You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

California Issues ...

- Thread starter GURPS

- Start date

California just opened a program funded by the California Dept of Social Services. The program offers guaranteed payments of $725 to select families.

Aside from income, the other qualification is that you can’t be White. This program is only for non Whites.

Taxpayer funded and Government organized discrimination.

Huntington Beach Mayor Gracey Van Der Mark says she will be DEFYING Gavin Newsom's new law that bans California election officials from requiring Voter ID

“The state cannot pass any laws that strip us of our constitutional rights so that law does not apply to us or affect our new election laws.”

In March, the voters of Huntington Beach voted to pass a ballot initiative empowering the city to require ID to vote. Immediately after the measure passed, the Democrat-controlled legislature introduced a bill to undo it, which Newsom signed into law a few days ago.

Hmmm... where have I heard that before. Sounds like, "You didn't build that."

GREG GUTFELD: These California officials are abusing their power to punish Elon Musk

'Gutfeld!' panelists react to the California Coastal Commission rejecting SpaceX's request to launch more rockets from the Vandenberg Space Force Base.

Who is John Galt?

GREG GUTFELD: These California officials are abusing their power to punish Elon Musk

'Gutfeld!' panelists react to the California Coastal Commission rejecting SpaceX's request to launch more rockets from the Vandenberg Space Force Base.www.foxnews.com

I'm embarrassed to say I've never read that book.Who is John Galt?

In the book, the government went after Hank Reardon, among others.I'm embarrassed to say I've never read that book.

I'm embarrassed to say I've never read that book.

The 1st movie was pretty good

The following two weren't.The 1st movie was pretty good

And it didint' help that they kept changing the actors.

LightRoasted

If I may ...

For your consideration ...

"In the character of John Galt, Ayn Rand presented her image of the ideal man: A man of reason, ambition, productivity, and achievement who pursued his rational self-interest, with his own happiness as his highest goal. And in that sense, John Galt represents the best within each one of us."

Could also be associated with the MGTOW movement.

Who is John Galt?

"In the character of John Galt, Ayn Rand presented her image of the ideal man: A man of reason, ambition, productivity, and achievement who pursued his rational self-interest, with his own happiness as his highest goal. And in that sense, John Galt represents the best within each one of us."

Could also be associated with the MGTOW movement.

California’s controlled demolition continues, signaling why the fledgling Democrat Resistance is already doomed. Local KTLA ran a story yesterday headlined, “Downtown Los Angeles skyscraper loses 2/3 of value.” Last appraised ten years ago at $605 million, the Bank of America Plaza in downtown LA just appraised at only $188 million — having lost 66% of its value in ten years. It has defaulted on its loans. The building’s occupancy is terrible. What could have caused this? Hint:

This type of depressing headline is common for the Big Blue Cities. Still, Democrats will deny, they’ll try to wave away the Blue commercial market meltdown, blaming it on pandemic fatigue and worker’s changing preferences for spending their days working in pajamas instead of coming into the office.

But that is a lie. To prove it, I rounded up two more headlines to make a trifecta.

First, compare the real estate market in Los Angeles, California with the market in Miami, Florida. In July, the Financial Times ran a story headlined, “Cost of Miami office space hits record high. In the very first paragraph, FT provided readers with what I like to call a “clue:”

Apparently, for some reason, unlike Los Angeles, Miami’s commercial market has not been hollowed out by work-from-home policies. It is not suffering from pandemic fatigue. It is booming. And it is stealing LA’s blue-chip companies.

But, Democrats will wail, that’s just because it’s Florida, and Florida is an outlier. But pardonne-moi, mon ami. Not so fast. Let’s consider the next best red market or, tipping the cowboy hat as deserved, arguably the best.

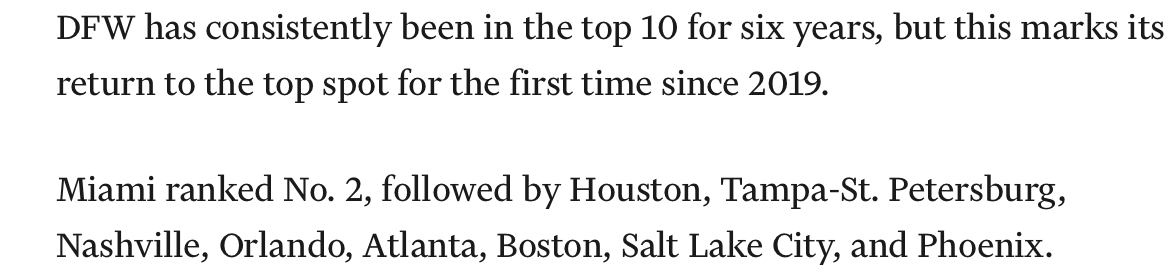

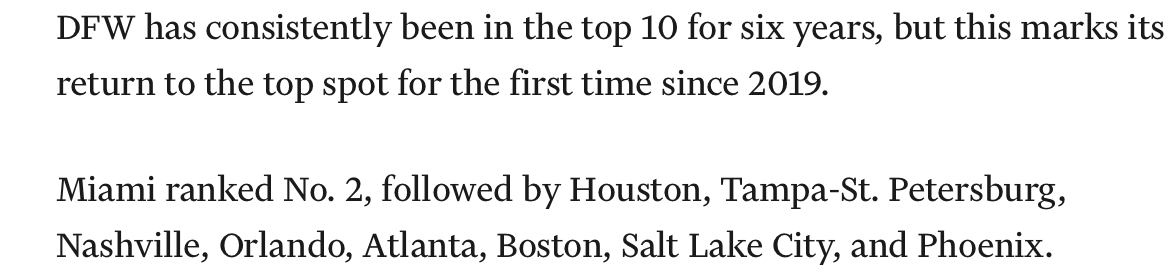

Early this month, just a few weeks ago, Dallas Magazine ran a story headlined, “Dallas Named Country's No. 1 Commercial Real Estate Market for 2025. Here's Why.” Not only did this delightful story prove that a second Big Red City is also not suffering pandemic fatigue or having any pajama problems, but it helpfully provided the current list of the top ten commercial real estate markets. Ready? See if you can spot any common characteristics:

You see it. Except for Boston, all the top-performing real estate markets are all Red State Big Cities.

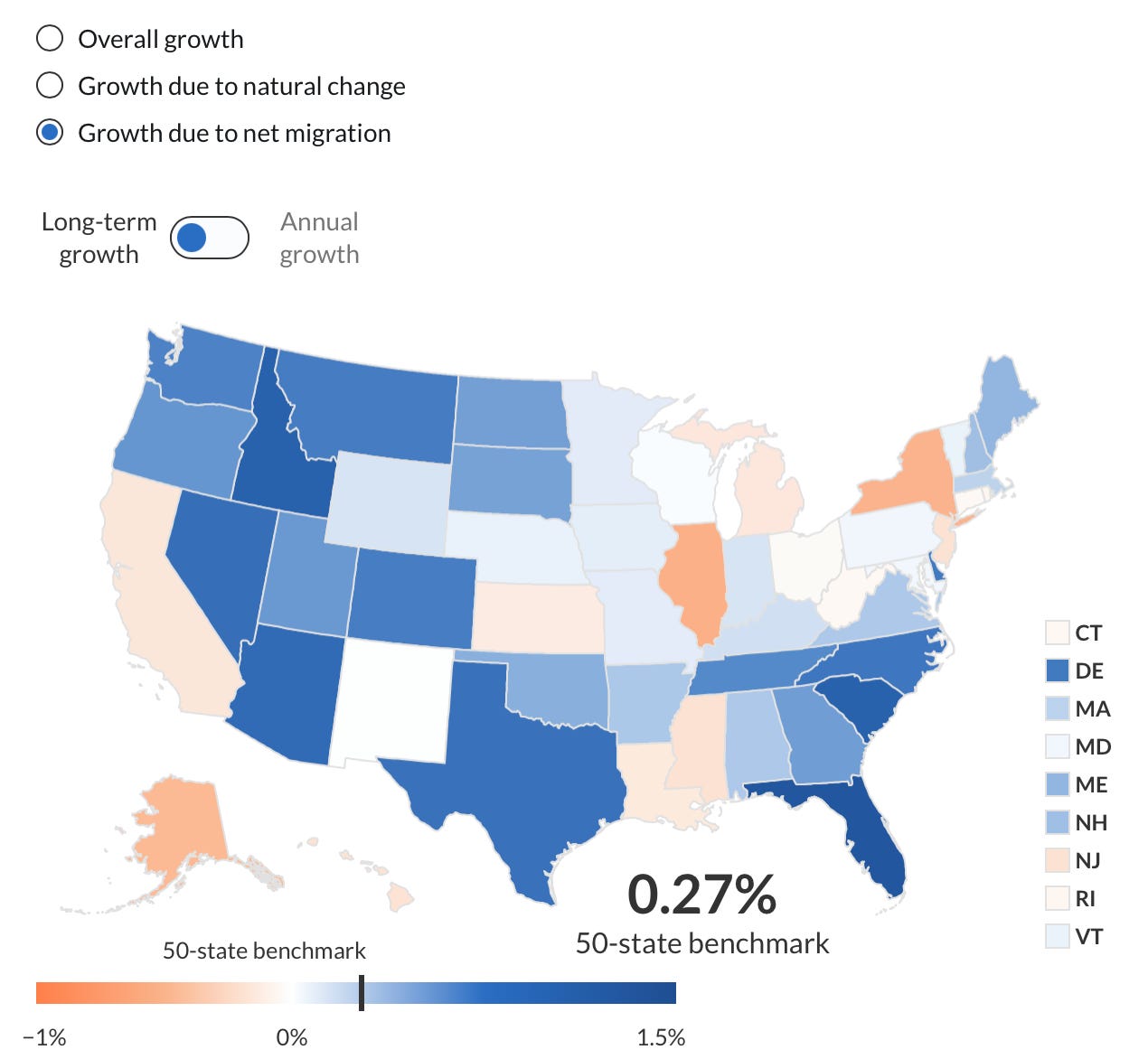

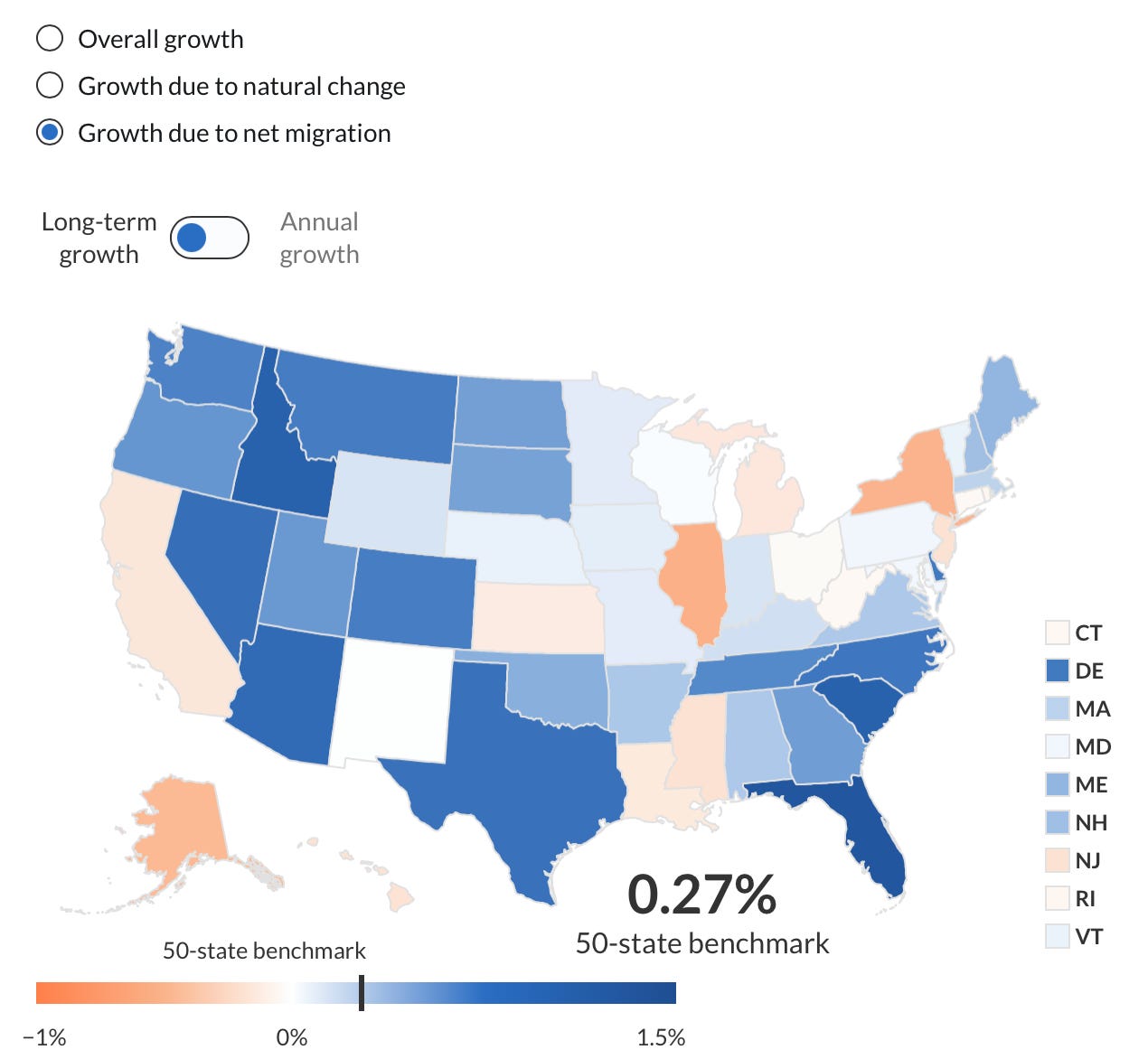

The commercial market metric is only one of many, although it is one of the clearest metrics and one of the most shocking. But when we look at other figures, we find similar trends. For example, consider this PEW Charitable Trust chart of states and their net migration changes:

See? The Red States win. Each new Red State citizen is a new taxpayer and a new contributor to the economy. And each one who’s moved means one fewer taxpayer and economic contributor from the Blue states of origin. The list of net loser states is a Blue wall of shame.

www.coffeeandcovid.com

www.coffeeandcovid.com

This type of depressing headline is common for the Big Blue Cities. Still, Democrats will deny, they’ll try to wave away the Blue commercial market meltdown, blaming it on pandemic fatigue and worker’s changing preferences for spending their days working in pajamas instead of coming into the office.

But that is a lie. To prove it, I rounded up two more headlines to make a trifecta.

First, compare the real estate market in Los Angeles, California with the market in Miami, Florida. In July, the Financial Times ran a story headlined, “Cost of Miami office space hits record high. In the very first paragraph, FT provided readers with what I like to call a “clue:”

Apparently, for some reason, unlike Los Angeles, Miami’s commercial market has not been hollowed out by work-from-home policies. It is not suffering from pandemic fatigue. It is booming. And it is stealing LA’s blue-chip companies.

But, Democrats will wail, that’s just because it’s Florida, and Florida is an outlier. But pardonne-moi, mon ami. Not so fast. Let’s consider the next best red market or, tipping the cowboy hat as deserved, arguably the best.

Early this month, just a few weeks ago, Dallas Magazine ran a story headlined, “Dallas Named Country's No. 1 Commercial Real Estate Market for 2025. Here's Why.” Not only did this delightful story prove that a second Big Red City is also not suffering pandemic fatigue or having any pajama problems, but it helpfully provided the current list of the top ten commercial real estate markets. Ready? See if you can spot any common characteristics:

You see it. Except for Boston, all the top-performing real estate markets are all Red State Big Cities.

The commercial market metric is only one of many, although it is one of the clearest metrics and one of the most shocking. But when we look at other figures, we find similar trends. For example, consider this PEW Charitable Trust chart of states and their net migration changes:

See? The Red States win. Each new Red State citizen is a new taxpayer and a new contributor to the economy. And each one who’s moved means one fewer taxpayer and economic contributor from the Blue states of origin. The list of net loser states is a Blue wall of shame.

☕️ THE UN-RESISTANCE ☙ Wednesday, November 27, 2024 ☙ C&C NEWS 🦠

What a great week! And it's only Wednesday. Trump's triumphant nomination; Middle East peace deal; Trump tweets solving border problems in real time; a Cal. high-rise signals doom for Democrats; more.

Sneakers

Just sneakin' around....

Speaking of California bans....

Sales of RVs are being 'banned' (effectively) because the RV makers don't make low or zero emission vehicles and can't offset their carbon credits (think someone posted that here recently).

Disposable 1 pound propane bottle, the standard for campers, is being banned, pushing for the refillable style, $30 for the bottle and another $15 for the fill tube vs $5 per disposable. This is in part due to the cost to dispose of the bottles that are tossed in the trash at campgrounds, upwards of $10-$12 per bottle. A single campground can accumulate thousands in a season. Not just California, but many states now jumping on this too.

I find it interesting that California is imposing these restrictions on an industry that accounts for a significant portion of income from campers and RVers. And haven't seen anything about rebates/incentives to buy the refillable propane canisters. The result will be the use of inexpensive refill adapters for the disposable canisters, but once you do that, it is illegal to transport them, not that anyone will check or even know the difference.

Sales of RVs are being 'banned' (effectively) because the RV makers don't make low or zero emission vehicles and can't offset their carbon credits (think someone posted that here recently).

Disposable 1 pound propane bottle, the standard for campers, is being banned, pushing for the refillable style, $30 for the bottle and another $15 for the fill tube vs $5 per disposable. This is in part due to the cost to dispose of the bottles that are tossed in the trash at campgrounds, upwards of $10-$12 per bottle. A single campground can accumulate thousands in a season. Not just California, but many states now jumping on this too.

I find it interesting that California is imposing these restrictions on an industry that accounts for a significant portion of income from campers and RVers. And haven't seen anything about rebates/incentives to buy the refillable propane canisters. The result will be the use of inexpensive refill adapters for the disposable canisters, but once you do that, it is illegal to transport them, not that anyone will check or even know the difference.