Bare-ya-cuda

Well-Known Member

You shouldn’t have any issues staying out of trouble with the IRS being unemployed and all.I’m more interested in staying out of trouble with the IRS so I tend to know the rules.

But go on and call it a gift.

You shouldn’t have any issues staying out of trouble with the IRS being unemployed and all.I’m more interested in staying out of trouble with the IRS so I tend to know the rules.

But go on and call it a gift.

So if I buy a stripper a set of implants is that a gift or income?One is income the other isn’t. See? That’s not very hard, now is it?

I’d call it a poor life decision.So if I buy a stripper a set of implants is that a gift or income?

The clues are all around you.

Maybe try finding out what the IRS defines as a gift and a gratuity? Webster doesn't collect your taxes...

So if I buy a stripper a set of implants is that a gift or income?

They waive it......... if you piss enough away.Resort fees, say MGM advertised $50/night, when you book the room there is a $20/night resort fee. They told me it was for the wifi and other amenities, their wifi sucked so bad I couldn't use it to check into my flight. It's pretty common at big tourist destinations.

Way cheaper than either a wedding or a divorce.I’d call it a poor life decision.

Na, I just went to the PO and took someones check and used that.Did you put it on your card?

If you are her "manager" its capital investment in a depreciating asset.So if I buy a stripper a set of implants is that a gift or income?

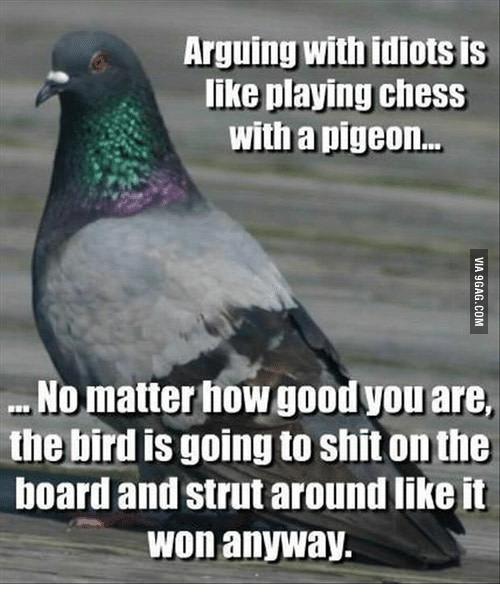

That wasn't hard, and yet I had to answer back my own argument because everyone else was all, "Well if you don't know I'm not going to tell you! AND you're an idiot!!"

Sometimes I just like to play with you people.

From the Google...

"Is Tipping the same as gifting?

Tips are considered wages. That makes the federal income tax implications very simple: income to Knutson of $12,000. Gifts, however, have very different tax implications. For federal income tax purposes, gifts are not taxable to the recipient."

So essentially, by tipping, you are supplementing the business owner's wages to the employee.

If you buy it, it's a gift. If she buys it, it's a tax deductible work expense.So if I buy a stripper a set of implants is that a gift or income?