If I may ...

How is that different from the 80s when I was a young adult starting out?

Minimum wage is just that - a minimum. Not a life goal, a minimum. Most of us manage to get some skills and/or education and earn a living wage to have a decent life.

You ran some numbers to show how the price of everything has increased, but prices have always increased. The price of housing, transportation, food, etc doubled from when my Mom was in her 20s to when I was that same age. The only difference is that back then we were told to work hard, take advantage of opportunities, and hone our skills; now young people are told that the government should give them a bougie condo and sweet ride for "free" (read: paid for by those of us who work for a living).

Having the government pay you used to be called "welfare" and it wasn't a career goal.

"You ran some numbers to show how the price of everything has increased, but prices have always increased." Yup. It wasn't always the case though. That began, (monetary inflation = price inflation), in 1913 with the creation of the Federal Reserve Act, leaving our Nation's money and economic control to the private banking cartels.

To answer your question of the difference when you were young in the 80's .... Because at the beginning of the 80's, it was only 9 years after Nixon severed the gold standard from the dollar in 1971, (creating a pure fiat currency), because of the Vietnam war spending devaluing the dollar, which foreign counties did not like, so they started to convert their trade dollar holdings into our gold at $35oz as per the Bretton Woods agreement after WW2, France being first in line. You, and everyone else at the time still had somewhat of a good dollar. Inflation, money creation, was relatively low during the 80's, after 1971, as seen below in the Federal Reserve charts.

The work ethic you, and most old timers, (not that you an old timer), were raised with, worked well with a stable currency, a stable dollar, and saving was encouraged and could pretty much be relied upon without too much dollar devaluation, thought there was still inflation running at 2% or less at the time. The system wasn't being manipulated to the extreme, as it is today, because of congressional banking reforms. Now, all those reforms have been eliminated. Today it is literally pretty much an unregulated free for all.

The reason this "welfare" is being doled out, is an attempt to quell what would be massive inevitable riots and total social anarchy. They've hidden, are hiding, the, (what would be miles of), bread and soup lines like of the great depression, by using these money distribution programs. This keeps the masses somewhat quite, while at the same time financially raping and pillaging our Nation, while also at the same time, allowing those Nations with US reserve dollar holdings to spend that money here that directly undermines the American people. Btw, these added unemployment insurance programs cannot last forever. That's why, we as a Nation are heading into a world of hurt in the future.

Look, you are not wrong in your ideals, nor is anyone else, when placed in the proper context of a true sound money system. But in a fiat debt based currency system, it does not matter so much. In the current system, it is a free for all. Only the strong survive. Or think of it this way; Only those that can and will take advantage of others, grifters, politicians, bankers, snake oil salesman types, will win this game. Those that play by the rules of old, of ethics and morality, will lose; have lost. Homelessness is blamed on drug and alcohol use and bad decisions. While there is some truth to that claim, the reality is because of our debt based currency system. Those living in poverty, the vast majority of the time, not their fault. There are only so many good high paying jobs seeing as all our manufacturing industry has been sent overseas. When, as in now, when inflation starts taking hold, employers start to lay off people, and in the current case with the addition of the COVID shutdown, are unwilling to increase pay because it affects their bottom line to increase labor costs to already increased and continuing increasing costs, across the board for everything else on their spreadsheets.

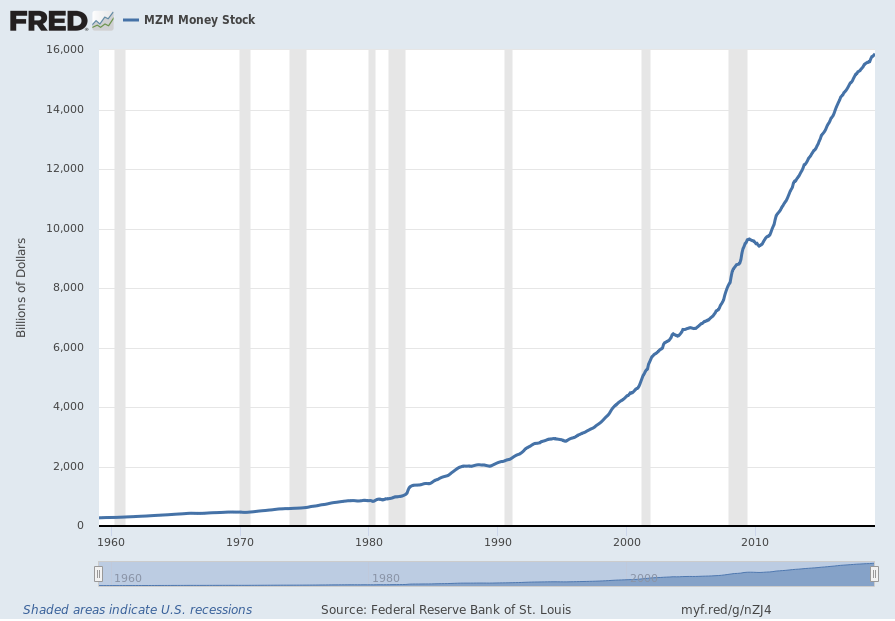

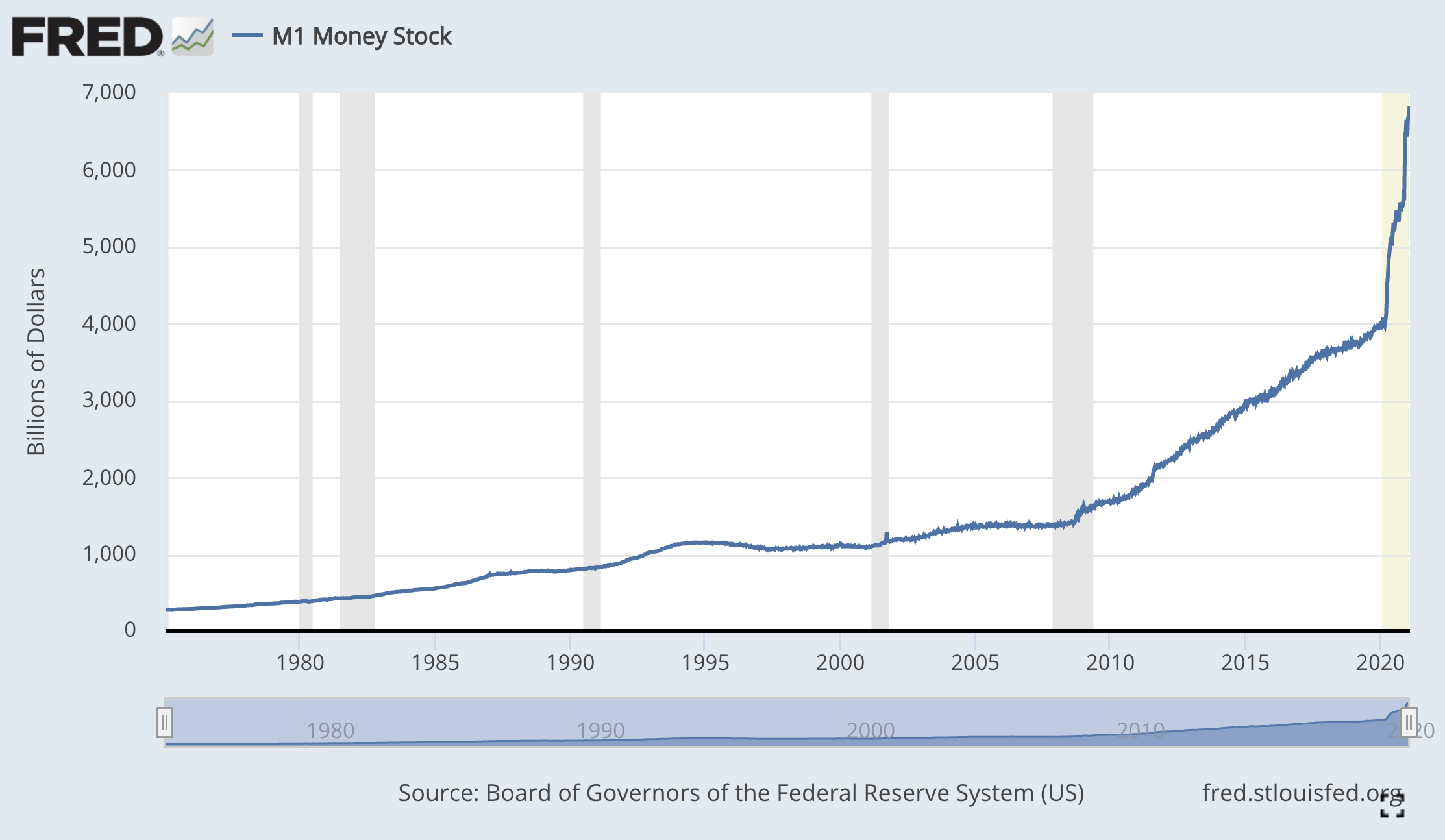

These charts show what inflation really is: Reckless expansion of the money supply.

Money of zero maturity (MZM), which represents all money that is readily available, is a measure of the liquid money supply within an economy.

Here showing most likely now over $16 Trillion, from about $200 Billion 1970.

M1 Money Stock: The money supply refers to the total volume of money held by the public at a particular point in time in an economy.

Here showing almost $7 Trillion from a level of $200 Billlion (in 1975)?