goods,” continues to be well above the rate that the U.S. had before the economically damaging COVID-19 pandemic, Fox explained. The necessities mentioned above (food, rent, child care) are significantly more expensive than they were just a year ago.

“Housing and gasoline costs were the biggest drivers of inflation last month, accounting for more than half of the total monthly increase,” Fox added. Food and auto insurance costs also went up, with the latter at a sobering 22.2% increase over the same time in 2023. Inflation is causing Americans to use up savings and increasingly rack up credit card debt to meet expenses, a situation that is both risky and unsustainable.

This Is Fine: Insurance Now a 'Luxury Item,' Thanks to Biden and the Left

For several years now, the Left has argued that we should allow people to steal, riot, loot, and thieve because they really need whatever it is they're stealing, and insurance will take care of it.

Several of us warned that this would end badly. Now, businesses are leaving high crime areas in droves, and insurance costs are skyrocketing.