Saudi Prince’s Rejection Of Musk Offer Highlights Twitter’s History Of Housing Alleged Saudi Spies

Elon Musk fired back Thursday at the Saudi investor who said he is rejecting Musk’s offer to buy the popular social media platform because his $43 billion offer is too low.

“I don’t believe that the proposed offer by @elonmusk ($54.20) comes close to the intrinsic value of (Twitter) given its growth prospects,” Prince Al Waleed bin Talal tweeted Monday morning, shortly after news of Musk’s offer broke.

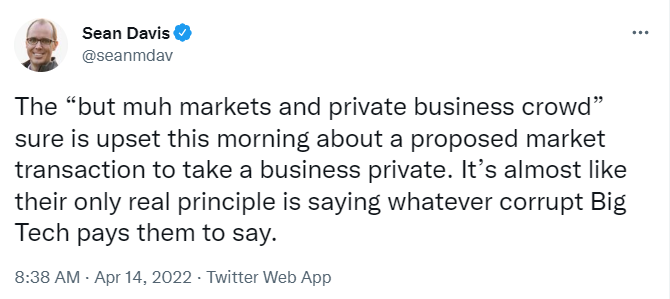

[clip]

As first reported by The New York Times, in 2019, two Twitter employees — an engineer and media partnerships manager — who had access to the personal information and account data of millions of users were investigated by the Department of Justice for allegedly spying on behalf of the kingdom and using their positions to silence critics of Crown Prince Mohammed bin Salman and other Saudi leadership.

According to the report, Saudi intelligence operatives persuaded the Twitter spies to collect information on dissidents and activists who spoke against the crown. A human rights lawyer representing one of the targeted dissidents said at the time, “The Saudi regime is trying to silence any voices for freedom or reform.”