You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FTX Saga

- Thread starter GURPS

- Start date

Only crypto currency I own are some foreign bills and coins I've collected over the years where I do not read the language.I never understood why anyone could read the news and come to the conclusion that BitCoin or any eCoin is a worthwhile investment. Yes, there are stories about people who made money in crypto currencies or the puff pieces about the 7 or 8 places in the world where they accept crypto to purchase legal stuff instead of black market stuff. But for every positive story there are several about an exchange being hacked and losing everyone's money, or going bankrupt and the CEO disappears with the funds, or crypto being associated with drugs/hacking/etc.

LightRoasted

If I may ...

For your consideration ...

In any ponzi scheme, there are always winners, many times big winners, in the beginning. Which are always touted to bring in the suckers. ~ Think MEMEs and all the pumping on Reddit and from the media. The one's that knowingly understand it's a ponzi from the beginning, exit well before a the scheme is found out and crashes. Some ponzi schemes crash in a very short time, others on a longer timeline. But when dealing with the amounts we're dealing with here, years in the making is not uncommon to give the illusion of legitimacy.I never understood why anyone could read the news and come to the conclusion that BitCoin or any eCoin is a worthwhile investment. Yes, there are stories about people who made money in crypto currencies or the puff pieces about the 7 or 8 places in the world where they accept crypto to purchase legal stuff instead of black market stuff. But for every positive story there are several about an exchange being hacked and losing everyone's money, or going bankrupt and the CEO disappears with the funds, or crypto being associated with drugs/hacking/etc.

Only crypto currency I own are some foreign bills and coins I've collected over the years where I do not read the language.

Australia and New Zealand Plastic Bills

Clem72

Well-Known Member

What happens when your bills go through the wash/dryer?Australia and New Zealand Plastic Bills

LightRoasted

If I may ...

For your consideration ...

FTX was a child's game, for comparison. Wanna know what is really slight of hand? 1st fact, ~ A Federal Reserve Note is owned by the Federal Reserve. 2nd fact, ~ To give the illusion of being on the up and up, aka legitimate, when more currency is needed to replace old worn out currency, or to increase supply due to need, the Federal Reserve places a print order to the Bureau of Printing and Engraving, an agency part of the Department of the Treasury, to print the notes required, either 1's or 5's or 10's, whatever. The Federal Reserve pays the Bureau of Printing and Engraving, or Department of the Treasury, ONLY, for the cost of printing, then those, (serialized), notes are delivered to the Federal Reserve for distribution.

So, really, it is not a true "US Dollar". They are "notes" representing debt, issued by a private bank, with the backing, protection, and enforcement, of the Government. One of the longest running ponzi schemes in modern history.

FTX was a child's game, for comparison. Wanna know what is really slight of hand? 1st fact, ~ A Federal Reserve Note is owned by the Federal Reserve. 2nd fact, ~ To give the illusion of being on the up and up, aka legitimate, when more currency is needed to replace old worn out currency, or to increase supply due to need, the Federal Reserve places a print order to the Bureau of Printing and Engraving, an agency part of the Department of the Treasury, to print the notes required, either 1's or 5's or 10's, whatever. The Federal Reserve pays the Bureau of Printing and Engraving, or Department of the Treasury, ONLY, for the cost of printing, then those, (serialized), notes are delivered to the Federal Reserve for distribution.

So, really, it is not a true "US Dollar". They are "notes" representing debt, issued by a private bank, with the backing, protection, and enforcement, of the Government. One of the longest running ponzi schemes in modern history.

Andrew Ross Sorkin’s Interview of Disgraced Sam Bankman-Fried Was Journalism Masterclass

In accordance with the journalistic principle of conveying issues in a way everyday people can understand, as opposed to providing what Sorkin called “an abstraction” in giving the numbers behind the FTX/Alameda Research crash, Sorkin quoted one of the many angry, damning emails from an investor who lost millions in the crash.

The investor, Andrew, wrote to Sorkin: “Can you please ask SBF why he decided to steal my life savings and the $10 billion more from customers to give to his hedge fund, Alameda. Can you ask him why his hedge fund was leveraging long all of these sh*tcoins. Please ask him if he thinks what happened was fraud.”

“What do you tell this man?” Sorkin asked.

Sorkin grilled SBF about contradictory and inconsistent statements such as SBF telling Bloomberg in August there was no connection between FTX and Alameda Research, which SBF also co-founded. For example, Sorkin asked about the connection between Alameda and FTX and noted that Alameda employees, including disgraced former CEO Caroline Ellison, were living in the penthouse with SBF.

“I know the people from Alameda decently well — almost as if you don’t know what’s happening there — “and there isn’t like a large amount, you know, of ways that we are actively working together. Anything like that, Alameda is a wholly separate entity. They are different offices, like different principal offices, we don’t have any shared personnel. We are also not the same company. We not all are under the same corporate umbrella or anything like that.” And yet, it seems like Alameda people were living in the same penthouse where you may very well be right now, all together.

Sam Bankman-Fried May Regret Throwing Caroline Ellison Under the Bus

It was here that the carefully constructed image Bankman-Fried had sought to project broke down. See, SBF wants to talk about complicated, wonky financial things — margin requirements and the complex market structure behind his now-bankrupt exchange, FTX. He will admit that he was a little careless, labeled things poorly, should have been more on top of his web of businesses — still, all this was really just a $32 billion misunderstanding. Got it? What he does not want to talk about is what this is actually all about — which is how much power and control he really had over all aspects of the FTX and Alameda. That would seem to include being his ex-girlfriend’s boss. “Look, I ****ed up big, but I’m pretty offended by some parts of that,” he said. “Caroline and I had been together for a while. I don’t control her. I never did. I think it’s really ****ed that you would say that I would — that that’s how things work.”

But when Bankman-Fried says, “I don’t control her,” what he’s really saying is, It’s Caroline’s fault. This tracks with the implications of various public statements he’s indirectly made about Ellison. It was just minutes earlier in the Twitter event that he said “there was a pretty big diffusion of responsibility.” He told my colleague Jen Weiczner that problems with Alameda “happened over the last year or so. And I haven’t been running Alameda during that year.” (Ellison was appointed co-CEO, along with trader Sam Trabucco, in October, 2021. In August, Trabucco left and she became the sole CEO). To the extent that he’s taking the blame, he appears to be saying that he bears responsibility for appointing someone unfit for the job: “I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part and failure to appoint someone to be chiefly in charge of that,” he told Andrew Ross Sorkin. What doesn’t quite work about Bankman-Fried’s apology tour is his insistence, on the one hand, that this was all a mistake, but then, on the other, that other people were really in control of it all – most notably Caroline Ellison.

But it is also not just Ellison he is trying to blame. Take a look back at his interview with Vox’s Kelsey Piper, where he throws two of his other former top lieutenants under the bus: director of engineering Nishad Singh is “ashamed and guilty,” while chief technology officer Gary Wang is “scared.” He then implied that they had acted unethically. (“It hit him hard,” Bankman-Fried said, referring to Singh while saying nothing about Wang).

FTX Founder Sam Bankman-Fried Arrested In The Bahamas, Setting Stage For Extradition To The US

FTX founder Sam Bankman-Fried was arrested by Bahamian authorities Monday evening after the United States Attorney for the Southern District of New York shared a sealed indictment with the Bahamian government.

This move sets the stage for extradition and U.S. trial for the onetime crypto billionaire at the heart of the crypto exchange’s collapse.

Bankman-Fried was expected to testify before the House Financial Services Committee on Tuesday.

His arrest is the first move by regulators to hold individuals accountable for the multi-billion dollar implosion of FTX last month.

Damian Williams, the U.S. Attorney for the Southern District of New York, said on Twitter that the federal government anticipated moving to “unseal the indictment in the morning.”

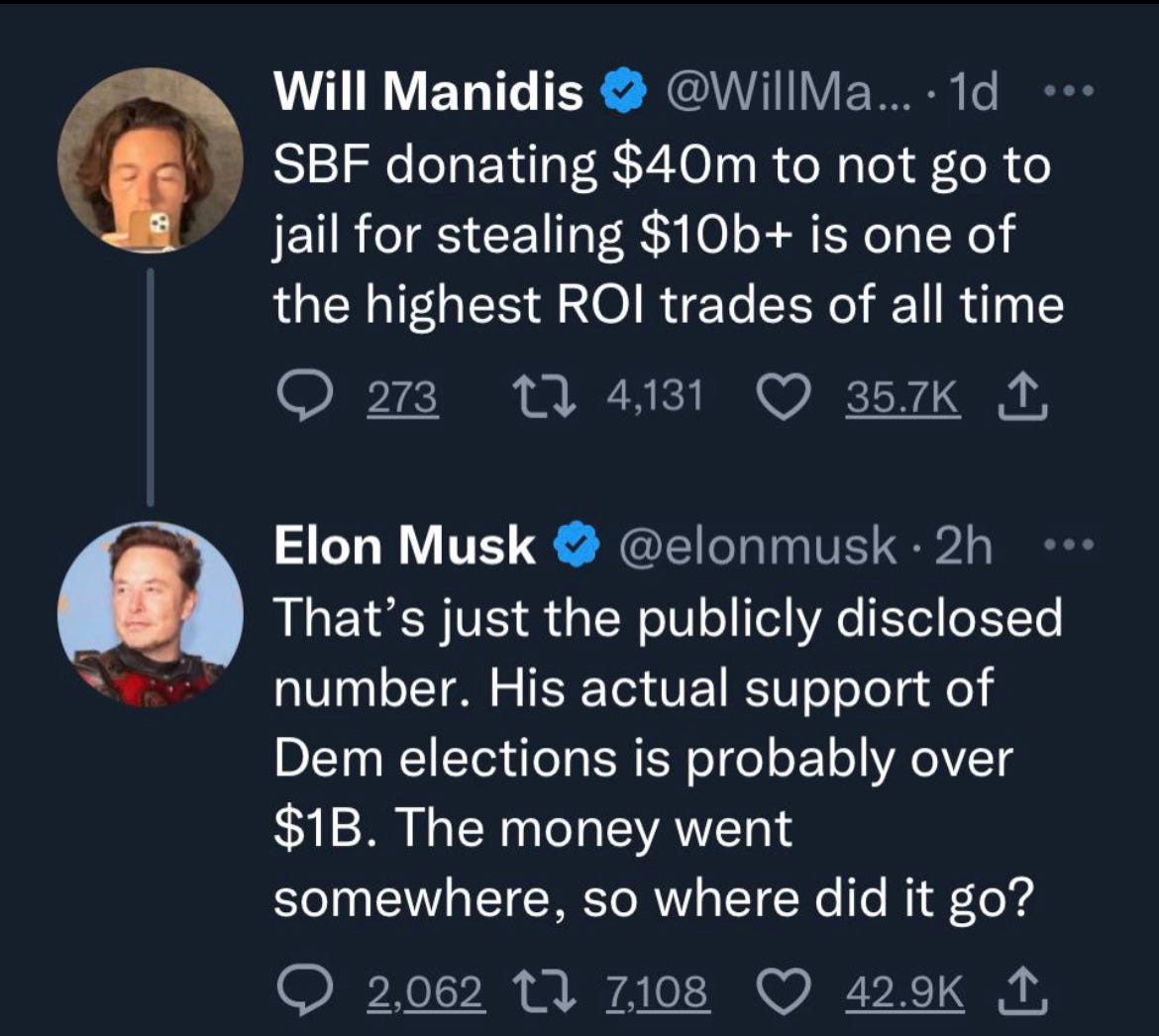

Will Democratic Operatives move to protect him ?

Tech

Well-Known Member

Canada and Britain have them too.Australia and New Zealand Plastic Bills

Mad Max made a call to the White House.

jrt_ms1995

Well-Known Member

fifyFTX Founder Sam Bankman-Fried Arrested In The Bahamas, Setting Stage For Extradition To The US

Will Democratic Operatives move to suicide him ?

You bet. Then use those bitcoins to buy an EV.Is now the right time to buy bitcoin? Sitting on some cash and trying to decide whether I should make payroll or buy bitcoins.

https://www.cnbc.com/2022/11/28/blo...Bdf0bGEADqahR_lU0TOadTHcDY#Echobox=1669650040

Can non-members of Congress ask questions during hearings? If so and I was a member of the House Financial Services Committee, I'd cede my time to FBN's Charles Payne. He was on a roll today on Outnumbered.

He and another FBN panelist were saying that the crypto shenanigans everyone is focused on is just a small portion of the SBF/FTX story.

He and another FBN panelist were saying that the crypto shenanigans everyone is focused on is just a small portion of the SBF/FTX story.