You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

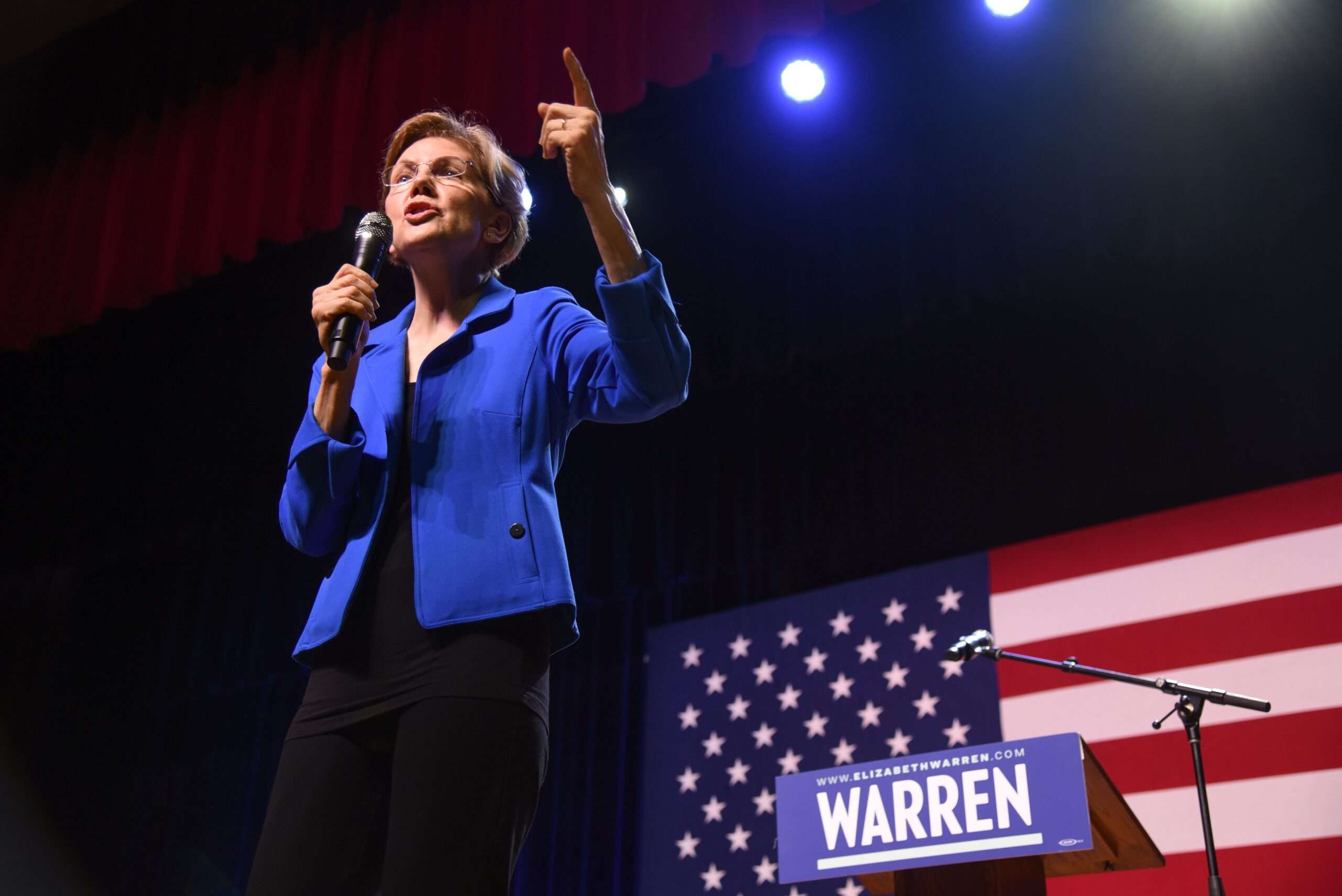

Fauxcahontas Clueless As Ever

- Thread starter GURPS

- Start date

I guess the financial sector needs to cut back on the number of meetings they hold.

Fly? They should be required to drive EVs.If they really wanted to stop pollution Congress would only be held once a year. The Congress critters fly in once and go home once and we would all be better off.

Crabcake42

Active Member

Hey tards, fixate on Warren cause Grups told you to, but you know Biden hates her, right? She has no position in the White House, every other person who ran against him other than Yang is part of his advisory panel.

she’s something else.

she’s something else.

Elizabeth Warren Blames High Food Prices on Grocery Chains' 'Record' 1 Percent Profit Margins

But Warren could hardly have picked a worse industry to use as an example: Grocery stores consistently have among the lowest profit margins of any economic sector. According to data compiled this month by New York University finance professor Aswath Damodaran, the entire retail grocery industry currently averages barely more than 1 percent in net profit. In its most recent quarter, Kroger reported a profit margin of 0.75 percent, during a time in which Warren claims that the chain was "expanding profits" due to its "market dominance."

In actuality, for much of the last year, grocery stores have seen enormous boosts in revenue, but not increased profitability, for the simple reason that everything has been costing more: not just products, but transportation, employee compensation, and all the extra logistical steps needed to adapt to shopping during a pandemic. Couple that with persistent inflation—which Warren also recently blamed on "price gouging"—and it is no wonder that things seem a bit out of balance.

Warren has had an itchy trigger finger for antitrust laws for some time. In 2019, as part of her presidential platform, she called for using the laws to forbid retailers from selling their own products. This would affect industry leaders like Amazon and Walmart, but ironically, it would have a devastating impact on grocery stores as well: Grocers increasingly rely on their own proprietary goods to stock cheaper alternatives alongside name brands. This provides not only less expensive options for consumers, but lower costs to the stores themselves. Store brands also help fill gaps created by external supply shortages.

But Warren could hardly have picked a worse industry to use as an example: Grocery stores consistently have among the lowest profit margins of any economic sector. According to data compiled this month by New York University finance professor Aswath Damodaran, the entire retail grocery industry currently averages barely more than 1 percent in net profit. In its most recent quarter, Kroger reported a profit margin of 0.75 percent, during a time in which Warren claims that the chain was "expanding profits" due to its "market dominance."

In actuality, for much of the last year, grocery stores have seen enormous boosts in revenue, but not increased profitability, for the simple reason that everything has been costing more: not just products, but transportation, employee compensation, and all the extra logistical steps needed to adapt to shopping during a pandemic. Couple that with persistent inflation—which Warren also recently blamed on "price gouging"—and it is no wonder that things seem a bit out of balance.

Warren has had an itchy trigger finger for antitrust laws for some time. In 2019, as part of her presidential platform, she called for using the laws to forbid retailers from selling their own products. This would affect industry leaders like Amazon and Walmart, but ironically, it would have a devastating impact on grocery stores as well: Grocers increasingly rely on their own proprietary goods to stock cheaper alternatives alongside name brands. This provides not only less expensive options for consumers, but lower costs to the stores themselves. Store brands also help fill gaps created by external supply shortages.

Hijinx

Well-Known Member

The little grocery stores i the neighborhoods are much higher than the big stores like Kroger and Giant.

That is why we only go to them when we run out of something and need it quick.

They cannot compete in prices with the big chains.

This female troll comes out from under her bridge and has no freaking idea of WTF is going on.

That is why we only go to them when we run out of something and need it quick.

They cannot compete in prices with the big chains.

This female troll comes out from under her bridge and has no freaking idea of WTF is going on.

Elizabeth Warren Attacks Elon Musk During CNN Interview; Musk Responds With Tweet

“You know how much he paid in taxes? One of the richest people in the world? Zero,” Warren said. “And he’s not the only one. Jeff Bezos, right, another one of the richest people in the world, he pays less in taxes than a public schoolteacher or a firefighter. And they do this because they’re only being taxed on income. They very cleverly make sure they have no official income. They just have all this stock that keeps building in value, building in value. They borrow against it. It’s just not right.”

Media reports claim that Musk paid $0 in federal income taxes in 2018, but did pay $455 million in taxes between 2014 and 2018. Musk tweeted in late December that he would “pay over $11 billion in taxes this year.”

Musk responded to the comments from Warren by writing on Twitter: “Will visit IRS next time I’m in DC just to say hi, since I paid the most taxes ever in history for an individual last year. Maybe I can have a cookie or something …”

THEN CHANGE THE ****ING LAWS .. Otherwise STFU

Elizabeth Warren Says the Solution to High Gas Prices Is Higher Taxes on Oil Companies

Leaving aside the fact that the senator has evidently never met a corporate tax she didn't want to hike, history shows that imposing a windfall profits tax on oil is particularly shortsighted. As part his administration's response to the Iran oil shock that tripled the price of petroleum in 1979, President Jimmy Carter championed the Crude Oil Windfall Profit Tax of 1980.

"The main purpose of the tax was to recoup for the federal government much of the revenue that would have otherwise gone to the oil industry as a result of the decontrol of oil prices," noted a 2009 Congressional Research Service (CRS) report. That report found that the windfall profits tax (WPT) raised far less money than projected by the Carter administration while simultaneously reducing the amount of domestic oil that would have otherwise been supplied:

The $80 billion in gross revenues generated by the WPT between 1980 and 1988 was significantly less than the $393 billion projected. Due to the deductibility of the WPT against the income tax, cumulative net WPT revenues were about $38 billion, significantly less than the $175 billion projected. This report presents estimates of the amount of foregone oil production from 1980-1986 due to the WPT under three alternative supply price responses, reflecting three different assumptions about the price elasticity of the domestic oil supply function, a critical factor (statistic) in estimating lost oil output and increased import dependence. From 1980 to 1988, the WPT may have reduced domestic oil production anywhere from 1.2% to 8.0% (320 to 1,269 million barrels). Dependence on imported oil grew from between 3% and 13%.

Louise

Well-Known Member

She's been trying to mask her real self since she left Oklahoma.

Good one, Post of the day!

Warren wouldn’t be Warren if she didn’t take the opportunity to also lie about Republicans, claiming the GOP wants to fight “culture wars” because it is out of ideas on important issues like the economy.

Earth to Lizzie: Wrong. Republicans fight “culture” wars because they choose to protect young kids from the indoctrination of so-called Critical Race Theory, radical-left sex “education,” gender identification, gender fluidity, and other such LGBTQIA+ nonsense.

As to the economy, Lizzie, Republicans have “plenty of ideas” — and care a hell of a lot — about out-of-control Democrat spending, runaway inflation, energy independence, a secure southern border, and enforcement of immigration laws.

I don’t normally include long quotes in my articles, but I’m making an exception in the following case to illustrate Warren Unplugged, in all her socialist glory.

Neep a nap? Or, a shower?

Earth to Lizzie: Wrong. Republicans fight “culture” wars because they choose to protect young kids from the indoctrination of so-called Critical Race Theory, radical-left sex “education,” gender identification, gender fluidity, and other such LGBTQIA+ nonsense.

As to the economy, Lizzie, Republicans have “plenty of ideas” — and care a hell of a lot — about out-of-control Democrat spending, runaway inflation, energy independence, a secure southern border, and enforcement of immigration laws.

I don’t normally include long quotes in my articles, but I’m making an exception in the following case to illustrate Warren Unplugged, in all her socialist glory.

So the point I’m trying to make is that we need to do more. Yes, we need to do climate change. Yes, we need to do prescription drugs. And we need to make sure that we’re paying for it by making sure that giant corporations that make billions of dollars in profits and pay nothing in taxes are actually paying a minimum tax.

And yes, Amazon, I’m looking at you in that one, and other corporations. Look, we need to also authorize the FTC so they can go after companies that are price gouging. And we need to remember that it’s not only what Congress can do, it’s also what the administration can do. Millions of people need their student loan debt cancelled.

Mr. President, today would be a great day to cancel $50,000 in student loan debt for tens of millions of people across this country. My point is that we have nearly 200 days. And not just one negotiation going on, we should have multiple negotiations going on. There is a lot we can deliver for American families, and we need to make that happen.

Neep a nap? Or, a shower?

Elizabeth Warren: We Need Big Tech ‘Rules’ to ‘Break’ Elon Musk’s Stranglehold

Warren said, “I see that we need to make two big changes. The first one is we need a wealth tax in America. Let’s talk about how Elon’s purchase here was subsidized by tens of millions of people who have paid their taxes every year. The second part is we need rules of the road for big tech. But ultimately, what all of this boils down to is power. Who’s going to have the power in our country? Are we going to make these decisions as a democracy, or is this going to be Elon Musk all by himself off in a room, a bazillionaire who just plays by his own set of rules, and that’s really what’s at stake here.”

She added, “We need rules of the road, and look. There are going to be rules. Like I said, the only question is will Elon Musk decide all of the rules by himself in a darkroom, or is it going to be the case that we’re going to decide this as a country? We’re going to make rules in a democracy.”

Warren added, “Rules of the road could help facilitate that kind of competition and frankly, break the stranglehold of someone like Elon Musk coming in and owning the whole thing.”

Why Lizzie ...... Twitter / Facebook / Google have been making decisions in a dark room by themselvesd all along

Don't Like It, Build YOUR OWN Twitter

glhs837

Power with Control

Elizabeth Warren: We Need Big Tech ‘Rules’ to ‘Break’ Elon Musk’s Stranglehold

Warren said, “I see that we need to make two big changes. The first one is we need a wealth tax in America. Let’s talk about how Elon’s purchase here was subsidized by tens of millions of people who have paid their taxes every year. The second part is we need rules of the road for big tech. But ultimately, what all of this boils down to is power. Who’s going to have the power in our country? Are we going to make these decisions as a democracy, or is this going to be Elon Musk all by himself off in a room, a bazillionaire who just plays by his own set of rules, and that’s really what’s at stake here.”

She added, “We need rules of the road, and look. There are going to be rules. Like I said, the only question is will Elon Musk decide all of the rules by himself in a darkroom, or is it going to be the case that we’re going to decide this as a country? We’re going to make rules in a democracy.”

Warren added, “Rules of the road could help facilitate that kind of competition and frankly, break the stranglehold of someone like Elon Musk coming in and owning the whole thing.”

Why Lizzie ...... Twitter / Facebook / Google have been making decisions in a dark room by themselvesd all along

Don't Like It, Build YOUR OWN Twitter

Wait, so now Twitter is "the whole thing"?

Hijinx

Well-Known Member

Has Elizabeth Warren ever bed right about anything?

It's a serious question. She runs off at the mouth with her stupid suggestions, and any scrutiny of them proves she doesn't have a clue. Why do people send this dork to the Senate?

Next question are Massachusetts voters as stupid as she is?

It's a serious question. She runs off at the mouth with her stupid suggestions, and any scrutiny of them proves she doesn't have a clue. Why do people send this dork to the Senate?

Next question are Massachusetts voters as stupid as she is?

TPD

the poor dad

Don’t they call themselves massholes?Next question are Massachusetts voters as stupid as she is?

glhs837

Power with Control

Why yes, yes we do....Don’t they call themselves massholes?

First, it's worth noting that people with college degrees are more likely to both be employed and, on average, are better paid than those who never attended college. People who attend college are also more likely to come from comparatively affluent households in the first place.

Second, it's worth asking: Who has $50,000 worth of school loans? Not, for the most part, struggling dropouts from state schools. No, large student loan values are heavily associated with professional schools that produce graduates who, on average, go on to be fairly well-compensated.

The single largest source of student loan debt is MBA programs, as Brookings Institution Senior Fellow Adam Looney has noted, and MBA grads average more than $73,000 in earnings their first year out of school. "The five degrees responsible for the most student debt are: MBA, JD, BA in business, BS in nursing, and MD," Looney wrote in 2020. "That's one reason why the top 20 percent of earners owe 35 percent of the debt, and why most debt is owed by well-educated individuals."

Technically, it's true that well-paid professional school graduates fall into the category of "working people." But they are not the sort of working people Warren wants you to think of when she uses those words.

What Warren wants, and what Biden appears to be considering, is a massive program of government aid that would disproportionately benefit doctors, lawyers, well-paid medical specialists, and comfortably salaried individuals with advanced business degrees.

But for some reason, you don't hear Warren and Biden talking about their plan to give huge amounts of money to corporate lawyers and junior associates at hedge funds.

How much money would a program like this cost? Cost, of course, is slightly tricky to define here, since a student loan forgiveness program would not spend money so much as fail to collect it. But a program to forgive $50,000 per borrower would come in at around $950 billion, according to the Committee for a Responsible Federal Budget. This would be in addition to the cost of the current pause on student loan repayment, which has already cost more than $100 billion.

reason.com

reason.com

Second, it's worth asking: Who has $50,000 worth of school loans? Not, for the most part, struggling dropouts from state schools. No, large student loan values are heavily associated with professional schools that produce graduates who, on average, go on to be fairly well-compensated.

The single largest source of student loan debt is MBA programs, as Brookings Institution Senior Fellow Adam Looney has noted, and MBA grads average more than $73,000 in earnings their first year out of school. "The five degrees responsible for the most student debt are: MBA, JD, BA in business, BS in nursing, and MD," Looney wrote in 2020. "That's one reason why the top 20 percent of earners owe 35 percent of the debt, and why most debt is owed by well-educated individuals."

Technically, it's true that well-paid professional school graduates fall into the category of "working people." But they are not the sort of working people Warren wants you to think of when she uses those words.

What Warren wants, and what Biden appears to be considering, is a massive program of government aid that would disproportionately benefit doctors, lawyers, well-paid medical specialists, and comfortably salaried individuals with advanced business degrees.

But for some reason, you don't hear Warren and Biden talking about their plan to give huge amounts of money to corporate lawyers and junior associates at hedge funds.

How much money would a program like this cost? Cost, of course, is slightly tricky to define here, since a student loan forgiveness program would not spend money so much as fail to collect it. But a program to forgive $50,000 per borrower would come in at around $950 billion, according to the Committee for a Responsible Federal Budget. This would be in addition to the cost of the current pause on student loan repayment, which has already cost more than $100 billion.

Elizabeth Warren Wants Joe Biden To Deliver a Massive, Illegal Handout to the Well-Off

Sen. Elizabeth Warren likes to describe herself as someone who sides with working people. For example, in a recent New York Times op-ed, the Massachusetts

Hijinx

Well-Known Member

I know a of 3 people close to me that are professionals who had student debt.

2 are Doctors and one a nurse.

Now of those 3 they were in a program that pays off their debt if they work at certain hospitals for 3 years.

In other words they work off their debt. While also getting paid.

Not a bad program.

Now I hear AOC and the Muslim lady Congresscritter who are crying about paying their debt and I know for certain they are making $170,000 dollars a year of my tax money.

1. They can afford to p[ay off their own debt.

2. They are already sucking on the Government tit.

If you borrow money it is a debt. Pay it back.

I don't have a college education, I worked for my salary , and I paid off every loan I ever made.

These people should do the same.

2 are Doctors and one a nurse.

Now of those 3 they were in a program that pays off their debt if they work at certain hospitals for 3 years.

In other words they work off their debt. While also getting paid.

Not a bad program.

Now I hear AOC and the Muslim lady Congresscritter who are crying about paying their debt and I know for certain they are making $170,000 dollars a year of my tax money.

1. They can afford to p[ay off their own debt.

2. They are already sucking on the Government tit.

If you borrow money it is a debt. Pay it back.

I don't have a college education, I worked for my salary , and I paid off every loan I ever made.

These people should do the same.