You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Talk

- Thread starter BoyGenius

- Start date

MMDad

Lem Putt

Did you all fall for the phony "the end is near, all the banks are going to fail and be nationalized" drama by Wall Street this week, or did you bravely step in and buy them for pennies on the dollar Thursday and Friday?

I sat there and wished I had some liquidity to buy them up. Unfortunately, the only way I could buy anything right now would be to sell other things at a loss.

The one concept that I actually understand is buy low and sell high, and I refuse to break it now for a gamble.

I have a theory about the "nationalization" panic. Was Dodd just testing the waters so Obama could find out how the markets would react? Did Obama think the markets would like it, but he wanted someone not in his administration to test it? When he saw the reaction, he was able to jump in and shut off the panic, making him look like the calming influence.

BoyGenius

Cyber Bully Victim

I sat there and wished I had some liquidity to buy them up. Unfortunately, the only way I could buy anything right now would be to sell other things at a loss.

The one concept that I actually understand is buy low and sell high, and I refuse to break it now for a gamble.

I have a theory about the "nationalization" panic. Was Dodd just testing the waters so Obama could find out how the markets would react? Did Obama think the markets would like it, but he wanted someone not in his administration to test it? When he saw the reaction, he was able to jump in and shut off the panic, making him look like the calming influence.

I think Dodd is just an idiot, no theory required.

Bank of America was on sale yesterday, I ate at the buffet like Warren Buffet.

Look at this trade that went down yesterday, I bought a lot of stuff, but completely missed this one:

Chevy Chase Bank Approves Redemption of Chevy Chase Bank and Chevy Chase Preferred Capital Corporation Issuances

During the panic, those two stocks, a $25 note and a $50 note, both preferred shares, were trading at $6 and $12. Once that press release came out they popped right to near par value, one for a 121% gain.

BoyGenius

Cyber Bully Victim

I sat there and wished I had some liquidity to buy them up. Unfortunately, the only way I could buy anything right now would be to sell other things at a loss.

The one concept that I actually understand is buy low and sell high, and I refuse to break it now for a gamble.

I have a theory about the "nationalization" panic. Was Dodd just testing the waters so Obama could find out how the markets would react? Did Obama think the markets would like it, but he wanted someone not in his administration to test it? When he saw the reaction, he was able to jump in and shut off the panic, making him look like the calming influence.

Look at these $25 Merrill Lynch notes yesterday for $5.90.

MER.F: Summary for MERRILL LYNCH & CO - Yahoo! Finance

SECURITY DESCRIPTION: Merrill Lynch Preferred Capital Trust V, 7.28% Trust Originated Preferred Securities (TOPRS), liquidation amount $25, guaranteed by Merrill Lynch & Co. Inc. (NYSE: MER) (See our definition of Guaranteed in our Glossary of Income Investing Terms for the technicalities of the guarantee), redeemable at the issuer's option on or after 9/30/2008 at $25 per share plus accrued and unpaid dividends, with no scheduled maturity, distributions of 7.28% per annum are paid quarterly on 3/30, 6/30, 9/30 & 12/30 to holders of record one business day prior to the payment date. The company has the right, at any time, to defer interest payments for up to 6 consecutive quarters (see IPO prospectus for details). The trust's assets consist of the 7.28% Partnership Preferred Securities representing the limited partnership interests of Merrill Lynch Preferred Funding V L.P. which have no scheduled maturity date and which were purchased from the company using the funds generated from the sale of the trust preferred securities. See the IPO prospectus for further information on the trust preferred securities by clicking on the ‘Link to IPO Prospectus’ provided below.

If they don't go bankrupt, which I don't think they will, they can't get out of paying these notes.

Thousand dollar BAC preferred notes for $162 each yesterday:

BAC-PL: Summary for BANK AMER PFD SER L - Yahoo! Finance

By the end of the day after the White House reassurance on banks speech, they were selling for $290.

Tilted

..

I have a theory about the "nationalization" panic. Was Dodd just testing the waters so Obama could find out how the markets would react? Did Obama think the markets would like it, but he wanted someone not in his administration to test it? When he saw the reaction, he was able to jump in and shut off the panic, making him look like the calming influence.

No, Dodd is just an irresponsible idiot who never got over the fact that he couldn't get a date to the homecoming dance, so he's still desperately trying to prove that he's one of the cool kids. The Administration basically came out and said, 'For future reference, Dodd doesn't have a clue what he's talking about and you all shouldn't pay any attention to anything he has to say.' It had to be an embarrassing moment for Dodd, and I'm sure his feelings of impotence were further intensified. I suspect his deepening insecurities will lead him to make even more ridiculous comments in the future.

There would have been no need for the Administration to test the waters on this issue, because everyone would have known, to a virtual certainty, what the market's reaction was going to be.

BoyGenius

Cyber Bully Victim

No, Dodd is just an irresponsible idiot who never got over the fact that he couldn't get a date to the homecoming dance, so he's still desperately trying to prove that he's one of the cool kids. The Administration basically came out and said, 'For future reference, Dodd doesn't have a clue what he's talking about and you all shouldn't pay any attention to anything he has to say.' It had to be an embarrassing moment for Dodd, and I'm sure his feelings of impotence were further intensified. I suspect his deepening insecurities will lead him to make even more ridiculous comments in the future.

There would have been no need for the Administration to test the waters on this issue, because everyone would have known, to a virtual certainty, what the market's reaction was going to be.

I have to say, some of the clowns on CNBC were just as irresponsible, or even more so with their nationalization baiting, as Dodd was.

BoyGenius

Cyber Bully Victim

Tilted, have you seen Berkshire Hathaway lately?

Buffett's Berkshire Hathaway falls to 5-1/2-yr low | Markets | Hot Stocks | Reuters

If Warren doesn't get his chit together soon, even low life chumps like me are gonna be shareholders.

Buffett's Berkshire Hathaway falls to 5-1/2-yr low | Markets | Hot Stocks | Reuters

If Warren doesn't get his chit together soon, even low life chumps like me are gonna be shareholders.

Tilted

..

I have to say, some of the clowns on CNBC were just as irresponsible, or even more so with their nationalization baiting, as Dodd was.

Yeah, but they are mostly just offering conjecture on what everyone is talking and wondering about. A lot of times, they are just relaying the buzz from the pits. Most people recognize that they are speculating, as that is part of their job, and that they have no policy making power.

It is entirely different for someone who is part of the policy making machine, and not a journalist, to make such statements. They are granted inherent validity, and that being the case, it is irresponsible for someone like Dodd to go running off at the mouth like that, especially since the only point of it seems to have been self aggrandizement.

I will agree in general, that some of the commentary on CNBC, and obviously on other media outlets, is somewhat irresponsible - but taking it too seriously is mostly a mistake on the part of the listener.

Tilted

..

Tilted, have you seen Berkshire Hathaway lately?

Buffett's Berkshire Hathaway falls to 5-1/2-yr low | Markets | Hot Stocks | Reuters

If Warren doesn't get his chit together soon, even low life chumps like me are gonna be shareholders.

It's been in my periphery, but not something I've invested any time in following. I've never been in awe of Buffet to the extent many seem to be. His historic results speak for themselves, and at times he can be intriguing to listen to. But, I think it's been a long time since he had that fire in his belly that made him what he is.

He seems to be satisfied just being Warren Buffet now, and the driving force that made him that doesn't readily reveal itself - perhaps it has retired. I think he still has the ability to make money, but that goal may no longer be as dear as it once was, thus I'd expect his results to suffer somewhat.

BoyGenius

Cyber Bully Victim

Yeah, but they are mostly just offering conjecture on what everyone is talking and wondering about. A lot of times, they are just relaying the buzz from the pits. Most people recognize that they are speculating, as that is part of their job, and that they have no policy making power.

It is entirely different for someone who is part of the policy making machine, and not a journalist, to make such statements. They are granted inherent validity, and that being the case, it is irresponsible for someone like Dodd to go running off at the mouth like that, especially since the only point of it seems to have been self aggrandizement.

I will agree in general, that some of the commentary on CNBC, and obviously on other media outlets, is somewhat irresponsible - but taking it too seriously is mostly a mistake on the part of the listener.

Here's what I'm talking about: end of day bell, Maria B. announces that the bad economy and Citigroup brought down the market. Citi finished the day up 5.42%. Where the hell does she come up with that? Worse, the government went out of their way this morning to state in press releases etc. that they have no interest in nationalizing banks, but yet the talking heads continued to pound Citi and BAC on it all day long.

BoyGenius

Cyber Bully Victim

Local Banks

The Emptyprize ran this article the other day about a couple of our local banks. One took TARP money, the other did not.

County First Bank says no thanks to bailout money

I looked them up to check out the investment potential, here's the symbols:

CUMD.OB: Summary for COUNTY FIRST BK (MD) - Yahoo! Finance

TCFC.OB: Summary for TRI-COUNTY FINANCIAL - Yahoo! Finance

They are both over-the-counter stocks that trade at a very low volume. In other words, you're not getting out of them very easily if you buy them. Personally, I thought their dividend payments were too meager in relation to a lot of other low hanging fruit at these low market levels, but for someone with a long-term view who has an interest in investing in something locally, these might be a nice fit for you. Anyway, check them out and share your thoughts.

The Emptyprize ran this article the other day about a couple of our local banks. One took TARP money, the other did not.

County First Bank says no thanks to bailout money

I looked them up to check out the investment potential, here's the symbols:

CUMD.OB: Summary for COUNTY FIRST BK (MD) - Yahoo! Finance

TCFC.OB: Summary for TRI-COUNTY FINANCIAL - Yahoo! Finance

They are both over-the-counter stocks that trade at a very low volume. In other words, you're not getting out of them very easily if you buy them. Personally, I thought their dividend payments were too meager in relation to a lot of other low hanging fruit at these low market levels, but for someone with a long-term view who has an interest in investing in something locally, these might be a nice fit for you. Anyway, check them out and share your thoughts.

BoyGenius

Cyber Bully Victim

Last trade 12 Feb, average trade is 14? The dividend isn't bad but you are right, if you buy it you won't be selling it very quickly.

This GE income security is trading at nearly a 10% dividend even though the Yahoo page doesn't correctly reflect that.

GEA: Summary for GENL ELEC CAP PINES - Yahoo! Finance

Online bank accounts are still nearly 3%. That's why I say the risk, reward is still a long ways off on these two.

BoyGenius

Cyber Bully Victim

That'll be 30% Mr. Lewis!

Ever wanted to charge a bank credit card rates? I got to thinking about this during this latest crash. It's not uncommon for (average or below) folks to have a credit card that charges them anywhere from 18-30% interest rates. So what if you could do that back to a bank? In this latest crash you actually could.

"The Merrills trade at an enormous discount to the BAC's. Of these senior preferreds, the average Merrill Trust trades at a 26.08% yield while the average Bank of America Trust trades at a 18.37% yield. The spread ought to be inconsequential. Instead, it is a 42% difference and presents yet another special opportunity in this wildly inefficient market we find ourselves in."

Market Rap - An In Depth Look Into Bank Of America Corp Preferred Trusts And Their Wacky Yields And Spreads

It gets better. What if you could do this at a level above Government ownership in these banks?

"Until recently, investors didn't make much distinction between the two. One benefit of regular preferreds is that dividends are taxed at the preferential 15% rate for individuals, while trust preferreds' dividends are taxed like ordinary income. Trust preferreds now trade at higher prices than regular preferreds of the same company, because investors want to own securities that rank above the government's TARP investments."

Holders of Preferred Stocks Face Fewer Risks and More Rewards - Barrons.com

Want to learn about preferred stocks? Here's your Bible (requires a free, instant registration to access data):

QuantumOnline.com Home Page

Many of these stocks have already doubled since their lows Friday, but some bargains remain, and who says you won't get another crack at them with the, God forbid, next crash.

Ever wanted to charge a bank credit card rates? I got to thinking about this during this latest crash. It's not uncommon for (average or below) folks to have a credit card that charges them anywhere from 18-30% interest rates. So what if you could do that back to a bank? In this latest crash you actually could.

"The Merrills trade at an enormous discount to the BAC's. Of these senior preferreds, the average Merrill Trust trades at a 26.08% yield while the average Bank of America Trust trades at a 18.37% yield. The spread ought to be inconsequential. Instead, it is a 42% difference and presents yet another special opportunity in this wildly inefficient market we find ourselves in."

Market Rap - An In Depth Look Into Bank Of America Corp Preferred Trusts And Their Wacky Yields And Spreads

It gets better. What if you could do this at a level above Government ownership in these banks?

"Until recently, investors didn't make much distinction between the two. One benefit of regular preferreds is that dividends are taxed at the preferential 15% rate for individuals, while trust preferreds' dividends are taxed like ordinary income. Trust preferreds now trade at higher prices than regular preferreds of the same company, because investors want to own securities that rank above the government's TARP investments."

Holders of Preferred Stocks Face Fewer Risks and More Rewards - Barrons.com

Want to learn about preferred stocks? Here's your Bible (requires a free, instant registration to access data):

QuantumOnline.com Home Page

Many of these stocks have already doubled since their lows Friday, but some bargains remain, and who says you won't get another crack at them with the, God forbid, next crash.

BoyGenius

Cyber Bully Victim

Last trade 12 Feb, average trade is 14? The dividend isn't bad but you are right, if you buy it you won't be selling it very quickly.

Today is a perfect illustration of the danger of these low volume OTC stocks such as Tri-County Bank (TCFC). The stock started out today with a 10.50 asking price and a 10.05 bid price. Around 1:00 PM, five trades were executed for 10.49 and 10.50, a total of 900 shares. Immediately after that the asking price went to 15.00.

There's a chance someone may come along and buy some shares for $15, but an even bigger chance someone else will sell some again after that in the $10 range unless we get a significant move to the upside in the market. This makes for some Pepto-Dismal stock ownership that causes huge swings in your portfolio if you own a substantial amount of shares in stocks like this.

To me, the measly 3.81% yield of this thing doesn't compensate for the emotional distress it will inflict when someone dumps their shares, because on low volume stocks, the only buyers are usually vultures.

I've got this same dilemma on a REIT OTC stock I own. I can't sell it because there are no buyers that won't inflict a 50% loss, but the upside is it reliably pays a roughly 20% dividend, so there's no sense in getting rid of it either.

BoyGenius

Cyber Bully Victim

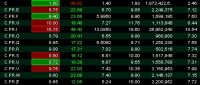

In this previous post I talked about the Capital Trust preferred shares of banks and the outrageous dividends they were paying:

http://forums.somd.com/consumer-financial-affairs/167422-stock-talk-4.html#post3613744

Today held some stunning developments for these types of shares. While most people were horrified by the losses incurred by the common stock of Citigroup because of the dilution that took place with the government's move to exchange their preferred shares for common stock, the Capital Trust and Convertible preferred shares raked in huge gains and gained dividend protection.

Citi to Exchange Preferred Securities for Common, Increasing Tangible Common Equity to as Much as $81 Billion

http://www.citi.com/citi/press/2009/090227a.pdf

As a result, these shares gained anywhere from 12% to 72% (the convertible had a 72% gain this morning) today.

You could easily argue that buying common shares of any bank that has TARP money holds the same risk.

http://forums.somd.com/consumer-financial-affairs/167422-stock-talk-4.html#post3613744

Today held some stunning developments for these types of shares. While most people were horrified by the losses incurred by the common stock of Citigroup because of the dilution that took place with the government's move to exchange their preferred shares for common stock, the Capital Trust and Convertible preferred shares raked in huge gains and gained dividend protection.

In connection with the transactions, Citi will suspend dividends on its preferred shares. As a result, the common stock dividend also will be suspended. The company will continue to pay the distribution on its Trust Preferred Securities and Enhanced Trust Preferred Securities at the current rates.

Citi to Exchange Preferred Securities for Common, Increasing Tangible Common Equity to as Much as $81 Billion

http://www.citi.com/citi/press/2009/090227a.pdf

As a result, these shares gained anywhere from 12% to 72% (the convertible had a 72% gain this morning) today.

You could easily argue that buying common shares of any bank that has TARP money holds the same risk.

Attachments

CrashTest

Well-Known Member

anyone buying any C today?

Bought C today. A day late as usual. Wanted it last week but was too lazy.

W

Wenchy

Guest

I'm still buying (mutual funds) and praying for a miracle.

BoyGenius

Cyber Bully Victim

Cheap doesn't mean a good deal

I would put a stop loss sell order on that purchase to lock in a profit while you still have it, but that's just my opinion.

Bought C today. A day late as usual. Wanted it last week but was too lazy.

I would put a stop loss sell order on that purchase to lock in a profit while you still have it, but that's just my opinion.