Nothing like waiting until the last moment to provide requested documentation. The amount of paperwork they just dropped plus what's supposed to drop next week, there's no way Trump's attorneys can go through it all in 30 days.Manhattan DA Alvin Bragg asks to delay Trump's Stormy Daniels hush-money trial by 30 days

- The trial over claims the former president, 77, falsified records to cover up payments to porn star Stormy Daniels was due to begin on March 25

- Trump last week asked Justice Juan Merchan to delay his trial on 34 counts until the Supreme Court finishes reviewing his claim of presidential immunity

Prosecutors in Donald Trump's hush money case have asked for a 30-day delay in the start of the trial to review new evidence.

The trial over claims the former president, 77, falsified records to cover up payments to porn star Stormy Daniels was due to begin on March 25.

But the start date could now be pushed back due to a recent disclosure of thousands of pages of new documents by prosecutors led by Manhattan DA Alvin Bragg.

Trump last week asked Justice Juan Merchan to delay his trial on 34 counts until the Supreme Court finishes reviewing his claim of presidential immunity.

The Supreme Court announced last month that it will hear arguments in Trump's immunity case on April 25.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump Trial

- Thread starter GURPS

- Start date

Trump, Co-defendants Challenge Judge’s Ruling Allowing Fani Willis to Stay

Steve Sadow, attorney to former President Donald Trump, filed on March 18 a request for review of Fulton County Superior Court Judge Scott McAfee’s decision to allow Fulton County District Attorney Fani Willis to remain on the high-profile Georgia election case.

Co-defendants Rudy Giuliani, Mark Meadows, Robert Cheeley, Michael Roman, David Shafer, Harrison Floyd, and Cathleen Latham, who had joined the initial motion for disqualification, joined the motion for a certificate of immediate review.

“Defendants believe that the relevant case law requires dismissal of the case, or at the very least, the disqualification of the District Attorney and her entire office under the facts that exist here, and the resignation of Mr. Wade is insufficient to cure the appearance of impropriety the Court has determined exists,” the motion reads.

What Happens If Trump Can't Make Bond in New York?

Yesterday we learned the shocking news from Donald Trump's legal team that he has thus far been unable to raise the ludicrous sum of $454 million to post a bond in his civil "fraud" trial in New York City. Under the terms of the latest round of lawfare being waged against him by partisan NY Attorney General Letitia James, Trump is supposed to put up the bond in cash and can not use the value of his properties to cover the requirement while he appeals the ruling. Trump's team reportedly approached multiple financial firms, but none were willing to put up the cash against the value of his properties without doing so at a ruinous disadvantage to the former President. The deadline is Monday, so what happens if he can't pull this off or obtain some relief through the courts? The DA will be able to start going after his properties around the city, something she has previously said she "would not hesitate to do." (NY Post)

New York Attorney General Letitia James will be free to start going after Donald Trump’s prized properties should the former president fail to make the deadline to post the $454 million bond in his civil fraud case.

Trump, 77, on Monday filed papers in an appeal court case seeking to get out of having to post the bond as he fights the massive judgment from February — which accrues $112,000 in interest daily.

The presumptive Republican 2024 presidential nominee had approached over 30 firms to secure the bond — to no avail — and he’s facing “insurmountable difficulties” getting the financial backing, his attorneys wrote in the filings.

This has been the goal of Letitia James from the beginning, almost certainly in coordination with Biden's Justice Department and the White House. It's just one element of the larger lawfare playbook being deployed against Trump. They will do their level best to try to bankrupt him and tarnish his image as a successful entrepreneur, hoping that it will drag down his standing in the polls.

The ridiculous amounts of money involved simply highlight the absurd premise behind this entire scheme. Trump was hit with politically motivated charges that have never been filed based on such a premise in a court of law. He was found guilty of fraud when there was no evidence of any injured party ever being defrauded. Most legal analysts seem to agree that this conviction should be immediately overturned on appeal. But that doesn't matter to Trump's political opponents. The goal is to keep him off the playing field and tied up with all of this nonsense when he should be out on the campaign trail. It's all painfully obvious.

‘Stack the Deck So Trump Wins’ – Leftists Melt Down Over Judge Cannon’s Jury Instructions in Jack Smith’s Classified Docs Case

Judge Aileen Cannon issued a jury instruction order in Jack Smith’s classified documents case and the leftist legal analysts are going apocalyptic.

Cannon gave two options for jury instructions.

The first option:

In a prosecution of a former president for allegedly retaining documents in violation of 18 U.S.C. § 793(e), a jury is permitted to examine a record retained by a former president in his/her personal possession at the end of his/her presidency and make a factual finding as to whether the government has proven beyond a reasonable doubt that it is personal or presidential using the definitions set forth in the Presidential Records Act (PRA).

The second option is:

A president has sole authority under the PRA to categorize records as personal or presidential during his/her presidency. Neither a court nor a jury is permitted to make or review such a categorization decision. Although there is no formal means in the PRA by which a president is to make that categorization, an outgoing president’s decision to exclude what he/she considers to be personal records from presidential records transmitted to the National Archives and Records Administration constitutes a president’s categorization of those records as personal under the PRA.

CNN legal analyst Norm Eisen said both of Judge Cannon’s options for jury instructions are wrong.

“Cannon seems inclined to push the case to trial but is basically asking if she can stack the deck so Trump wins,” Norm Eisen said.

☕️ ODORS AND OPPORTUNITIES ☙ Tuesday, March 19, 2024 ☙ C&C NEWS 🦠

Trump’s lawyers appeal of Judge McAfee’s order in Fani Willis case; Trump’s NY lawyers file massive appeal in the real estate case; and libs call for Trump judge's removal after her 2-page order.

Many TDS people are calling for Judge Cannon to be removed because of how effective she’s been:

If you read the short order, you wouldn’t make heads or tails of it. You certainly wouldn’t understand all the liberal angst. In a few paragraphs, Judge Cannon simply proposed two dense jury instructions about the President’s authority under the Presidential Records Act, and asked the lawyers to propose alternative instructions if they don’t like hers. She also asked them to identify what, exactly, the jurors are supposed to decide on those two issues.

Asking parties to prepare jury instructions is unremarkable. In every jury trial, the instructions always come from the parties. Both sides propose instructions, try to work out any differences, and if they can’t agree the judge decides whose instruction wins. Or the judge can draft their own instruction. (Judges would rather use mutually-agreed instructions because it eliminates appeals over jury instruction wording.)

That said, asking for two specific instructions, and proposing the language first, is not common. So people are right to conclude the judge is up to something.

Courtwatcher Julie Kelly thinks Judge Cannon is trying to build an airtight case for dismissal. As it happens, Judge Cannon is currently considering a Trump motion to dismiss his case for “selective and vindictive prosecution.” That motion argues that it’s unconstitutional to prosecute Trump since Biden did the same thing (or worse) and isn’t being prosecuted by DOJ.

Judge Cannon is still thinking about it.

This latest order focuses on some difficult language in the Presidential Records Act. It’s not perfectly clear what is the difference between documents that are “personal” and documents that are “presidential,” including who decides which documents are the President’s “personal” documents versus which ones are considered “presidential.”

Does the President decide? If not the President, then who? Who has more authority than the President? Santa Claus? A divine being? David Copperfield? Is a seance involved?

Julie Kelly thinks the judge forcing the government to take a position on what that PRA language means, so that she can turn around and hang them with their own words. Simply put, it looks like Judge Cannon is setting them up for something.

Annoyed Special Prosecutor Jack Smith

I have a general rule to be 1,000 times more cautious whenever a judge asks me to concede something. Especially if the judge seems like he’s trying to be innocently helpful. For instance, the judge might ask, “Mr. Childers, would you concede the sky is colored blue?” That’s a red flag. Usually judges ask for concessions to set lawyers up, so later they can’t appeal the judge’s decision. After all, they conceded. So I’m likely to answer with something like, “well your honor, sometimes the sky has clouds in it, which are white. Plus, the sun is yellow. So, no, I can’t concede the sky is blue.”

Something like this must be what Julie Kelly senses. Judge Cannon’s request for the government to draft two jury instructions feels like a way to get them to concede something, to set them up, to make the government take a position that Judge Cannon can then rule on somehow, based on their own words.

It sure seems like more good news. Certainly, both the Fani Willis case and this Mar-a-Lago Raid case now seem heading in the right direction, with smart, reliable judges at the helm. Only Judge Engoran’s case still feels out of control, and of the three, Engoran’s is the least problematic case for Trump, since it’s only about money and has no chance of jail.

Last edited:

The newest Trump motion asks permission to appeal the judge’s ruling immediately, out of the normal order. Normally, to appeal this kind of order, defendants must wait until after trial and after an unfavorable jury verdict.

It stinks that defendants have to wait so long to appeal, but it’s for a good reason. The rationale is the rule cuts down the appeals court’s workload. After all, the defendants might be found innocent at trial. If that happens, the defendants won’t need help from the appeals court, since they won anyway. This way, the appeals court won’t have to review thousands of intermediate rulings during a case.

The order reeks of appellate opportunity. Tellingly, in its very first argumentative paragraph, the motion cited the case’s lingering “odor of mendacity.” Basically, the motion argued that getting rid of Nathan Wade didn’t cure the appearance of impropriety — an appearance of impropriety the judge expressly found.

The motion’s mention of the case’s “lingering odor of mendacity” — all the lying — reinforced my view that Judge McAfee’s order was more helpful than harmful. Judge Joe Brown agreed with my take and made the same point on his 2-hour show last week. (Watch at 1.25x or 1.5x speed; hat tip C&C comments). Judge Brown thinks Judge McAfee’s order was an appellate gift to Trump, a kind of an insurance policy, to whip out after an unfavorable jury verdict.

In other words, Judge McAfee’s order seemed so well-designed for an appeal it looks like he was trying to help Trump.

Last week I suggested Trump’s lawyers might want to jam the order in their back pocket and not immediately appeal. But Trump’s lawyers clearly disagree. With access to a lot more inside strategic information than me (or Judge Brown), they clearly think an immediate appeal now is better than relying on the order to rescue the case later. NBC’s article hinted at a possible reason why:

If they don’t want to take this fetid case first, the appeal is the best say to buy some time. I made the same point while evaluating Fani’s appellate options. It’s no secret. Crazed liberals expressed terror yesterday at the thought the appeal might prevent a 2024 trial. For just one example:

I’d never second-guess Trump’s lawyers’ decision to appeal now. After all, Trump’s lawyers are operating in the context of his various cases, which are all heating up. They surely have a global strategy. There’s a critical path for the entire inventory of cases that we can’t see from the outside.

The appeal may or may not happen. Both Judge McAfee and the Appellate Division must give a green-light. Given the case’s unique nature, and the order’s strong language criticizing Fani, I’d guess a 75% chance (strong confidence) the appeal will be granted.

But this case is a unicorn, which means that nobody can really predict anything.

If the immediate appeal is allowed, things quickly get even more interesting. Will the appellate court set expedited deadlines to hurry things along? Or will it stick with the normal amount of briefing time since the issues are so novel and important? If briefing is expedited, will the parties ask for more time anyway? Will the court of appeals hold oral arguments? After that, how will the appeals court rule? It has creative options besides just affirming or reversing; for example, it could order Judge McAfee to re-open the evidence and then re-decide.

At this point, there’s not enough perfume in Atlanta to get the stink off Fani Willis.

☕️ ODORS AND OPPORTUNITIES ☙ Tuesday, March 19, 2024 ☙ C&C NEWS 🦠

Trump’s lawyers appeal of Judge McAfee’s order in Fani Willis case; Trump’s NY lawyers file massive appeal in the real estate case; and libs call for Trump judge's removal after her 2-page order.

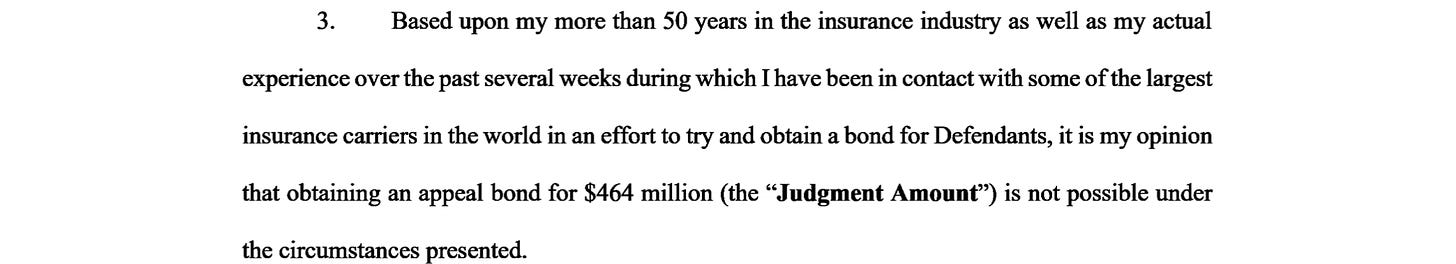

The Reply’s very first exhibit was the affidavit of Gary Giulietti, president of the Lockton Companies, described as “the largest privately held insurance brokerage firm in the world.” That would make him a qualified insurance expert. Gary started with the conclusion—bonding the unbelievable $464 judgment is literally impossible:

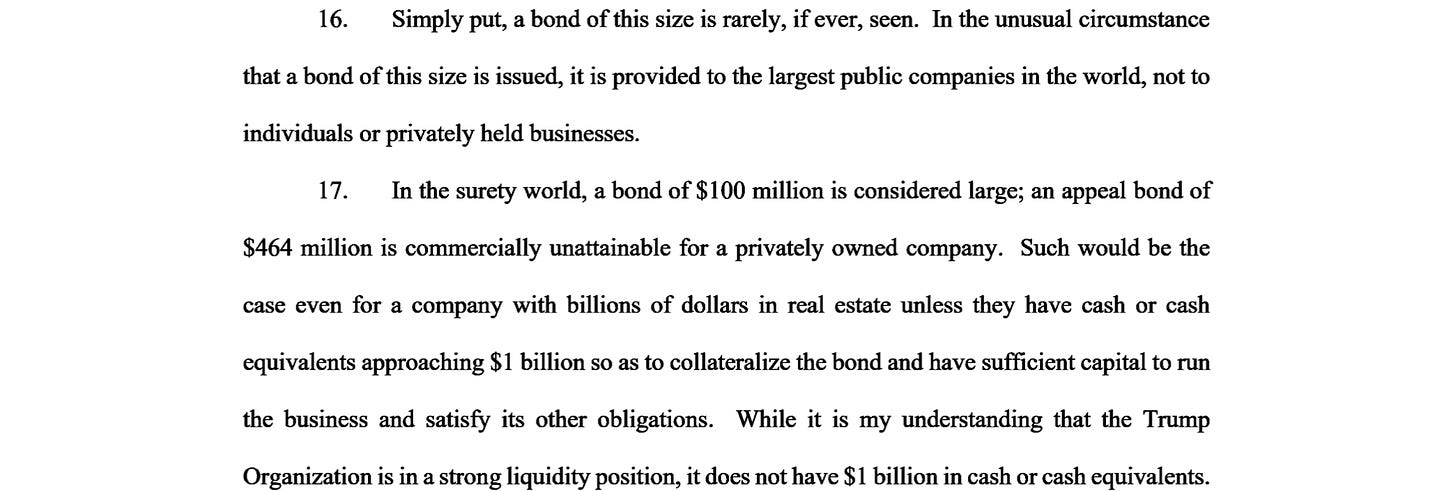

Later, Gary explained why buying a bond for that insane judgment is impossible—it’s because it’s another legal unicorn:

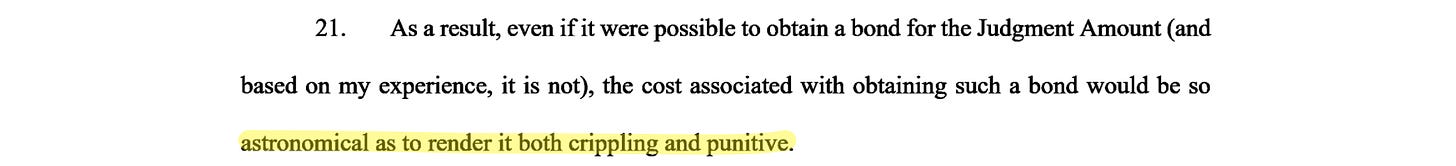

Finally, Gary noted that, even if Trump could get a bond for that whopper judgment, the bond’s cost, by itself, would be “punitive”:

Trump’s lawyers are smartly setting up the appellate argument that the bond requirement itself is unconstitutional in this case. There are two ways to argue constitutional issues: ‘facially’ or ‘as-applied.’ In a facial challenge, a plaintiff argues a law is unconstitutional for everybody. But in the less-common ‘as-applied’ scenario, the plaintiff argues the law only becomes unconstitutional when it is applied to him.

To prevent being reversed for unconstitutional “unusual punishment” or “excessive fines,” Judge Engoran, who looks much like an old goat, would have been better off ordering a lower penalty for Trump’s completely victimless crime. But the pallid Judge got greedy, or happy, or something, and ordered an historic, planet-sized judgment, which is now creating all sorts of legal problems.

To make the constitutional argument, the Trump team first needed to prove they really tried to buy an affordable bond — but couldn’t. That is exactly what this reply memo carefully documented.

You’re getting to see some very good lawyering here. Trump’s lawyers are multiplying the issues, giving themselves more tools with which to work. They started out with very little to work with and are building the tools as they go.

Monday is the deadline to post the bond. If Trump doesn’t post the bond, and the appeals court refuses to stay without bond, then woke, Soros-funded District Attorney Letitia James can commence collections. Like foreclosing on — liquidating — Trump’s various properties in New York.

But that won’t end the fight. Trump can resist collections, and can fight with James in state court, on a property-by-property basis, slowing things down. When Trump runs out of state-court options, he can then throw the threatened properties into Chapter 11 bankruptcy. He might be able to stop Letitia James for two or three years.

So, the bond is a real problem, but it isn’t fatal. Not yet. Trump still has options.

☕️ ODORS AND OPPORTUNITIES ☙ Tuesday, March 19, 2024 ☙ C&C NEWS 🦠

Trump’s lawyers appeal of Judge McAfee’s order in Fani Willis case; Trump’s NY lawyers file massive appeal in the real estate case; and libs call for Trump judge's removal after her 2-page order.

Florida state attorney Dave Aronberg asserted on Tuesday that special counsel Jack Smith may resort to drastic measures to attempt to disqualify the judge in former President Donald Trump’s classified documents case.

Judge Aileen Cannon is presiding over the case against Trump and on Monday ordered the former president and Smith to submit proposed jury instructions, which means the judge is focusing on a trial much earlier than anticipated, according to The Washington Post. The order benefits Trump and Smith will appeal it as well as potentially try to disqualify Cannon, Aronberg asserted on MSNBC’s “Jose Diaz-Balart Reports.”

“My head is spinning because this is sort of an incomprehensible order by Judge Cannon,” Aronberg said. “First off, she’s asking for jury instructions on a case that will not be heard before the November election, and so what is the rush?”

Judges direct juries on how to evaluate evidence shortly ahead of deliberations which indicates that Cannon is focusing on the end of the trial already, according to the Post. Cannon’s Monday order indicates she is giving credence to Trump’s argument that he has the power to determine that certain classified documents are personal to him and his property.

dailycaller.com

dailycaller.com

Judge Aileen Cannon is presiding over the case against Trump and on Monday ordered the former president and Smith to submit proposed jury instructions, which means the judge is focusing on a trial much earlier than anticipated, according to The Washington Post. The order benefits Trump and Smith will appeal it as well as potentially try to disqualify Cannon, Aronberg asserted on MSNBC’s “Jose Diaz-Balart Reports.”

“My head is spinning because this is sort of an incomprehensible order by Judge Cannon,” Aronberg said. “First off, she’s asking for jury instructions on a case that will not be heard before the November election, and so what is the rush?”

Judges direct juries on how to evaluate evidence shortly ahead of deliberations which indicates that Cannon is focusing on the end of the trial already, according to the Post. Cannon’s Monday order indicates she is giving credence to Trump’s argument that he has the power to determine that certain classified documents are personal to him and his property.

Florida State Attorney Says Jack Smith May Press ‘Red Button’ To Try To Disqualify Judge And Get Trump

Aronberg asserted that Jack Smith may resort to drastic measures to attempt to disqualify the judge in Trump's classified documents case.

Radical Judge Engoron Punishes Trump More, Orders Court to Oversee Organization's Finances for 3 Years

At least, that’s how it reads, seeing as Trump will have to disclose his every financial move to his government overlords. Engoron wrote:

Based on the Court's findings in its February 16th Order, the Court ordered the continued monitoring of Defendants' financial and accounting practices and disclosures, including and enhanced role for the Monitor, for a period of no less than three years, as well as the appointment of an Independent Director of Compliance.

Who will be monitoring the operations of the multi-national real estate conglomerate? An experienced businessperson? A financial expert? No, it will (continue to) be another judge:

Retired federal Judge Barbara Jones, who has monitored the Trump Organization's finances as part of a preliminary injunction in 2022, will continue in her role for the next three years.

The monitor will allow reviews of the organization's internal accounting records, recordkeeping, financial reporting policies and more.

The Trump Organization will be required to provide the monitor with monthly bank statements, notify the monitor at least five business days before major cash or asset transfers, and inform the monitor about debt restructuring or payment.

That already sounds like enough, but there’s even more. The court has to be notified of just about every piece of paper shuffled during the workday:

"Defendants shall not evade the terms of this Monitorship Order by transferring assets, reincorporating existing business entities in other forms or jurisdictions, modifying entity ownership, or any other form of restructuring or change in corporate form," the order from Engoron states.

Jones will also be able to advise the court on orders to change operations within the Trump Organization.

glhs837

Power with Control

Radical Judge Engoron Punishes Trump More, Orders Court to Oversee Organization's Finances for 3 Years

At least, that’s how it reads, seeing as Trump will have to disclose his every financial move to his government overlords. Engoron wrote:

Who will be monitoring the operations of the multi-national real estate conglomerate? An experienced businessperson? A financial expert? No, it will (continue to) be another judge:

That already sounds like enough, but there’s even more. The court has to be notified of just about every piece of paper shuffled during the workday:

Too bad they didnt pay one tenth of that attention to the Biden shell companies.

Now that James has her judgment, she is allowed to start collecting the money by garnishing and foreclosing on Trump’s properties. You might think that just filing the appeal should stop (‘stay’) the collections process; after all, the appellate court might reverse everything.

But way back in the very old days, some defendants used the appeal process to buy time for moving their assets out of the judgment’s reach. Obviously, Trump can’t move Trump Tower anywhere. But he could transfer the deed to a Cayman Island cutout or something. He should ask Biden how it’s done.

The law fixed that problem, by requiring defendants to “bond” the full amount of the judgment, if they to put collections on hold during the appeal. A “bond” is a third-party guarantee of payment, like insurance, or a bail bond, where a well-funded professional bonding company agrees to pay the judgment if the appeal loses — even if the defendant disappears.

Obviously, the bonding company itself must have the money to pay, which cuts down the list of possible providers in Trump’s mega bond case. And bond companies don’t take risks.They absolutely will not undertake a bond obligation without first getting collateral.

For example, to provide a $1 million dollar bond, a bonding company might first want a mortgage on the defendant’s house, and some liens on his cars. They won’t take just anything as collateral, like your collection of celebrity Pez dispensers. Trump Tower might be worth a few hundred million, but if it also has big bank loans, the bond company will probably pass.

Next, the more risk there is, the more the bond costs. Even though bonds are secured with collateral, customers “buy” the bonds. That’s how the bond seller makes money. In my experience, the average price of an appeal bond is ten percent (10%) of face value. In terms of this, this bond would be a unicorn. Nobody’s ever seen anything as big or like it. Plus it’s politics.

How could you possibly calculate the risk? What about the risk the democrats and the feds might try to cancel the bond company for helping Trump?

In other words, to buy an appeal bond — to stay collections during the appeal — Trump first must give the bonding company mortgages on collateral valued over $454 million (or even up to $600 million, with interest), and pay cash, at least $60 million, maybe more, as the bond price — money he’d never ever get back, regardless if he ultimately wins or loses.

There might not even be a bonding company big enough and crazy enough to get involved.

In hindsight, Judge Engoran’s “fine” looks calculated to drain Trump’s campaign account by effectively making it impossible to buy a bond. Trump could just put up the whole $500 million or so, depositing it in the court’s registry, and then he won’t need a bond.

Not coincidentally, $500 million is around the same amount Trump has in his presidential campaign account, as Judge Engoran (or anybody) could easily determine from Trump’s mandatory FEC filings.

If Trump can’t (or won’t) buy a bond or put up the money, he may still pursue the appeal. But in that case, Soros-backed District Attorney Letitia James can also start collecting, which is exactly what the TDS-infected corporate media can’t wait to see. The memes are already drowning the Internet.

But, as I’ve explained before, and as the Guardian article explained, it will be painfully difficult and tooth-gnashingly slow for James to collect Trump’s assets (though she’d get there eventually).

If Trump had any other way to come up with the money, he should do that, and not take a chance that some rogue judge will help James collect on an important asset.

Corporate media’s “Get Trump” hopes were dashed again when on Friday, the New York Times ran a (non-paywalled) story headlined, “Trump Media Merger Provides Trump a Potential Cash Lifeline.” With a quick bit of impressive financial wizardry and fast work, Trump’s Truth Social announced on Friday it had shareholder approval to merge with already-publicly-traded media company Digital World Acquisition Corporation, which trades as DWAC.

According to the Wall Street Journal, Truth Social could start trading on the stock market as soon as this week, when the paperwork is complete. It was great news, but it’s still not the whole answer. CBS News ran an article Friday headlined, “Trump could score $3.5 billion from Truth Social going public. But tapping the money may be tricky.” The ‘tricky’ part is that owners, like Trump, are normally barred from selling any shares for at least six months after a company goes public. Sellers can sometimes get that restriction waived, but that takes time, too.

For several intractable reasons, there is no feasible way Trump could access the Truth Social money today, in time to put up the money to stay collections. But, if Trump could borrow what he needed from a coalition of billionaires, he could pay them back pretty fast with interest after he gets his Truth Social money. How likely is that? Remember the name of Trump’s bestselling 2009 book:

Let’s make a deal.

Finally, the court of appeals yet to rule on Trump’s massive motion filed last week to reduce or eliminate the bond requirement. That ruling will come today, and we will learn whether New York’s appellate court will uphold Engoran’s ridiculous judgment and prove it has also lost its damned mind. Or, if it does the right thing, and starts pumping water out of New York’s sinking ship of business, the bond requirement could be waived or greatly reduced.

I wouldn’t dare to predict what will happen today in this insane case. If Trump can pull the cash together without bankrupting his campaign, it would be better to just deposit the whole amount with the court than buy an unimaginably-expensive appeal bond for $50 million, which would also tie up all his collateral.

Stay tuned.

☕️ IN THE MUD ☙ Monday, March 25, 2024 ☙ C&C NEWS 🦠

Deadline looms for Trump appeal bond and options appear; RFK panicking poll-watching dems; judge allows illegals to vote and hold office in DC; Ukrainians whine about high-tech NATO tanks; and more.

Trump’s “dangerous, violent, and reprehensible rhetoric fundamentally threatens the integrity of these proceedings and is intended to intimidate witnesses and trial participants alike — including this Court,” DA Alvin Bragg said in a blistering filing in New York Supreme Court.

Bragg’s request came after Trump, in numerous social media posts, targeted Judge Juan Merchan’s adult daughter over her work for a Democratic political firm. Bragg’s indictment charges Trump with falsifying business records to conceal a hush money payment to porn star Stormy Daniels ahead of the 2016 presidential election.

“There is no constitutional right to target the family of this Court, let alone on the blatant falsehoods that have served as the flimsiest pretexts for defendant’s attacks,” Bragg’s filing said.

Trump “knows what he is doing, and everyone else does too,” the DA wrote.

Merchan last week imposed a gag order that bars Trump from speaking about likely witnesses and other figures, but does not explicitly prohibit criticism of the judge or his family.

Trump doesn't have to say anymore. The seed has been planted. The right-wing media will follow setting up grounds for appeal if needed.Trump “knows what he is doing, and everyone else does too,” the DA wrote.

Jesse Watters Summarizes Judicial Bias/Corruption in the New York ‘Hush Money’ Case

April 3, 2024 | Sundance | 113 Comments

Jesse Watters ran a devastating segment last night on radical Judge Juan Merchan who silenced President Donald Trump from talking about his family’s financial ties to the current junk case he is presiding over against Donald Trump in New York City. Judge Merchan should be removed for his conflicts. This is peak corruption and cannot stand.

As Jesse Watters outlined succinctly in his monologue, “Trump is banned from talking about the judge’s family. Why? Because the judge’s family was paid by the Biden campaign. The judge’s family is currently being paid by Adam Schiff over $10 million.”

“The judge is threatening to put Trump in jail for pointing out that his liberal family is getting rich off this trial and richer if he’s convicted.” “The judge’s daughter isn’t seven. She’s 34. He’s not attacking her. He’s just saying what she does for a living. How’s that an attack? He just wants a new judge. One whose family isn’t funded by Democrats.”

A serial perjurer will try to prove an old misdemeanor against Trump in an embarrassment for the New York legal system

Like his predecessor, Bragg previously scoffed at the case. However, two prosecutors, Carey R. Dunne and Mark F. Pomerantz, then resigned and started a public pressure campaign to get New Yorkers to demand prosecution.

Pomerantz shocked many of us by publishing a book on the case against Trump — who was still under investigation and not charged, let alone convicted, of any crime. He did so despite objections from his former colleague that such a book was grossly improper.

Nevertheless, it worked. Bragg brought a Rube Goldberg case that is so convoluted and counterintuitive that even liberal legal analysts criticized it.

Trump paid Daniels to avoid any publicity over their brief alleged affair. As a celebrity, there was ample reason to want to keep the affair quiet, and that does not even include the fact that he is a married man.

It also occurred before the 2016 election and there was clearly a benefit to quash the scandal as a candidate. That political motivation is at the heart of this long-delayed case.

It is a repeat of the case involving former Democratic presidential candidate John Edwards. In 2012, the Justice Department used the same theory to charge the former Democratic presidential candidate after a disclosure that he not only had an affair with filmmaker Rielle Hunter but also hid the fact that he had a child by her. Edwards denied the affair, and money from donors was passed to Hunter to keep the matter quiet.

The Justice Department spent a huge amount on the case to show that the third-party payments were a circumvention of campaign finance laws. However, Edwards was ultimately found not guilty on one count while the jury deadlocked on the other five.

With Trump, the Justice Department declined a repeat of the Edwards debacle and did not bring any federal charge.

But Bragg then used the alleged federal crime to bootstrap a defunct misdemeanor charge into a felony in the current case. He is arguing that Trump intentionally lied when his former lawyer Michael Cohen listed the payments as retainer costs rather than a payment — to avoid reporting it as a campaign contribution to himself.

Thus, if he had simply had Cohen report the payment as “hush money,” there would be no crime.