Wedbush securities analyst Dan Ives told FOX Business on Friday that Twitter's move to prevent a takeover from Musk is a "predictable defensive measure" that will "not be viewed positively by shareholders given the potential dilution and acquisition unfriendly move."

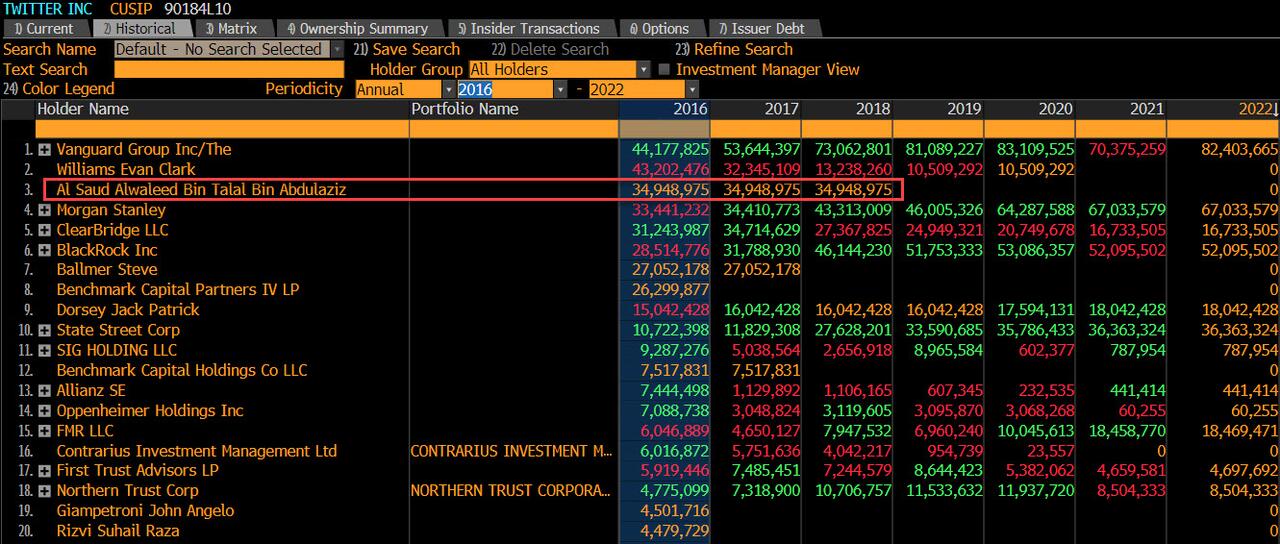

Under the plan, which is also referred to as a "poison pill", shareholders' rights will become exercisable if an entity, person or group acquires beneficial ownership of 15% or more of Twitter's outstanding common stock in a transaction not approved by the board. In the event that the rights become exercisable, existing Twitter shareholders — except for the person, entity or group triggering the plan — would be entitled to purchase additional shares of common stock at a discount. Musk currently has a 9.2% stake in Twitter.

"The Board has the back against the wall and Musk and shareholders will likely challenge the merits of the poison pill in the courts," Ives explained. "We believe Musk and his team expected this poker move which will be perceived as a sign of weakness not strength by the Street."

Going forward, Ives says that Musk will need to give specifics behind his financing for the $43 billion bid and come back to Twitter's board with a formal response. Meanwhile, he expects that Twitter will kick off a strategic process to look for other buyers.

Musk, who has offered to take Twitter private at $54.20 per share, has stated that the $43 billion bid is his "best and final" offer. However, he revealed at TED2022 on Thursday that he is prepared with a "plan B" if the offer is formally rejected. He did not elaborate on the details of that plan.

Twitter, Musk battle escalates: Poison pill, Musk’s ‘plan B’ and a divided Wall Street

FOX Business takes a deep dive into the latest developments of Elon Musk's battle with Twitter and what investors and analysts are forecasting.